- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

Revenue Soared in the 3rd Quarter! AMD's Data Center Business Is Surging Forward, and Share Price Re

In the semiconductor industry, AMD (Advanced Micro Devices) has always been a tenacious challenger. Although it has yet to surpass NVIDIA, a giant in the data center GPU market, it is currently going all out to outdo itself. Recently, although AMD’s share price performance has been somewhat disappointing and was even overlooked by the market for a while, it is precisely this sluggish state that presents a potential “golden buying” opportunity for astute investors.

Just like in a marathon, although AMD is running a bit slower, it is now in an “acceleration period”. The third-quarter financial report shows that its data center business has started to grow at an accelerating pace. Although the share price hasn’t kept up, in the long run, AMD’s potential is actually seriously underestimated.

Therefore, although AMD may still experience some fluctuations in the short term, this instead offers investors an excellent “rebound” opportunity. Whoever seizes it may reap substantial returns in the coming months.

AMD Grasps Market Opportunities

In the tech circle, AMD has always been a remarkable name. As an important player in the semiconductor field, AMD’s growth and challenges have always been intertwined. Especially in the GPU and data center markets, although it currently plays the role of a pursuer, AMD is gradually narrowing the gap with NVIDIA and even catching up through technological innovation and product upgrades.

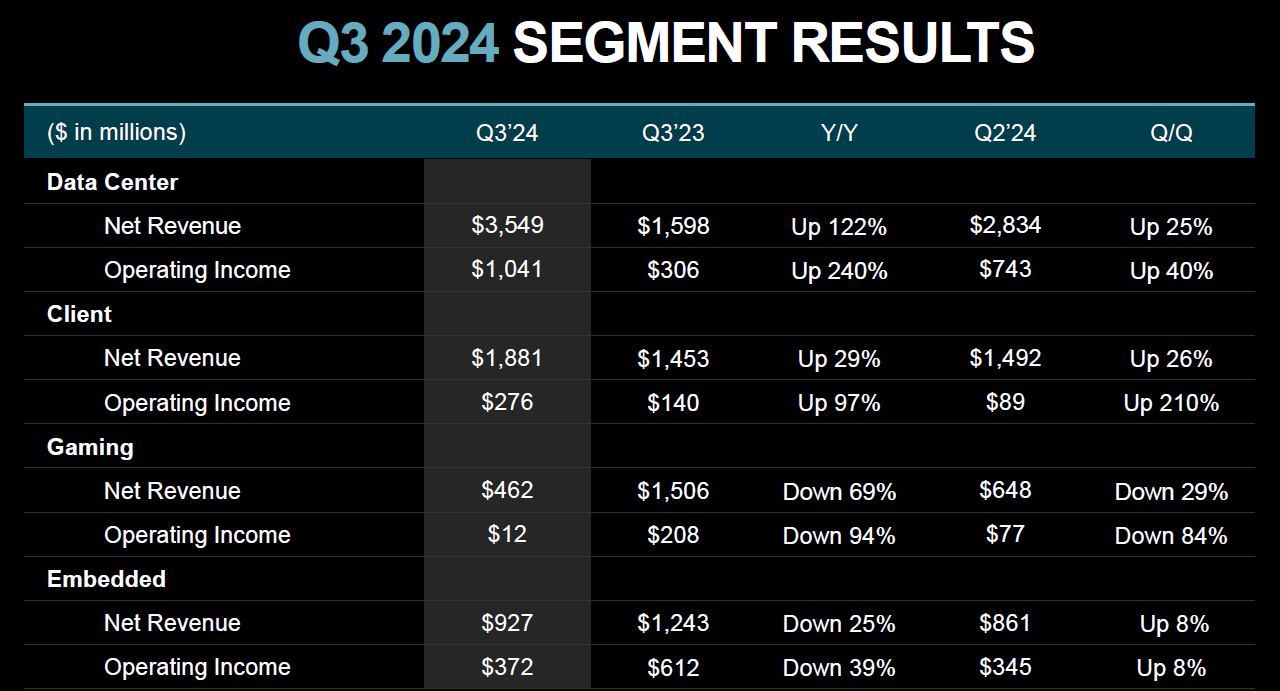

Firstly, one of AMD’s strengths lies in its steady progress in the data center market. Its MI300 accelerator has begun to shine in high-performance computing fields such as AI and machine learning. In the third quarter of 2024, AMD’s data center revenue grew by 122% year-on-year, which is undoubtedly a significant improvement for a market that has long been dominated by NVIDIA. Although AMD is still some distance away from NVIDIA’s dominant position in the GPU market, with the continuous promotion of the MI300 series, AMD is gradually carving out a niche for itself in the data center field.

