- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Microsoft's stock price has risen for seven consecutive days! With the dual benefits of dividend inc

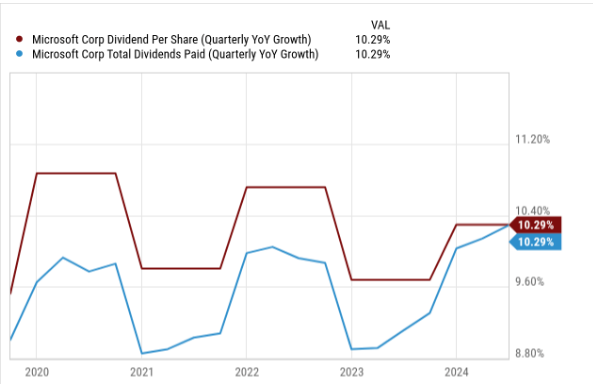

Microsoft (NASDAQ: MSFT) announced this week that its board of directors has approved a new $60 billion share repurchase program, which has no expiration date and will replace the repurchase program announced in 2021. At the same time, the software giant has raised its quarterly dividend by 10%, from the current 75 cents per share to 83 cents. The new dividend will be paid on December 12, 2024 to shareholders registered on November 21, 2024.

After the buyback plan was announced, although Microsoft’s stock price rose by less than 1% in after-hours trading, it rose and closed at $431.34 in regular trading that day. So far this year, the stock has risen by 15.38%. In addition, before announcing the dividend increase and buyback news, Microsoft’s stock price had risen for six consecutive trading days, wiping out all the losses since the release of the quarterly report at the end of July. However, the stock closed down 1% to $430.81 on Wednesday, ending a seven-day rise.

Increasing dividends and large-scale stock buybacks are expected to help

Microsoft’s recently announced $60 billion share buyback plan is part of Company Finance’s strategy to increase earnings per share (EPS) by reducing outstanding stock, thereby increasing shareholder value. This large-scale buyback plan has no clear maturity date, demonstrating Microsoft’s strong confidence in its future financial condition and business growth.

Stock buybacks are usually conducted when a company believes its stock is undervalued. This behavior can send a positive signal to the market, indicating that the company’s management is optimistic about the company’s current stock price and future prospects. For Microsoft, this strategy is not just about financial operations, but also reflects the company’s commitment to continuously investing in its core business areas such as Cloud Services and artificial intelligence.

In the same announcement, Microsoft also announced an increase in dividend from $0.75 to $0.83, an increase of 10.7%. This demonstrates the stability and confidence of the company’s free cash flow and long-term retained earnings. This dividend growth is consistent with Microsoft’s development trajectory in recent years and is also a return for long-term support for shareholders.

In the long run, the stock buyback plan may have a positive impact on Microsoft’s shareowner value. By reducing the circulation of stocks, the company can increase earnings per share, which usually leads to a reevaluation of the stock in the market and may push up the stock price. In addition, the buyback plan can also provide a way to return capital to shareowners, especially when the company has sufficient cash on hand.

From historical data, Microsoft’s past stock buybacks have also significantly supported the stock price. For example, in the previous buyback cycle, Microsoft’s stock price rose significantly after the buyback announcement. This not only enhanced the market’s confidence in Microsoft, but also increased its attractiveness in the minds of investors.

However, stock buybacks also have their limitations. For example, if the market environment deteriorates or the company’s business growth does not meet expectations, even with buyback support, the stock price may be affected. In addition, buybacks reduce the company’s capital for other investments (such as mergers and acquisitions, research and development), which may limit the company’s long-term growth potential.

What are the investment values of Microsoft?

Microsoft has always maintained its position as an industry leader among global tech giants. With the continuous expansion of Cloud Services, artificial intelligence, and Enterprise Services, Microsoft has successfully diversified its business to remain competitive in the face of fierce market competition. Microsoft’s success is not only reflected in its strong product line and innovation capabilities, but also in the performance of its stock price, which has provided significant returns for investors. Looking ahead, the company is still expected to bring good returns to investors.

