- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

8 Common International Remittance Platforms and Their Pros and Cons Summary

In recent years, as globalization continues to deepen, the cross-border movement of funds and talent has become increasingly frequent, and more and more people are beginning to engage in international trade and investment fields.

For example, as more people choose to study, work, and settle abroad, buying property and investing overseas has become a common phenomenon. In this process, making large overseas remittances plays an indispensable role.

There are many ways to make international remittances. Below, I have organized the 8 most commonly used international remittance platforms, along with their advantages and disadvantages, for your reference:

Common International Remittance Platforms

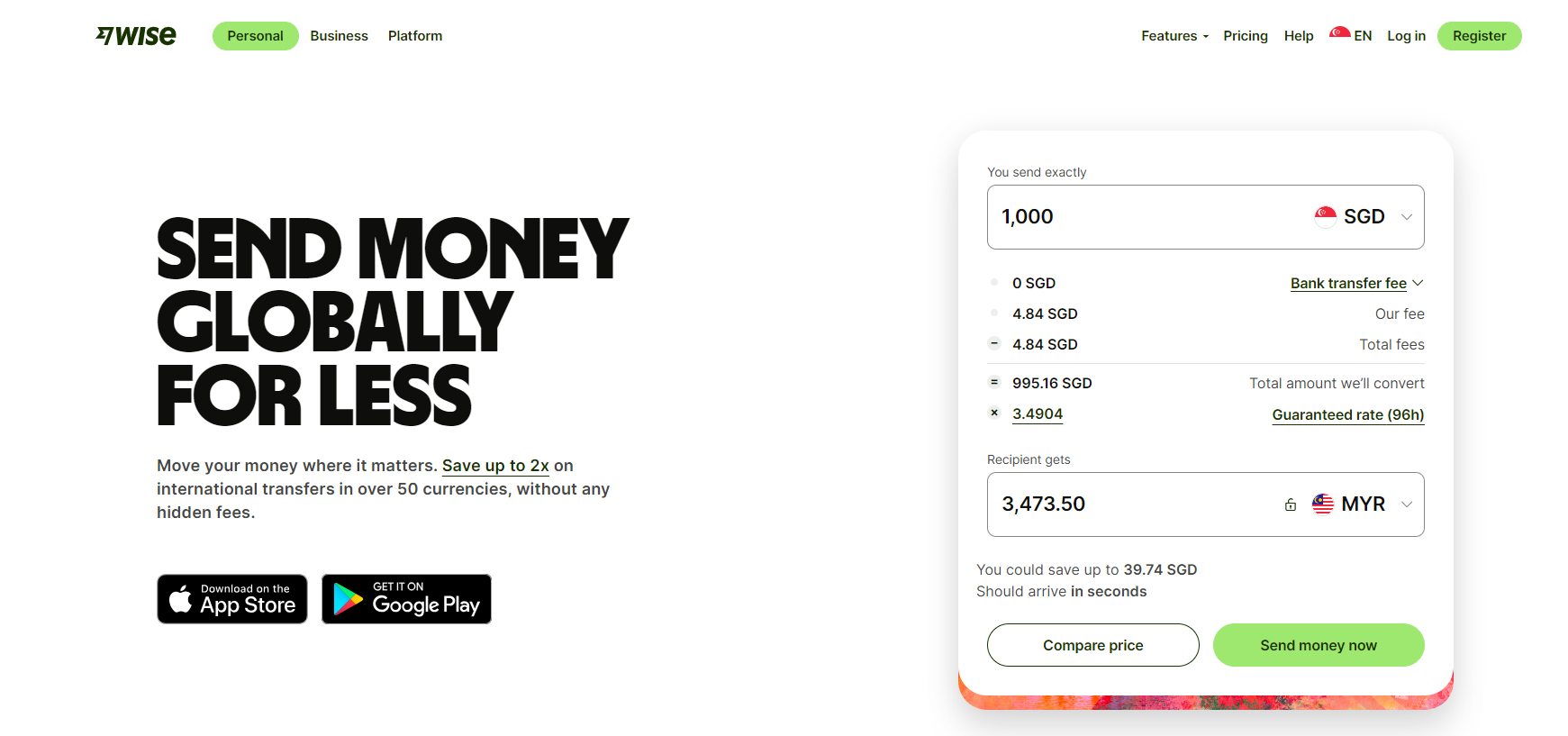

Wise (TransferWise)

If you are looking for a good way to remit money overseas, Transferwise is one of the leading services. An interesting point about Transferwise is that they use the actual exchange rate, also known as the mid-market rate.