Meanwhile, AMD is not simply aiming for direct competition with NVIDIA. It clearly understands that AI and machine learning are becoming the main driving forces behind the global computing demand. As the demand for computing power in various industries skyrockets, AMD’s high-performance chips are of particular importance in this trend. From cloud computing to autonomous driving, almost every “future” tech field cannot do without powerful data processing capabilities, which is exactly where AMD excels.

More importantly, AMD is not just focusing on hardware. It is also working hard to build a more complete ecosystem. By continuously optimizing open-source software and improving the synergy between hardware, AMD is gradually transforming from a simple hardware supplier to a solution provider in the data center field. This can not only enhance customer loyalty but also help it stand out in the fierce market competition.

Although NVIDIA currently has a market share close to 90% in the GPU market and AMD still occupies about 10%, with the growth of AI demand, AMD has the opportunity to further expand its share. Currently, AMD’s position in the data center GPU market is still far behind that of NVIDIA. NVIDIA’s Blackwell GPU is in such high demand that supply can hardly meet it. However, this provides a unique opportunity for AMD. With the shortage of NVIDIA’s Blackwell GPU, AMD can take this opportunity to quickly fill this market gap and strive for more market share for itself.

All in all, AMD is adopting a gradual yet steady strategy to build strong market competitiveness in key areas.

Data Center: AMD’s Powerful Growth Engine

If there is an area where AMD’s performance shines the brightest, it must be its data center business.

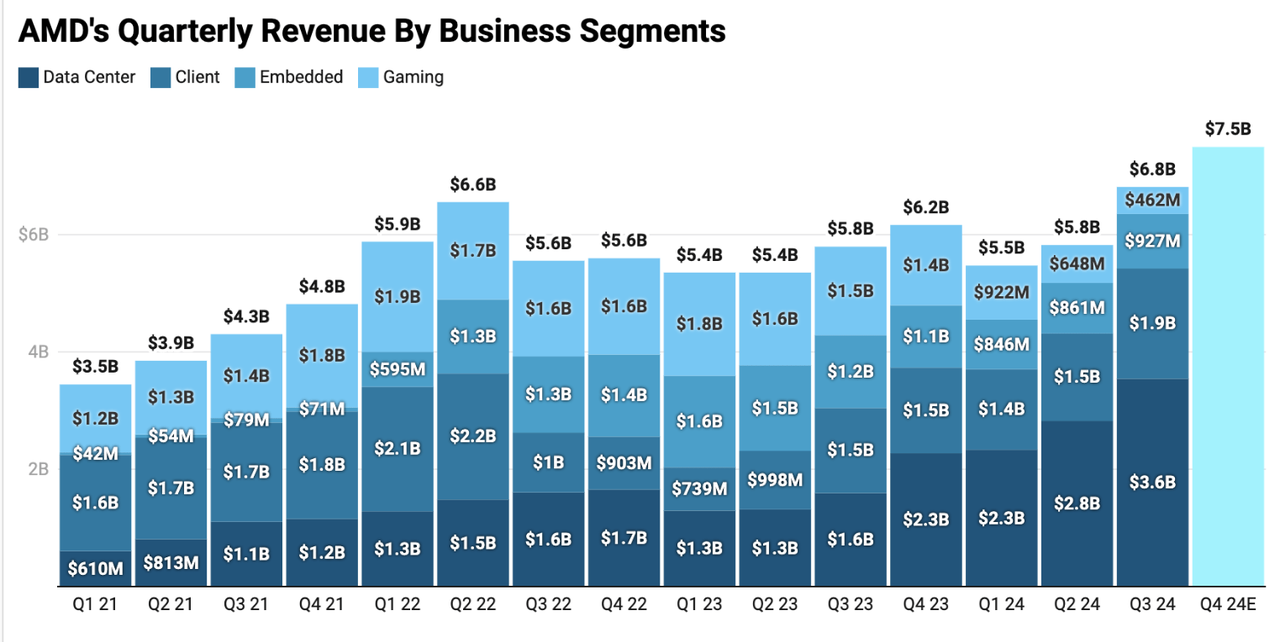

Looking at the data in the third quarter of 2024, you will find that the data center has already accounted for more than half of AMD’s total sales. In this year, AMD’s data center division contributed $3.5 billion in revenue to the company, accounting for 52% of the net sales. Compared with the situation last year, when it was only $1.6 billion and accounted for 28%, it’s a huge change.

