- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- 6th Ann

How to open an account with Hong Kong Standard Chartered?

Standard Chartered is one of the three note-issuing banks in Hong Kong and one of the most common banks in daily life. The bank has numerous branches in major areas of Hong Kong and provides a range of diversified banking services, including competitive credit card discounts and lower stock trading commissions, to meet the savings and investment needs of the general public, such as foreign exchange transfers, stock trading, and loans. This article will provide a detailed introduction to the requirements, process, and account types of Standard Chartered account opening, helping you make wise decisions when opening an account.

Online account opening requirements

In Hong Kong, the process of opening a Standard Chartered account online has become more convenient. In recent years, most banks have launched mobile account opening services, allowing new customers to open an account without having to go to the branch in person or submit physical documents. Simply through the Standard Chartered mobile application, customers can open a comprehensive deposit account. Customers who want to open a bank account on their mobile phone must meet the following conditions:

- Do not hold any deposit accounts with Standard Chartered (Hong Kong) Limited, including savings accounts, current/checking accounts, comprehensive deposit accounts, and time deposit accounts

- Hold a valid adult Hong Kong Identity Card (HKID).

- Hong Kong permanent residents or non-permanent residents aged 18 or above

- This account is for personal use only

- Non-US residents, non-US citizens who do not hold a US permanent resident card (green card)

Online account opening process

- Download the app and register an account: First, download the SC Mobile app and click “Open Account” on the homepage.

- Enter contact information: Enter your mobile number and email address.

- Verify your phone: You will receive a one-time password via SMS to verify your phone number.

- Identity Verification: Prepare your Hong Kong identity card and take a selfie verification.

- Fill in personal information: Provide your personal information, including employment details, etc.

- Set up login credentials: Create your online banking username and password.

- Wait for notification: After submitting your application, you will be notified of the status of your application via SMS and email.

- Activate your account: Log in to SC Mobile and follow the instructions to complete your account setup.

Required Documents

If you choose to open an account through the SC Mobile application, there is no need to upload any documents during the entire application process, greatly simplifying the account opening process. However, if you prefer to open an account through a more traditional method, here are the documents and steps you need to prepare:

- Fill out the account opening form online: First, you can fill out the account opening application form through the Standard Chartered official website.

- Visiting Branch: After completing the form, you will need to proceed to the nearest Standard Chartered branch to complete the account opening procedure.

- Submit identity documents: At the bank, you need to provide a copy or photo of a valid adult Hong Kong Identity Card (HKID). If you are not a permanent resident of Hong Kong, you can also submit your passport or other valid identity document containing your photo and ID number.

Through these steps, Standard Chartered provides customers with flexible and convenient account opening options, whether they choose a mobile app or go to the bank in person.

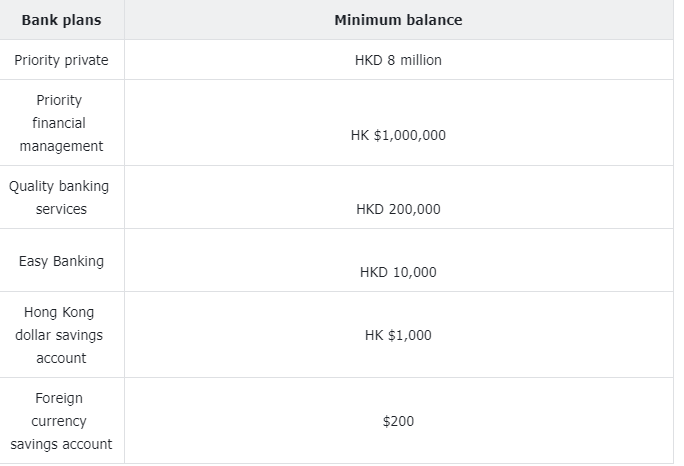

Account opening minimum balance requirement

When opening a Standard Chartered account, depending on the account type, you may need to meet specific initial deposit or monthly salary requirements and maintain a certain minimum balance to avoid service fees.

Starting from August 1st, 2019, Standard Chartered has cancelled the service fee for the minimum total balance of the “Priority Wealth Management” account. However, if the balance of the “Priority Wealth Management” account does not meet the minimum requirements, customers may still be charged a service fee of HKD 900 per quarter.

This means that although some fees have been waived, customers still need to pay attention to their account balance to ensure that no additional fees are incurred due to not reaching the minimum balance. Therefore, it is very important to understand the specific requirements and possible fees of each type of account when choosing bank services to avoid unnecessary expenses.