Advantages of Wise

- Global coverage: Wise supports transfers in multiple currencies, covering many countries and regions around the world.

- Fast remittance: Wise uses a remittance network different from the traditional SWIFT wire transfer, with 80% of remittances received within 24 hours, and 35% of remittances even receiving funds instantly.

- Security: Wise is regulated by one of the world’s leading financial institution regulatory bodies, the UK Financial Services Authority (FSA).

- Low fees: Wise’s fees are lower than other remittance platforms on the market, and there are no hidden charges.

Disadvantages of Wise

- Remittance limit: Wise’s remittance limit is generally one million or the equivalent in other currencies; if you want to make large remittances, you need to submit an additional application to Wise, which is more suitable for small transfers.

- Limited coverage: Although the transfer system covers the world’s major regions and the most popular currencies on the market, it is still somewhat inconvenient for business owners dealing with smaller markets or emerging economies.

BiyaPay (Global Multi-Asset Trading Wallet)

Established in 2019, BiyaPay is an international wallet that provides multi-asset trading services to users worldwide, including global payments and international remittances, as well as major investment services such as U.S. stocks, Hong Kong stocks, options, and cryptocurrencies. Its most notable feature is the support for real-time exchange rate queries and exchanges of over 20 fiat currencies and more than 200 cryptocurrencies, offering users faster, lower-cost, barrier-free online international remittance.

Advantages of BiyaPay

- Multi-currency support: BiyaPay supports real-time exchange rate queries and exchanges for more than 20 fiat currencies and over 200 cryptocurrencies, providing us with global remittance, online payment, fiat and cryptocurrency exchange, online deposits and withdrawals, and other financial services.

- Fast and convenient remittance: BiyaPay’s currency exchange and remittance operations are conducted online via an APP or webpage, with no face-to-face transactions and no bank counter operations needed, enabling instant transfers worldwide.

- Low fees: BiyaPay’s global remittance fee is 1%, which is price-competitive compared to traditional remittance methods (such as TransferWise’s 1.5% and Xoom’s 1.8%).

- High security: All BiyaPay global remittances are completed online, supporting full-process on-chain tracking, holding multiple compliance qualifications; it has obtained financial licenses in the U.S., Canada, the U.S. SEC, and New Zealand, making your cryptocurrency to fiat currency exchanges more secure and legal, avoiding the risk of over-the-counter transactions being frozen; it has a comprehensive KYC certification and professional legal offshore accounts, treating every remittance with care, allowing users to remit with peace of mind.

- Unlimited amount: Traditional remittance methods (such as Xoom) have limits and policy restrictions, but BiyaPay’s cryptocurrency exchange to fiat method is borderless, global, decentralized, real-time, making global remittances unlimited and instantaneous.

Disadvantages of BiyaPay

- Newcomer to the market: Compared to other platforms, BiyaPay is more well-known in the cryptocurrency field than in the traditional remittance field.

- Service range restrictions: BiyaPay focuses on cryptocurrency services such as BTC, ETH, USDT exchange to USD, etc., which is significantly different from other platforms.

