- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Intel has plummeted nearly 60% this year and might be ousted from the Dow. Can it recover and reshap

In 2024, Intel faces unprecedented challenges. Since the beginning of this year, the company’s stock price has plummeted by nearly 60%, becoming the worst-performing stock in the Dow Jones Industries Average Index (DJIA). This decline has caused widespread concern and concern among the market and investors. Relevant reports indicate that Intel may be kicked out of the Dow Jones Industrial Average. If kicked out this time, it will further damage Intel’s already damaged reputation and further depress the stock price.

The reason for Intel’s stock price crash

Strategic mistake, missing the AI development boom

Strategic mistakes are an important factor in Intel’s dilemma. Especially in the field of artificial intelligence, Intel missed key development opportunities. For example, the company had the opportunity to invest in OpenAI, but ultimately failed to take action. In contrast, Nvidia and other competitors quickly laid out in the AI field, gaining significant market share and technological advantages. In addition, Intel’s slow response to changes in market demand prevented it from timely adjusting its product roadmap and Technology Investment direction, further weakening its competitiveness in emerging fields. These strategic mistakes not only affected the company’s market performance, but also led to a decline in investor confidence in Intel.

Technological innovation lags behind and lacks competitiveness

Technological innovation is the core of competition in the semiconductor industry, and Intel’s pace in this field appears to be slow. Especially in the fields of artificial intelligence (AI) and high-performance computing (HPC), Intel’s technological progress lags behind its competitors. For example, Nvidia’s leading position in AI and GPU has posed a severe challenge to Intel. Nvidia’s AI accelerator and high-performance computing products have achieved significant success in the market, causing Intel’s market share in these key areas to significantly shrink. Although Intel has made multiple improvements in the Xe GPU series, it has not been able to effectively challenge its competitors’ technological leadership.

The new quarterly financial report is disappointing

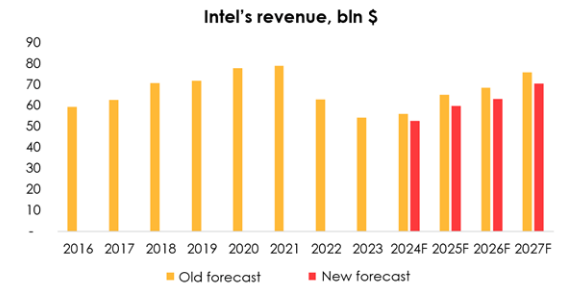

In the second quarter of 2024, Intel’s financial report showed that the company’s revenue was $12.20 billion, year-on-year unchanged, but failed to meet the market’s expected $12.40 billion. More importantly, the company’s profitability has significantly decreased, with operating revenue of $1.96 billion and a serious loss of negative 15.3% in operating profit margin. The company’s performance expectations have also been lowered in the financial report. Intel lowered its revenue forecast for 2024 from $56 billion to $52.80 billion, and lowered its revenue forecast for 2025 from $65.30 billion to $59.80 billion.

This series of downgrades reflects the company’s pessimistic expectations for future market demand. After the financial report was released, Intel’s stock price plummeted 26.06% on the same day, and its market value instantly evaporated by about $32 billion, setting the largest single-day decline in more than 40 years.

The OEM business is facing challenges, further increasing financial pressure

The company’s foundry business department also faces many challenges. Although Intel has invested a lot of resources to develop its foundry business, its current production capacity and cost structure are still difficult to compete with global industry leaders. The losses in this area not only affect the company’s overall financial performance, but also restrict the development of the company’s other core businesses.

Faced with the risk of being kicked out of the Dow Jones Industrial Average, it may further have adverse effects

Intel’s current low stock price puts the company at risk of being removed from the Dow Jones Industries Average Index (DJIA). If this happens, it will have a series of potential negative impacts on the company.

Being kicked out of the Dow Jones may have a direct impact on stock prices. The Dow Jones’ Constituent Stock Passive Fund and ETF usually adjust their investment portfolios, and the excluded stocks may face pressure from capital outflows, which will impose additional burdens on stock prices. In addition, the market may interpret the exclusion as a sign of poor company prospects, triggering further stock price declines.

Although the direct impact of being removed on Intel’s market value may be small, the potential impact on the company’s reputation and investor confidence cannot be ignored. This impact may not only lead to short-term stock price fluctuations, but also have negative effects on the company’s long-term market performance. Therefore, Intel needs to take active measures to restore market confidence and consolidate its position among investors.

Intel takes active measures to respond

Intel is taking proactive steps to address current challenges. By spinning off its OEMs, selling Mobileye stock, adjusting capital expenditures, and laying off employees, the company hopes to restore market competitiveness in the long term. However, the effectiveness of these measures still needs time to be verified, and Intel needs to maintain strategic coherence and effectiveness in the execution process to achieve its goal of reshaping the future.