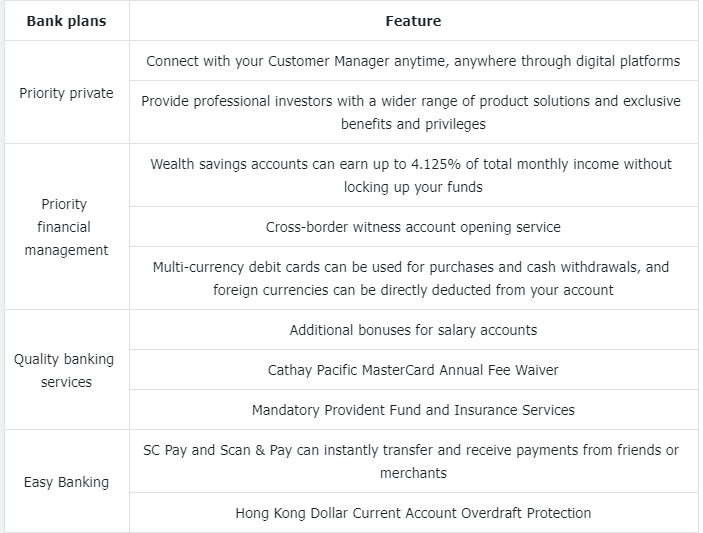

Account type

Appointment method

If you are not eligible to open an account using the SC Mobile App, or have difficulty entering the required information on your phone, or need services such as checkbooks that require a handwritten signature, you need to bring the application documents to the Standard Chartered branch to open an account. You can fill out the information online before going to the branch to speed up the account opening process. Users can register on the Standard Chartered website, provide their name and contact information, submit information online, and then Standard Chartered will contact you and invite you to the branch to complete the account opening process.

Time required

If the conditions for opening an account with a mobile phone are met and the submitted information is complete and correct, the account opening can usually be completed within a few minutes after submitting the application. Standard Chartered will send a confirmation notification of the account opening result to the customer via SMS and email on the day of successful account opening to ensure that the customer is informed of the account status in a timely manner.

After successfully opening an account, new customers can immediately start using Standard Chartered’s mobile banking application and online banking services, view account details, and enjoy various banking services provided by Standard Chartered. This includes functions such as deposits, withdrawals, and transfers. It should be noted that certain functions such as withdrawals and transfers will be activated within two working days after account verification to ensure account security and correct function settings.

Frequently asked questions

If I already have a Standard Chartered credit card, can I still open a Standard Chartered account?

Yes, even if you already have a Standard Chartered credit card, as long as you do not currently hold any Standard Chartered deposit accounts and meet other requirements, you can still use the SC Mobile App to open an account. After the account is successfully opened, your Standard Chartered credit card information will be automatically updated based on the information you provided in the account opening application.

What are the benefits of having a Standard Chartered salary account?

When a customer opens an account with Standard Chartered, they can choose to set the account as a payroll account. To do so, the customer needs to fill out a “Automatic Payroll Account Change Notice” and notify the employer to change their payroll account info. Within two months after opening the payroll account, the customer should set up the automatic payroll function through the bonus payroll account. Depending on the monthly salary amount, the customer may enjoy corresponding points or cash rewards, and the specific content of these benefits may change with the promotion period. Detailed information can be found on Standard Chartered’s official website.

In addition to daily salary needs, if you have overseas travel, overseas investment and other needs, opening a Standard Chartered account can also bring many conveniences. You can meet other needs by binding BiyaPay.It is an international wallet that provides multi-asset transactions for users worldwide. Its functions include global payment and international remittance, as well as major investment services such as US/Hong Kong stocks, options, and digital currencies. Its most notable feature is that it supports real-time exchange rate queries and exchanges for more than 20 legal currencies and more than 200 digital currencies, allowing large remittances to be made anytime, anywhere in most countries or regions around the world, with fast arrival speed, low handling fees, and unlimited amount.

If you often need to frequently exchange and transfer in different currencies, you will encounter various deposit and withdrawal troubles, such as: foreign exchange limit, telegraphic transfer limit, no Hong Kong card or offshore account, difficult cross-border remittance, difficult return to China, slow deposit and withdrawal of securities firms, missing market trends or serious liquidation, etc. Therefore, you can also use BiyaPay as a professional deposit and withdrawal tool to address the above difficulties

Summary

After the above introduction, I believe everyone has a certain understanding of how to open an account. After following the process, you can obtain a bank account and handle related business. Finally, I hope everyone can choose the most suitable service according to their own needs when choosing a bank or Financial Services, and obtain the best service experience.