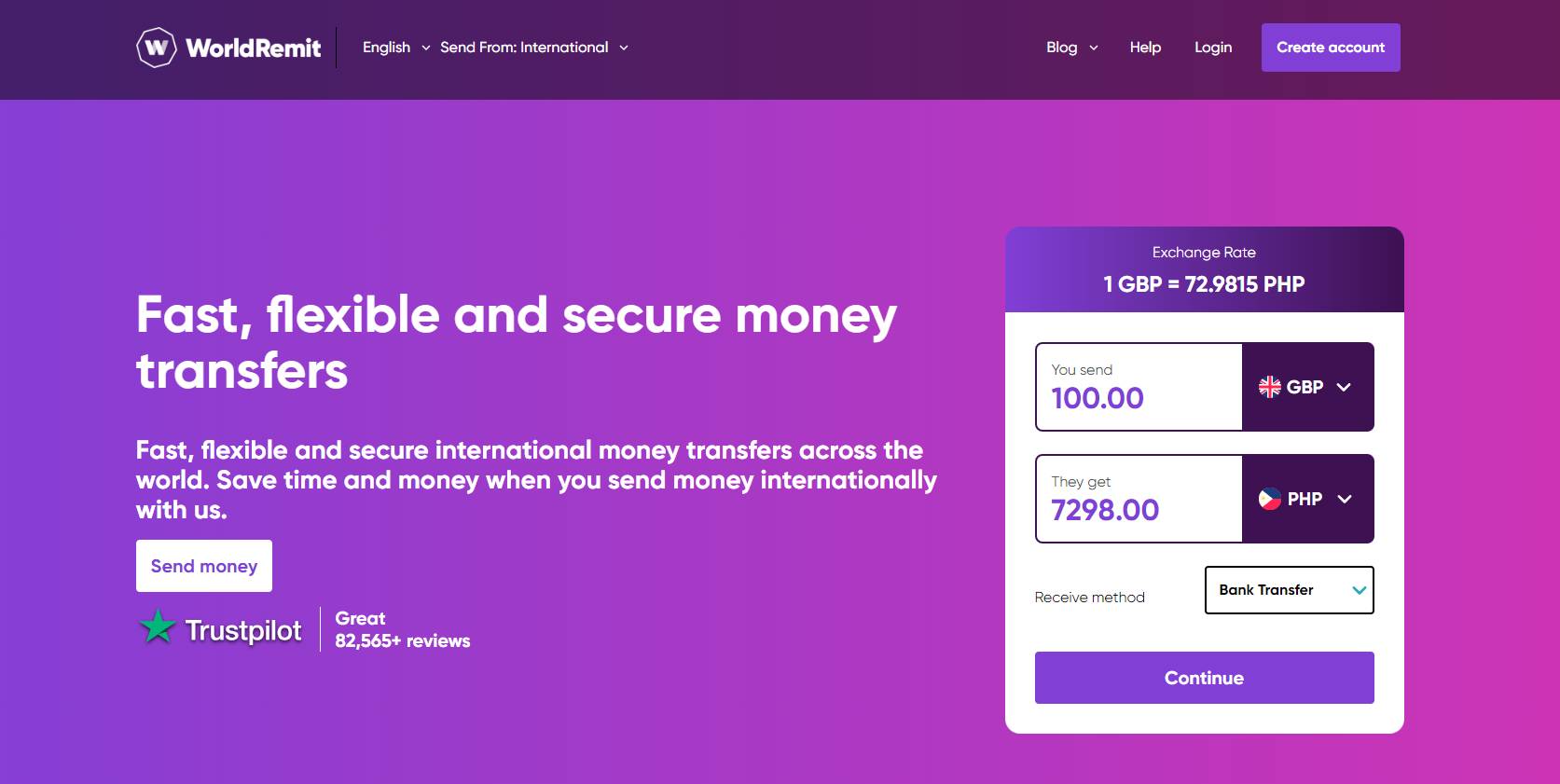

World Remit

WorldRemit is an online remittance service focused on remittance. They are particularly suitable for transfers to regions such as Asia, Africa, and South America. The company pairs with China UnionPay debit cards in China, allowing customers to transfer money to more than 14 Chinese banks at a cheaper price.

Advantages of WorldRemit

- Simple and easy-to-use interface: Opening an account and setting up transfers with World Remit is very simple and can be done on mobile and computer devices.

- No minimum transfer amount: Whether it’s sending a small birthday gift or paying a car down payment, World Remit meets your needs.

- More payment options: Unlike XE, World Remit offers cash withdrawal or currency options.

- Secure service: Security is a major concern when transferring online, and World Remit has excellent security and a good reputation. The service has earned the trust of many customers.

Disadvantages of World Remit

- The maximum transfer amount is limited: World Remit’s maximum transfer amount is $10,000, and even lower for some currencies.

- Variable transfer fees: Different countries have different transfer fees.

- Limited transfer system: World Remit is not licensed in some places.

- No business transfers: World Remit is designed for personal transfers only.

