- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

Xiaomi: Long Growth Runway, Undemanding Valuation

Summary

- Xiaomi’s foray into EVs has delivered early results and long term prospects are promising helped by industry growth and Xiaomi’s competitive advantages.

- Tech is a rapidly-changing industry but Xiaomi’s unique market position is difficult to emulate and potential threats from a comparable rival is unlikely for the foreseeable future.

- For a company with competitive advantages in a high-growth industry, their valuation appears undemanding.

Smartphone maker Xiaomi (OTCPK:XIACF) (OTCPK:XIACY) is the only major smartphone maker in the world with an EV business, an industry with tremendous long term growth prospects. For a company wielding competitive advantages in an industry with a long growth runway, Xiaomi trades at an undemanding valuation and could be worth a look.

Background

Chinese tech giant Xiaomi is best known for their competitive smartphones offering high specs at relatively affordable prices, as well as their wide ecosystem of devices spanning wearable devices, TVs, and smart home devices such as lamps, air conditioners, washing machines, refrigerators, and robot vacuum cleaners among hundreds of other such appliances which could be remote controlled using Xiaomi smartphones.

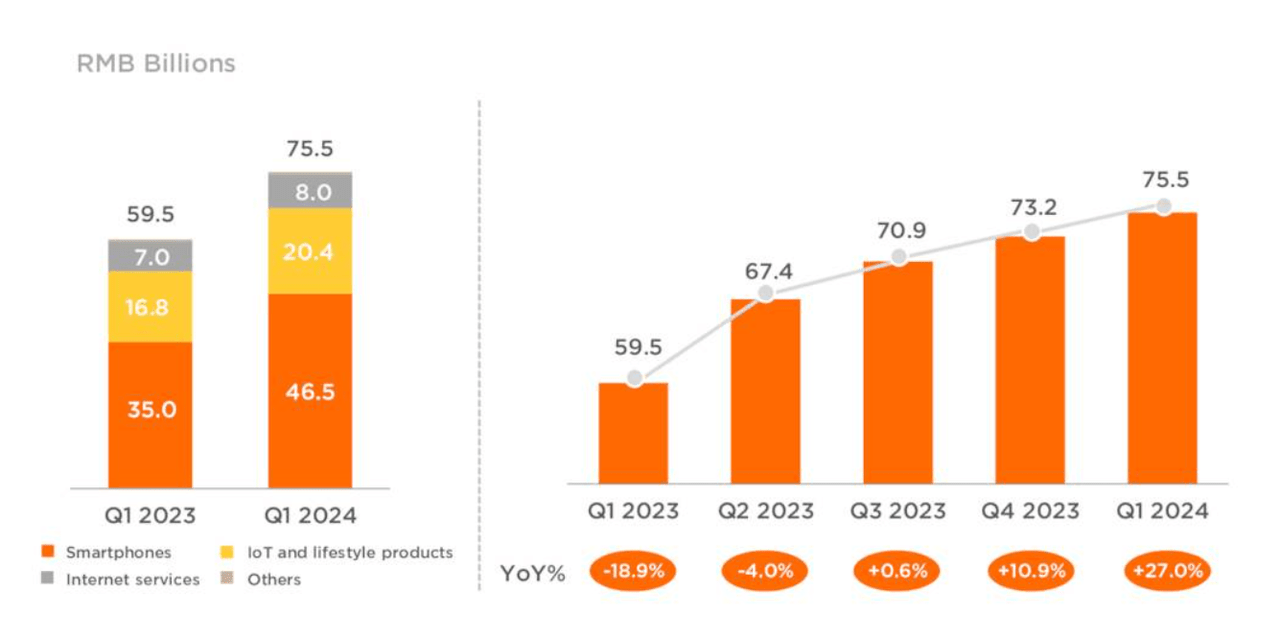

Barely two decades old, Xiaomi has emerged as the world’s third biggest smartphone vendor (behind veterans Samsung and Apple) and revenues have grown to nearly $40 billion as at FY2023 (at a CAGR of over 15% over the past eight years). While hardware margins were initially capped at 5%, overall margins have continued to grow on the back of a strategy focused on premiumization and post-purchase higher-margin services; gross margins have increased to 21% the most recent FY (ended December 2023) from 4% eight years earlier in FY2015. Operating margins improved to 6% the most recent fiscal year from negative eight years earlier despite heavy investments in R&D which increased to 7% of revenues in FY2023 from 2% of revenues in FY2015.

EVs a new long term growth opportunity

The company’s recent foray into EVs completes CEO Lei Jun’s Human x Car x Home smart ecosystem strategy, and holds potential to support continued top and bottom-line growth for Xiaomi. Although China’s EV market is quite saturated and highly competitive (undergoing a price war to boot), Xiaomi wields a few advantages to carve out a share of this growth market both at home as well as overseas. Xiaomi is the only player that offers a unique ecosystem of hardware and software built around their smartphone and in-house operating systems. This gives Xiaomi an edge over EV rivals in terms of smart cabins; Xiaomi’s new EV the SU7 for instance supports over 1,000 Xiaomi smart home devices allowing Xiaomi drivers to control their home appliances directly from their car (for instance turning on home lights so the house is fully lit before they arrive home). Additionally, Xiaomi is a household name in China, as well as in numerous other countries giving the company marketing advantages over lesser-known EV rivals.