Financial health analysis

Microsoft has long been known for its solid financial performance. The company’s revenue comes from a wide range of sources, from enterprise software solutions to consumer technology products, and each department is steadily growing. Especially the Cloud as a Service business, such as Azure and Office 365, which have become the main growth points of the company’s revenue. Microsoft’s revenue and profit growth, coupled with its ability to continuously generate strong cash flow, enable the company to carry out large-scale buyback plans and pay stable dividends.

Microsoft has maintained a relatively conservative financial leverage in terms of debt and capital structure, ensuring financial flexibility and risk control. This strategy enables the company to maintain sufficient capital and financial health even in uncertain economic times, which is crucial for maintaining investor confidence and attracting potential investors.

Market valuation

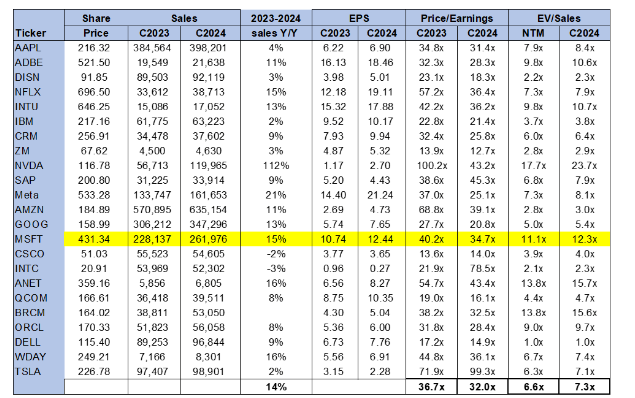

When discussing Microsoft’s valuation, we found that its stock price is relatively high, especially compared to its main competitors in the technology industry. The expected Price-To-Earnings Ratio (PE) for 2024 is as high as 34.7 times, significantly higher than the industry average of 32.0 times, compared to 30.8 times in the same period last year. It is worth noting that Microsoft’s Price-To-Earnings Ratio far exceeds the average level of other technology peers, and is expected to reach 12.3 times in 2024, compared to the industry average of only 7.3 times, indicating the market’s confidence in Microsoft’s future profit growth potential, especially in the field of artificial intelligence.

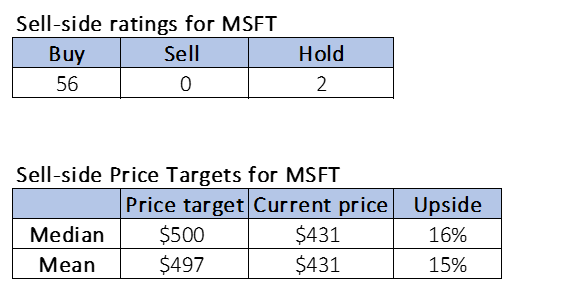

Wall Street’s attitude towards Microsoft is becoming increasingly optimistic. In a recent analysis of Microsoft, 56 out of 58 analysts gave a buy rating and only two gave a hold rating, indicating high market trust. The current stock price of Microsoft is about $431, while the average target price set by analysts is $497 and the median target price is $500. This indicates that analysts expect significant upward potential for Microsoft’s stock price, expanding from a potential increase of 9% -12% at $372 to a potential increase of 15% -16%.

The following summarizes Wall Street’s views on the stock:

These data indicate that the market generally expects Microsoft to continue to demonstrate outstanding performance in technology and the market, especially in the strategic growth area of artificial intelligence. Investors’ high praise for Microsoft is not only reflected in its high Price-To-Earnings Ratio, but also fully reflected in analysts’ buy ratings and positive price targets. This optimistic expectation is based on the company’s strong market position and continuous technological innovation capabilities, and is expected to drive the company’s future earnings and market performance.

Future growth potential

Microsoft’s continued investment in AI and Cloud Services is a strong driving force for its future growth potential. The company continues to launch innovative solutions and services, such as Azure AI, GitHub Copilot, and other enterprise and consumer products, which are important sources of future revenue growth for the company. In addition, with the acceleration of global digital transformation, Microsoft’s enterprise solutions and Cloud as a Service are expected to continue to expand market share.