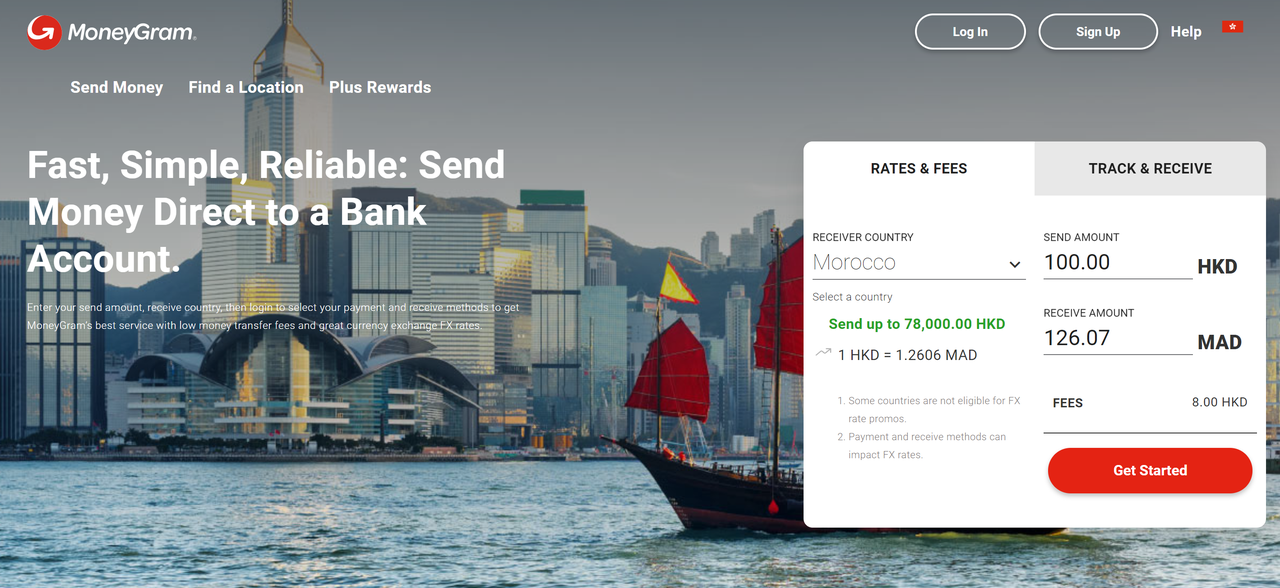

MoneyGram

When talking about remittance services, MoneyGram, one of the leading remittance companies, must be mentioned. MoneyGram’s services include providing remittance, money orders, and bill payment services to people without bank accounts or who do not wish to use regular bank accounts.

Advantages of MoneyGram

- Multiple currencies: With MoneyGram, you can reach anywhere, and they have agents all over the world.

- Instant transfer: Money can be transferred to most places in the world within just a few minutes.

- Multiple payment options: MoneyGram offers multiple payment options, unlike other online services, you can pay with cash or a bank card at branches, and you don’t have to wait for the verification process to complete.

- Multiple delivery options: Whether the funds are transferred to the recipient’s bank account, mobile wallet, or cash withdrawal, MoneyGram can fully support your transfer through its services.

Disadvantages of MoneyGram

- High fees: Compared to other online remittance services, MoneyGram’s fees are higher.

- Low maximum limit: The maximum you can transfer online through MoneyGram is $10,000.

- Currency exchange: When making international remittances from the U.S. to MoneyGram, you usually must remit in U.S. dollars, and you cannot choose to remit in foreign currency. They will charge a rate in U.S. dollars or local currency, depending on the recipient’s country/region. Local exchange rates may vary, which may increase the “cost” of the transfer.