Xiaomi’s EV marketing strategy involves courting users already invested in Xiaomi’s ecosystem. At a starting price of CNY 215,000, Xiaomi’s SU7 is pricier than BYD but undercuts Tesla by roughly CNY30,000. Xiaomi’s SU7’s value proposition is similar to their smartphone business’s positioning strategy i.e., high specs at affordable prices, with Xiaomi management claiming the SU7 surpasses Tesla across metrics like range (700km for SU7 versus 567km for Tesla’s Model 3). Xiaomi’s SU7s still has some catching up to do, for instance it lags Tesla in terms of autonomous driving capabilities however the company believes it would take 3-5 years to narrow the gap. Nevertheless, the fact that the SU7 was sold out in 24 hours having received 90,000 orders (for perspective Tesla sold an estimated 600,000 cars in China in 2023) suggests the company’s strategy is resonating well with their target market.

Thus, despite being a latecomer in a hyper competitive industry, Xiaomi’s EV looks well positioned to capitalize on what could be a significant long term growth opportunity. In China alone, the world’s biggest EV market, ICE vehicles still make up a significant chunk of overall auto sales (just under half), leaving considerable room for EV sales growth. Bloomberg estimates EV sales in China to grow 20% this year. Elsewhere, the SU7 may be well positioned to capture market share in some countries in Europe and Southeast Asia. Examples include Spain, and Southeast Asia where Xiaomi has significant smartphone market shares (Xiaomi is the leading smartphone brand in Spain with a 28% share, and the third biggest player in Southeast Asia with an estimated 15% market share), and where EV sales are on the cusp of rapid growth. These markets also have relatively value conscious consumers, who are likely to prioritize a high performance to price ratio, a gap Xiaomi is among the best positioned to exploit.

Stiff competition but comparable rival likely a far way off, if at all

Of the top global smartphone makers, Xiaomi is so far the only one with a viable EV offering. Apple (AAPL) ceased their auto project after a decade of development, and Samsung (OTCPK:SSNLF) has only just begun their car project with the company inking a partnership agreement with Hyundai in January this year. Chinese smartphone rival Huawei has a fledgling electric vehicle business but as a result of U.S. sanctions, they currently have a relatively limited smartphone presence outside China. Part of Xiaomi’s EV advantage against international smartphone makers lies in supply chain advantages in their home country, China, which dominates considerable portions of the EV manufacturing supply chain from batteries, to rare earth processing capabilities. The possibility of a comparable rival emerging and posing a threat to Xiaomi’s market appears low for the foreseeable future.

EV opens further avenues for service business growth

Xiaomi’s SU7 follows a playbook similar to their smartphone products whereby hardware is sold at low margins, which are offset by higher margin service revenues. The SU7 is currently sold at a loss however as volumes increase, break-even may be possible. In the meantime higher margin service revenues could offset any losses short term while contributing to longer term top and bottom line growth. For perspective, about half of Apple’s revenues are derived from services while services accounted for just around a tenth of Xiaomi’s revenues as of Q1 2024, suggesting ample room for growth, particularly as Xiaomi targets higher spenders along with their premiumization strategy.

Valuation

Xiaomi holds a smartphone market share of 14% in China according to their latest investor presentation. Bloomberg estimates China’s EV sales at around 10 million this year, up 20% YoY. Assuming Xiaomi captures about 5% or 500,000 cars of China’s EV market with their cheapest model over the medium term, the company could add roughly $14 billion in additional revenues to their top line or around 35% higher compared to their revenues of roughly $39 billion in 2023. Over three years, this would translate into an annual growth rate of around 14% which does not look unfeasible. At this point they may still be slightly loss making (Tesla’s China sales are around 600,000 and the company is estimated to break even after their latest price cuts which prices their cheapest model at around CNY 250,000).

Conservatively assuming Xiaomi’s net margins drop slightly to 4% translates into a net profit of roughly $2 billion and assigning a forward P/E of 28 (more on this below) translates into a market value of $72 billion at the end of the three year period, or over 7% upside annually from their market value of $58 billion today. A forward P/E of 28 does not look unfair considering they would still have enormous growth potential overseas, (for perspective Apple’s P/E is currently 29 and Tesla is 70) which not only supports further growth but with it could deliver continued profitability improvements from scale economies and expanding service revenues. From this perspective, Xiaomi is worth considering for investors. If investors want to enter the market, they can regularly monitor the relevant stock prices in the new multi-asset trading wallet BiyaPay, and buy or sell stocks at the appropriate time. It can not only recharge usdt to trade Xiaomi-related US and Hong Kong stocks, but also recharge usdt to withdraw US dollars and Hong Kong dollars to the bank account, and then withdraw fiat currency

Risks

The U.S has imposed 100% tariffs on Chinese EVs however at this stage this has a limited impact on Xiaomi as the company barely has a presence in the U.S. be in terms of smartphones or EVs (for that matter U.S. imports of Chinese EVs is essentially zero) and may not see any meaningful presence in the foreseeable future. However if other countries impose tariffs on Chinese EV imports, Xiaomi’s overseas growth prospects may be limited to their home market which may impact their valuation. Additionally, over in China, Xiaomi faces formidable competition from Huawei who like Xiaomi boasts an IoT ecosystem spanning smart home devices, smartphones, and EVs.

Conclusion

Xiaomi has a buy analyst consensus rating. Xiaomi is the only major smartphone maker that has successfully entered the competitive EV space. Their unique competitive advantages position them well to capture a share of the competitive but fast-growing market, a position unlikely to be threatened anytime soon which should allow Xiaomi to build sufficient scale and drive profitability through higher margin service revenues. Their valuation is undemanding, however the stock is not without risks and therefore could be viewed as a buy for investors with a high risk tolerance.

Source: Seeking Alpha

Editor: BiyaPay Finance