- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Strong Start to the Year with Seven Consecutive Rises, Will NVIDIA, Which Rose for a Year, Continue

In 2023, NVIDIA’s stock price soared by 240%, making it a highly-watched company in the AI field. To date, the company continues its strong momentum at the beginning of the new year, even achieving the most remarkable start to a year in its history, a noteworthy achievement in terms of market value growth…

Market data shows that in the first nine trading days of the new year, NVIDIA’s stock price has already increased by about 10%, with its market value climbing by approximately $128 billion. This marks the largest market value increase for NVIDIA in the first nine days of a year in its history.

This unprecedented record is a significant positive factor for NVIDIA’s bulls: it suggests that last year’s highly-watched artificial intelligence theme may continue to rise this year, especially for a company regarded as one of the earliest major beneficiaries of the AI concept.

A horizontal comparison shows that NVIDIA’s performance in the first two weeks of this year has already easily surpassed the U.S. stock market and other stocks among the so-called ‘Big Seven’ in the U.S. stock market, making the company an increasingly prominent star in the market.

Recently, NVIDIA’s outstanding performance has been in stark contrast to the S&P 500 index. In the past two weeks, affected by doubts about corporate profits and expectations of Federal Reserve rate cuts, the S&P 500 index has stalled near its highs, with significant declines in giants like Apple and Tesla.

NVIDIA Continues Making History

Shana Sissel, CEO of Banrion Capital Management LLC, states: ‘From my perspective, NVIDIA is undoubtedly the best investment target. NVIDIA dominates the GPU market, has strong customer relationships, and maintains rapid growth, which is rare in hyped themes.’

Although NVIDIA’s increase in the first nine trading days this year (about 14%) is lower than the same period last year, it’s fair to say that last year’s increase was somewhat ‘inflated,’ as it was based on a halving of the stock price in 2022. This year, after reaching historical highs, NVIDIA seeks further breakthroughs, which is more challenging.

For the next 12 months, industry analysts’ average target price for NVIDIA’s stock is close to $650, suggesting that the company, with a market value of over $1.3 trillion, still has about 19% upside potential. As of last Friday’s close, NVIDIA’s stock price was $547.10.

The recent Consumer Electronics Show (CES) further bolstered the confidence of NVIDIA stock supporters. The company launched three GPUs designed for AI PC devices at the show, stating that laptops based on RTX AI have up to 60 times the system performance of regular PCs.

NVIDIA’s CFO Colette Kress reiterated CEO Jensen Huang’s expectations last week, predicting the company will continue to grow until 2025, boosting the stock price.

Harsh V. Kumar, an analyst at Piper Sandler & Co., stated in a report on January 11: ‘NVIDIA is confident about end-user demand and notes that supply will increase every quarter this year. This gives us confidence in the company’s supply and order pattern for 2024.’

NVIDIA is expected to announce its fourth-quarter earnings in late February. According to industry analysts, NVIDIA’s revenue in the fourth quarter of last year is expected to grow by about 230%, building on a 206% increase in the third quarter.

How Can Investors Buy NVIDIA Stock?

Although NVIDIA shows strong momentum, there are still certain risks. Therefore, while seizing opportunities, investors should also pay attention to risk management. Using professional U.S. stock investment tools, investors can achieve reasonable asset allocation, maintaining stability amid market fluctuations. Here, I recommend BiyaPay as a professional investment tool for investors to seize market opportunities.

BiyaPay stands out for its professionalism and convenience, supporting online real-time trading of U.S. and Hong Kong stocks without needing an overseas bank account. If you already have a brokerage account and an overseas bank account, BiyaPay can be used as a funding tool for U.S. and Hong Kong stocks. By depositing digital currency (such as USDT) and exchanging it for USD or HKD, then withdrawing funds to a personal bank account, and finally transferring funds to a brokerage account. This method is not only fast and unlimited but also solves the funding issues in investment trading.

In summary, as a professional and convenient investment tool, BiyaPay helps investors achieve reasonable asset allocation in the U.S. stock market, seize investment opportunities, and implement a stable investment strategy.

The Future of NVIDIA

According to Reuters, analysts are highly optimistic about NVIDIA’s prospects, with its revenue outperforming expectations and announcing a $25 billion stock buyback plan. The key driving factor is strong demand for AI-driven technology (mainly supported by NVIDIA chips). NVIDIA’s revenue forecast significantly exceeds expectations, reflecting the continued boom in generative AI technology. It is realized that the demand for NVIDIA AI chips exceeds supply by at least 50%, a situation expected to last several quarters. This supply-demand imbalance has driven the company’s stock to historical highs.

It is noteworthy that the entire AI system, not just the chips, has become a major growth driver for the company. Although NVIDIA is known for its GPUs, the company also produces complete AI devices that include storage chips from other suppliers. The diversification of AI products has become an important growth driver. NVIDIA’s positive performance has had a ripple effect on other large tech stocks and AI-related companies, raising their stock prices.

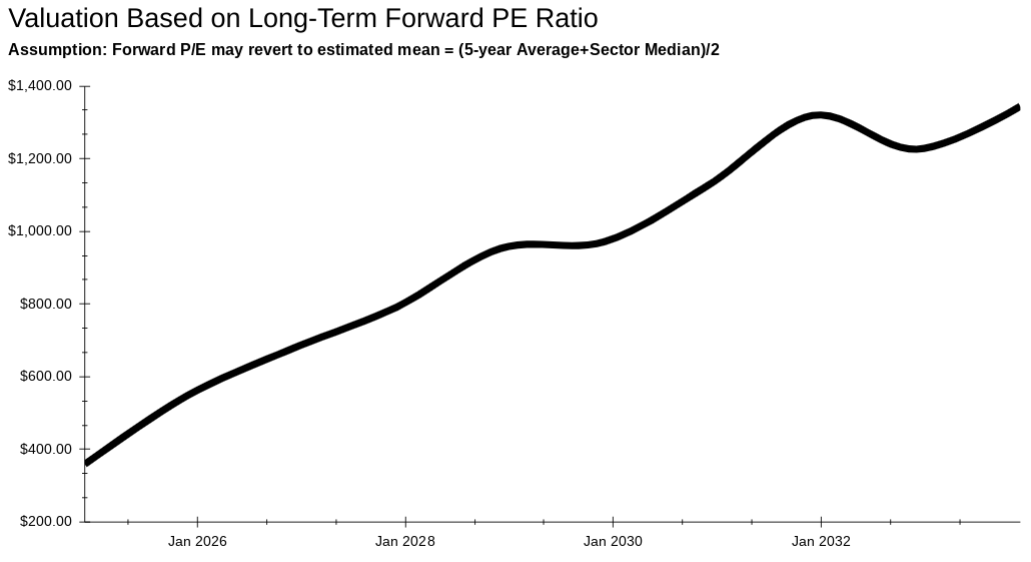

The company’s success is seen as a key moment in the tech industry in 2023, further highlighting its strong position in leveraging AI momentum. Analysts predict that NVIDIA’s data center business, driven by AI chips and related technologies, will expand significantly in the coming years. Although competitors like AMD are expected to make progress, NVIDIA’s software, especially CUDA, maintains a significant lead. Additionally, the demand for AI-related chips is expected to remain strong, surpassing other traditional server equipment.

Despite some weakness in certain chip sectors, the AI market remains a bright spot in the industry and is expected to continue growing.