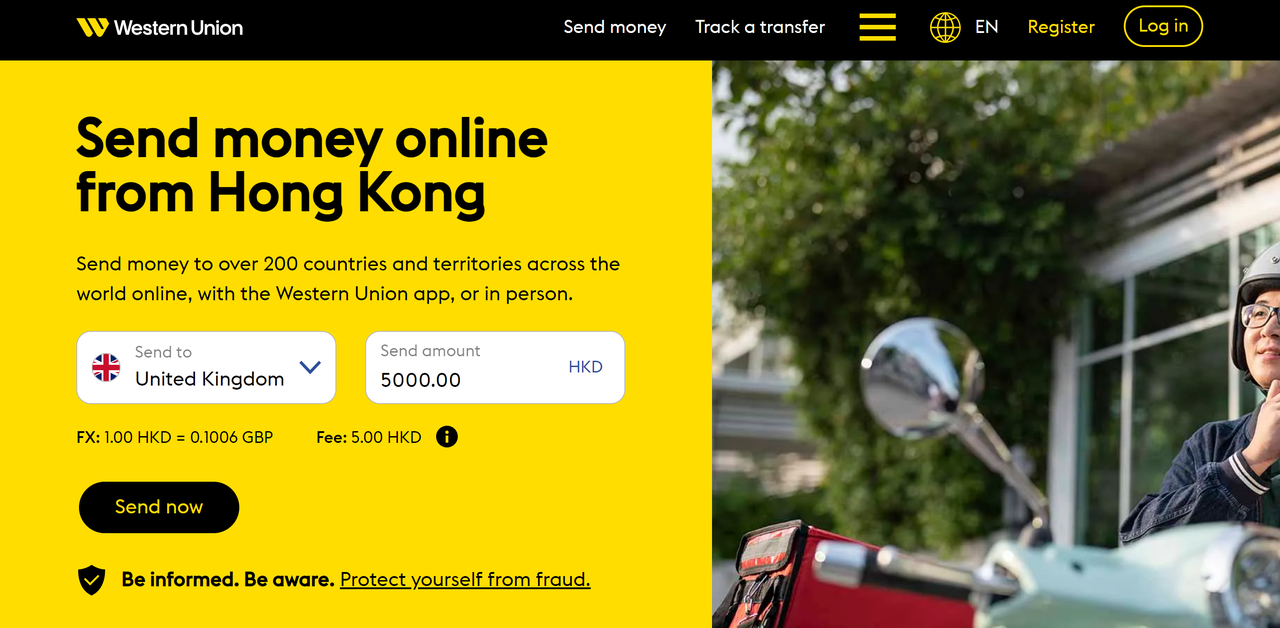

Western Union (Western Union)

Western Union is also a common international remittance method, supported by many banks. The remitter can go to any Western Union agent and fill out a remittance form, then receive a Money Transfer Control Number (MTCN). The recipient can withdraw cash at any Western Union remittance agent by presenting the MTCN and personal ID. By entering the postal code on the Western Union website, you can find nearby agent information. Currently, its partners include the Industrial and Commercial Bank of China, Bank of China, Agricultural Bank of China, China Post Savings, etc.

Advantages of Western Union

- Global network: Covers over 200 countries, with over 500,000+ agents.

- Fast speed: Many transfers can be completed within minutes.

- Diverse services: Offers a variety of transfer methods, including cash, bank cards, etc.

Disadvantages of Western Union

- High fees: The fees are relatively high, especially for small transfers.

- Less favorable exchange rates: The exchange rates are usually not as favorable as other platforms.