The continuous strengthening of competitiveness and market position is also the key to Microsoft’s future growth. The company’s extensive layout in the global market and deep partnerships provide it with opportunities to further penetrate and expand the market. With the development of technology and changes in market demand, Microsoft is expected to maintain its position as an industry leader through continuous technological innovation and strategic adjustments.

What risks will future development face?

Investing in Microsoft offers many potential benefits, but it is also risky. As a global tech giant, Microsoft faces a wide range of risks, including technological and market risks, macroeconomic risks, and legal and regulatory risks.

Technology and market risks

While Microsoft continues to promote technological innovation, it must also respond to the challenges brought by rapid technological iteration. The company needs to continuously invest in research and development to maintain the competitiveness of its products and services. However, the promotion of new technologies is not always successful, and failed implementation or insufficient market acceptance may have adverse effects on the company’s financial performance. Especially in the fields of Cloud Services and artificial intelligence (AI), Microsoft faces fierce competition from Amazon AWS and Google Cloud. These competitors may invest more funds in certain technology areas, such as Google, Apple, Meta, NVDA, etc., which requires Microsoft to continuously optimize its technology and services to maintain market share. Although Microsoft has made several major acquisitions and talent poaching, the success of its AI department is not guaranteed. Excellent talent and companies are not guaranteed to bring innovation or accelerate revenue growth.

Macroeconomic risks

Macroeconomic factors such as economic recession, currency fluctuations, interest rate changes, and inflation may also have a negative impact on Microsoft’s global business. Technology stocks are usually sensitive to economic cycles, and the uncertainty of the global economic environment may cause fluctuations in investor confidence, which in turn affects stock price performance. In addition, a large-scale market adjustment may cause greater damage to Microsoft than some other large technology companies, as Microsoft’s valuation is higher than some peers such as Apple and Google, and it may further decline before the market enters the “value” field.

Legal and regulatory risks

As a globally operating enterprise, Microsoft needs to comply with complex regulations in data protection, privacy, Anti-Trust laws, and cross-border operations in various countries. Especially in Europe and North America, technology companies face increasingly strict regulatory environments. Any legal litigation or regulatory changes may result in fines, business restrictions, and even reputational damage to the company. Although Microsoft is not directly involved in Anti-Trust lawsuits like some competitors, the company’s extensive business and market influence are always under the attention of regulatory agencies.

How do investors layout?

When facing investment in large technology stocks such as Microsoft, how to strategically layout is a problem that every investor must consider. This not only concerns capital appreciation, but also how to protect investments from unnecessary losses in a changing market environment.

Firstly, it is recommended that investors pay attention to diversification when constructing investment portfolios, avoiding excessive reliance on a single stock or industry. This strategy can effectively diversify risks caused by a certain market event, thereby protecting the stability of the overall investment portfolio.

For investors who decide to hold Microsoft stock for the long term, it is crucial to regularly evaluate the company’s fundamentals. By closely monitoring Microsoft’s financial report releases, business updates, and industry trends, they can adjust their holding strategy in a timely manner to adapt to market changes.

Interested investors can go to BiyaPay to monitor the market trends of Microsoft and seize investment opportunities in a timely manner. In addition, if you encounter difficulties in depositing and withdrawing funds, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can recharge digital currency to exchange for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited arrival speed, which will not let you miss investment opportunities.

In addition, given that Microsoft’s market performance may be significantly affected by technological innovation and macroeconomic factors, we should closely monitor these external factors to capture the market opportunities that may arise. For example, when Microsoft releases important technological updates or new products, it is often a good opportunity to increase holdings or achieve partial profits. Such a strategy can not only increase profits, but also limit potential losses when necessary.

In summary, as a leader in the global technology field, Microsoft continues to demonstrate its leadership position in the artificial intelligence and Cloud Service markets. Despite certain risks, Microsoft’s long-term growth potential and strong market position, combined with its active stock buyback and dividend growth strategies, provide investors with an attractive investment opportunity. Everyone can reasonably layout their investment strategies and find the right timing to get on board.