This is not surprising. After all, as AI applications like ChatGPT sweep across the globe, the data center has become an important source of performance growth for chip companies. Every quarter, enterprises have to invest billions of dollars in building IT infrastructure and deploying tens of thousands of AI accelerators.

In this massive digital investment, AMD is the second-largest beneficiary, second only to NVIDIA.

A Highlight in Each Quarter: Soaring Data Center Profits

AMD’s strong performance is not only reflected in revenue but also in significant growth in operating profit. In the third quarter, the operating profit of AMD’s data center division reached $1.04 billion, with a year-on-year growth of 240%, which is really eye-catching. AMD’s success in the data center has been translated into direct profit growth, demonstrating the huge potential of this business.

AMD’s sales grew by 122% year-on-year, while its operating profit grew by 240% year-on-year. These two figures are not accidental but are driven by the increase in data center sales and higher gross profit margins. The growth of these key performance indicators proves AMD’s potential for continued profitability in the future.

So, what is the “behind-the-scenes hero” driving all this growth? Obviously, it’s the MI300 Instinct chip.

This chip is AMD’s powerful response to NVIDIA’s H100 data center chip and has started shipping this year. The MI300 has begun to gain momentum in the market, and AMD hasn’t stopped there. The MI325X, a version with stronger memory performance, will be launched in the fourth quarter of 2024 to further consolidate its position in AI applications.

Moreover, AMD’s chip roadmap is full of confidence. It is expected that the MI350 series will carry the brand-new CDNA 4 architecture by 2025, and then the MI400 series to be released in 2026 will continue to boost the growth of the data center business.

It’s worth mentioning that NVIDIA’s Blackwell chip has just been announced as sold out, which is undoubtedly a plus for AMD. NVIDIA’s production capacity is tight, causing its customers, while waiting for new chips, may turn their attention to AMD. This is an excellent opportunity for AMD to seize market share, especially in the data center battlefield.

As we’ve seen in the previous analysis, AMD’s strong growth is not accidental. In the next few years, with the further expansion of the data center business, the share price is expected to recover and even exceed the current level. For long-term investors, this may be a worthy opportunity to pay attention to.

Currently, the market’s expectations for its future growth have not been fully reflected in the share price. Considering AMD’s strong performance in the data center business, the current undervaluation of AMD’s stock provides investors with a relatively safe “buying” opportunity.

Technology Support: There’s Still Gold Despite Market Sentiment

To be honest, AMD’s short-term share price trend is really a bit worrying.

Recently, its share price has fallen below the 20-day, 50-day, and 200-day moving averages, basically painting a picture of “negative sentiment” on the chart. In technical analysis, this situation is like putting a “sentiment is poor” label on the share price.

Judging from the Relative Strength Index (RSI), AMD’s current state is neither “overbought” nor “oversold”, but the trend is clearly weakening. The current RSI value is approximately 38. Although it hasn’t reached the “oversold” level (usually when the RSI falls below 30, it enters the oversold zone), the sentiment is obviously close to a low point. That is to say, the share price may continue to face certain pressure in the short term.

However, there is still hope. AMD’s share price has obtained strong support near $130, and investors can pay attention to whether this price level will once again become a key support area. In my opinion, AMD’s fundamentals are very strong, especially in the data center field, and there is a high possibility that the share price will rebound in the future.