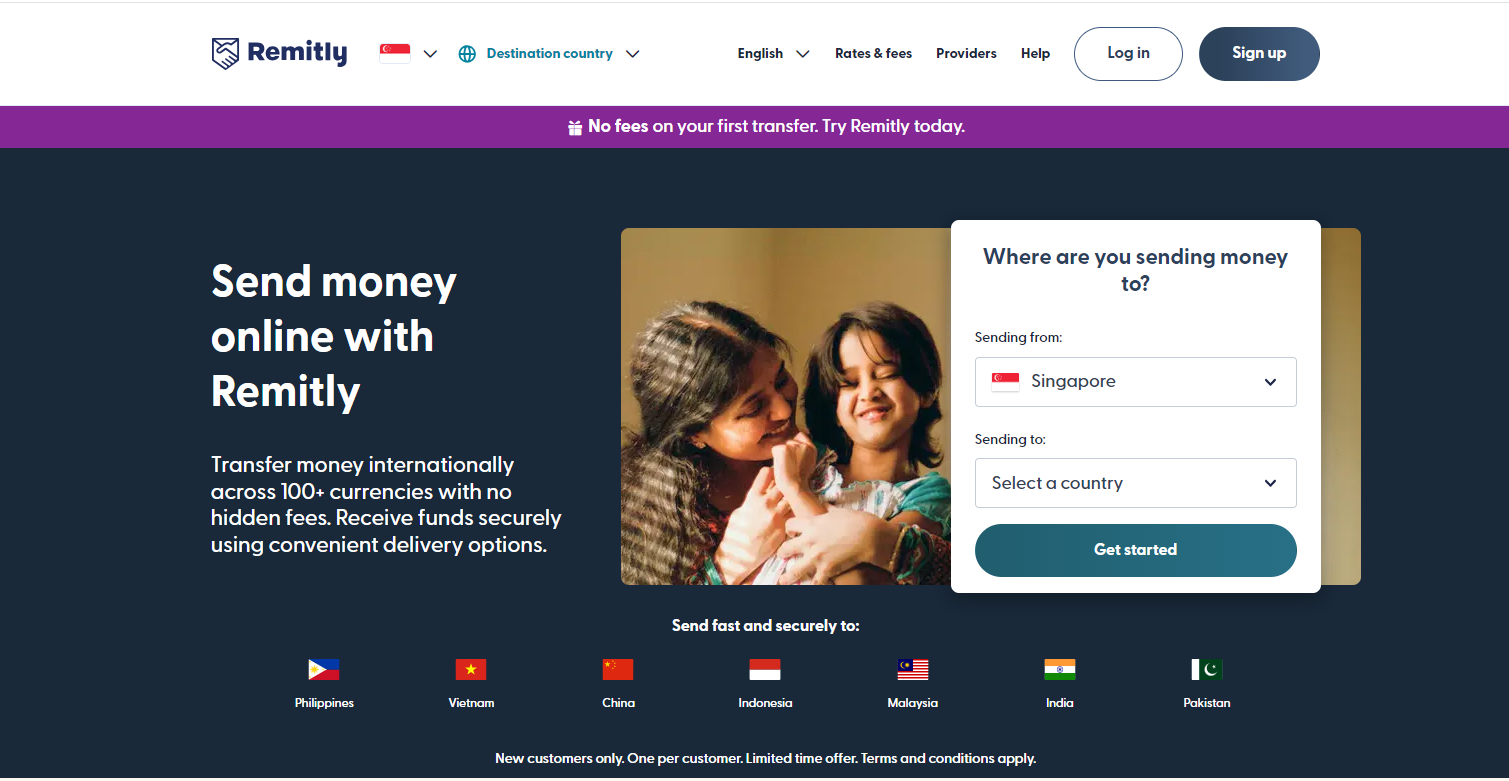

Remitly

Remitly is one of the largest independent digital remittance companies. It provides online transfer services, allowing people in the U.S., Canada, Eurozone, Australia, and the UK to remit to over 40 countries worldwide.

Advantages of Remitly

- Value for money: Remitly is easy to use, with a website and mobile application that allows you to transfer money anytime, anywhere.

- Multiple receiving options: Supports cash pickup and Alipay/WeChat payments.

- Easy handling: SMS/text message alerts help track transfer processing.

- Fast remittance speed: Payment with a bank card can be received instantly.

Disadvantages of Remitly

- Cost: Remitly is not the cheapest provider, exchange rates may be higher than mid-market rates, and fees may be higher than other platforms.

- Restrictions: There are monthly and daily sending limits.

- Location: Service is limited in some locations, local regulations may restrict remittance methods and the recipient’s receiving methods.