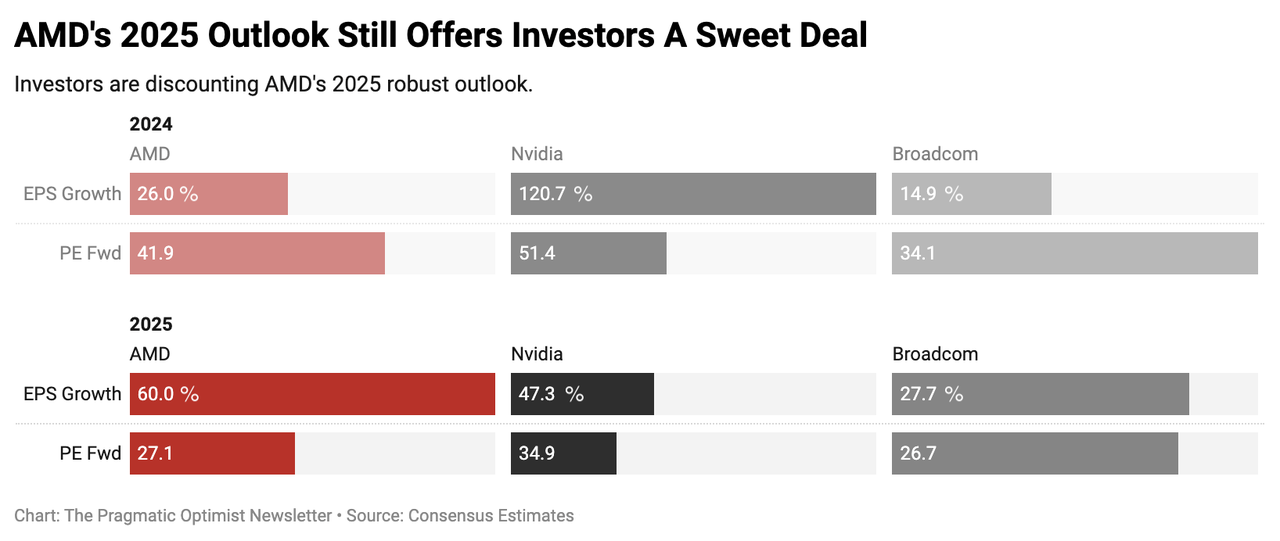

So far, AMD’s share price has been hovering around $136, and this price seems reasonable to investors. According to market analysis, AMD’s expected earnings per share in 2024 is $3.33, an increase of more than 26% compared to 2023. What’s more exciting is that the market generally predicts that AMD’s profit will grow substantially in 2025, with an expected year-on-year growth reaching 54%, which means that AMD’s profit growth is expected to double.

The high market expectations for AMD are also reflected in the price-earnings ratio: the expected price-earnings ratio (PE multiple) of AMD in 2024 is 41 times, and it will drop to 27 times in 2025. If you compare it with its peer NVIDIA, AMD’s share price seems much “cheaper”. NVIDIA’s expected price-earnings ratio in 2024 is 50 times, and it will be 34 times in 2025, about 20% more expensive than AMD.

Of course, everyone knows that NVIDIA’s profit growth rate is very fast, with an expected growth of 125% in 2024 and still 49% in 2025. This is why NVIDIA’s valuation is higher than AMD’s. However, it is worth noting that AMD’s profit growth may accelerate in 2024, while NVIDIA’s growth rate is expected to slow down.

If the market recognizes AMD’s progress in product upgrades and data center shipments in the next few years, AMD’s share price may see a considerable increase in the future. Therefore, for investors who are optimistic about AMD’s development, this is undoubtedly a profitable investment opportunity.

Investment Considerations and Recommendations

Although AMD has a promising outlook, it also faces several key risks.

In the data center GPU market, NVIDIA occupies an absolute dominant position with a market share as high as 90%, while AMD only has 10%. Although AMD has launched the MI300X chip to compete for market share, it still faces huge challenges to significantly surpass NVIDIA. If AMD fails to expand rapidly, its share price may remain fluctuating within a certain range.

However, it is expected that the demand for PC and game hardware will rebound in 2025. Recently, Lenovo has also raised its target for 2025, expecting strong demand next year. The game hardware market is also expected to grow strongly next year, which will boost AMD’s prospects.

Seriously Undervalued

According to the latest data, AMD’s expected growth rate in 2025 will exceed 20 - 25%. This growth momentum is in line with its strong operating profit margin, especially in the data center business. The market has high expectations for AMD’s efficiency and gross profit margin.

Compared with its peers, AMD’s 2025 earnings growth is seriously underestimated. According to market estimates, AMD’s earnings per share will grow by 60%, while the growth of its peers like NVIDIA and Broadcom is relatively slow, at 47% and 36% respectively.

Currently, AMD’s price-earnings ratio is significantly low compared to its 2025 earnings growth. Judging from the current situation, AMD’s 2025 price-earnings ratio should be 38 - 40 times, which means its target share price may reach $210 - $213, with considerable upside potential.

Based on the above analysis, I think AMD has huge potential in the next few years, especially with its further expansion in the data center and AI chip fields. If AMD can seize the current market opportunities, especially in the AI and GPU fields, it is expected to significantly increase its market share and drive up its share price.

However, investors also need to be aware of the risks, especially in the highly competitive GPU market and under the circumstances of uncertain global demand. Nevertheless, in the long run, AMD is still an investment opportunity worthy of attention, especially when its share price is relatively undervalued.