- Does not support large transfers, high fees

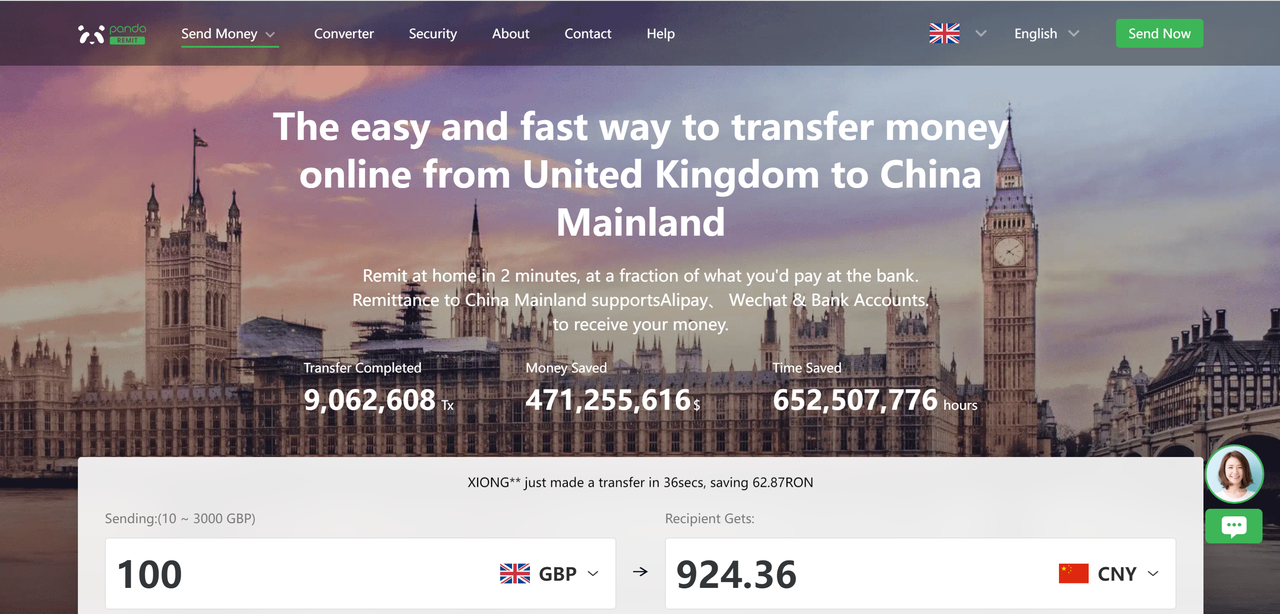

Panda Remit

Panda Remit is a cross-border remittance service provider, committed to providing fast, safe, and convenient international remittance solutions for individual and corporate clients. Panda Remit is dedicated to providing efficient, transparent, and cost-effective cross-border payment services, helping clients easily complete international remittances.

Advantages of Panda Remit:

- Chinese services: Provides a full Chinese interface and customer service for Chinese users.

- Fast speed: Transfers are usually completed within a few minutes to a few hours.

- Reasonable rates: Transfer fees are low, suitable for small transfers.

Disadvantages of Panda Remit:

- Limited coverage: Mainly targets remittances between the U.S. and China.

- Payment methods: Supports fewer payment and receiving methods.

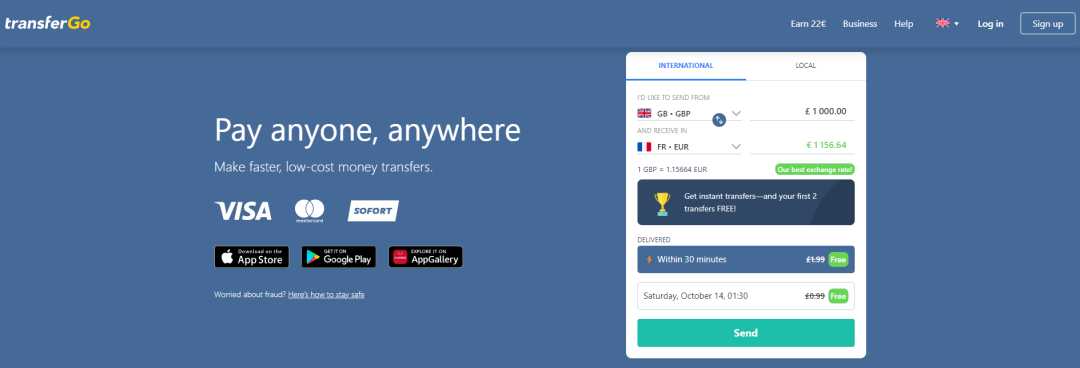

TransferGo

TransferGo is an online international transfer platform, providing low-cost, fast, and secure global remittance services. Payment can be made by debit card or credit card, and the following currencies are required: British pounds, euros, Polish zloty, Norwegian kroner, Swedish krona, and Danish kroner. Funds will be transferred to the bank account of your choice.

Advantages of TransferGo

- Good reputation: TransferGo is a top choice on Trustpilot for reviews.

- Easy to use: Easy transfers and remittances with competitive exchange rates and fees.

- Open fee structure: Total fees are displayed before the transfer.

- Convenience: TransferGo can be used as an app on iOS and Android.

- Simple use: Small payments can be made without full identity verification.

Disadvantages of TransferGo

- Bank-only: Can only remit to bank accounts.

- Service area: TransferGo is not suitable for global or U.S. customers.

- Amount matters: There is no preferential rate for sending large amounts of money.

Summary

Through the comparison of these 8 common international remittance platforms, we can see that each platform has its unique advantages and disadvantages. However, BiyaPay, as an emerging platform, stands out especially for users who need to make large cross-border transfers, with its unique support for multiple currencies and the convenience of online operations, as well as the advantage of unlimited amounts.

Despite being relatively new to the market, BiyaPay’s professionalism in the field of cryptocurrencies and its innovative services in international remittances make it a trusted choice. Whether for individual users or corporate clients, BiyaPay can provide an efficient, low-cost, and barrier-free solution for our international remittance needs. Through BiyaPay, global remittances can be made simpler and more secure, providing comprehensive support for our cross-border remittance needs.