Carry out strategic adjustments and spin off industries

In the face of severe market challenges, Intel is making a series of strategic adjustments to seek self-rescue. A key strategy is to spin off its wafer fab business into independent companies. This measure aims to improve the Operational Efficiency of the wafer fab business and allow independent companies to focus on innovation and market competition in the semiconductor manufacturing field. Through the spin-off, Intel can not only focus on its core business, but also introduce more investment and development opportunities for independent wafer fab companies through market-oriented mechanisms. After the spin-off, Intel can focus more on its main business areas, improve overall strategic execution and market response speed.

In addition, Intel is also considering selling its Mobileye stock. Mobileye is an important investment for Intel in the field of autonomous driving, but the returns in this field have not met expectations. Selling Mobileye stock can not only bring much-needed funds to the company, but also help Intel refocus on its core semiconductor business and optimize its asset portfolio. Although this transaction may have an impact on the company’s strategic layout, it helps alleviate current financial pressure and release more funds for more strategic projects.

Adjustment of capital expenditure

In order to cope with financial pressure, Intel has decided to significantly reduce capital expenditures. This includes canceling some factory projects that have not yet been implemented to reduce future funding needs. This adjustment reflects the company’s pragmatic attitude when resources are tight, aiming to concentrate resources on more strategic and profitable projects. Reducing capital expenditures helps the company maintain financial stability in the face of market uncertainty while improving investment return.

Control costs, announce layoffs and suspend dividends

Intel has also taken measures to lay off employees and suspend dividends to cope with economic difficulties. The company announced a 15% reduction in employees to reduce operating costs and improve liquidity. This measure will significantly reduce labor costs and help the company optimize its organizational structure to cope with resource constraints. In addition, Intel has decided to suspend dividend payments. Although this measure may have a negative impact on shareholders in the short term, it will help the company maintain stronger cash flow and support its restructuring and investment plans.

How should investors layout, is it an opportunity or a challenge?

Intel faces opportunities and challenges in the current economic and market environment. Understanding these factors helps investors make wise investment decisions and optimize their investment portfolios.

Especially when facing the current complex uncertainty, everyone should be cautious and observe. You can go to BiyaPay to monitor the real-time trend of Intel’s market, which can be directly purchased or find a suitable buying opportunity. If you have difficulties with deposits and withdrawals, you can also use it as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it to other securities firms to buy stocks. The arrival speed is fast, and there is no limit, so you will not miss investment opportunities.

The current stock price faces some upward potential, bringing investment opportunities

The market’s pricing of Intel has reflected the worst concerns

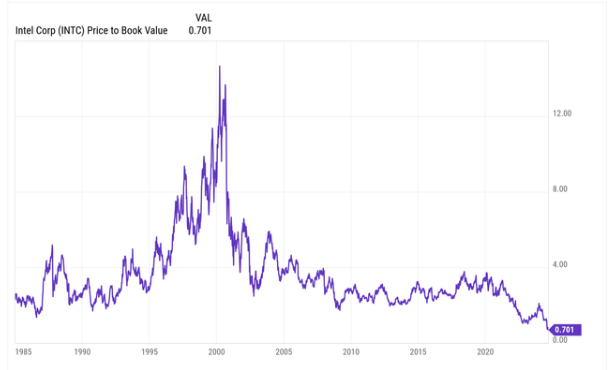

Intel’s current stock price is significantly lower than its carrying value, indicating the market’s pessimistic expectations for the company’s future. Specifically, Intel’s stock price is currently only 0.7 times its carrying value, which is a relatively low valuation level. This phenomenon indicates that the market has made the worst expectations for Intel’s current situation, and this pricing also reflects the market’s concerns about the company’s potential difficulties in the short term. However, the market’s pricing of Intel may have underestimated some of the company’s potential value.

Intel’s total assets are about $206 billion, including a large amount of foundry assets and $29.30 billion in cash and equivalents. In addition, the company is implementing a $10 billion cost reduction plan, which will help unlock the potential value of its assets and reduce its debt burden of $53 billion. Against this backdrop, despite short-term challenges, the company remains one of the most strategic companies in the US. The undervaluation of the market may mean that investors have the opportunity to find value gaps at the current low stock price level.

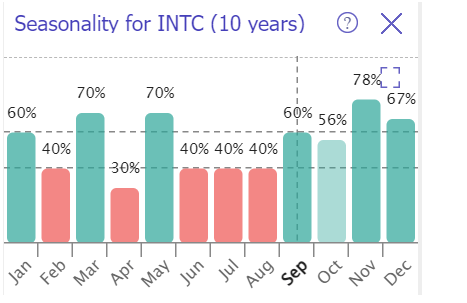

Seasonal trends indicate that stock prices may rebound in the future

Historical data shows that Intel’s stock usually performs well at the end of each year. Although Intel’s stock price has fallen by about 60% since the beginning of the year, this decline may have attracted some investors who bought on dips, leading to a short-term rebound in the stock price. In addition, despite Intel’s weak fundamental performance in 2023, the stock still rose by 90% that year. This historical seasonal performance and the cyclical trend of the stock market indicate that Intel may experience a certain stock price rebound before the end of the year.

Last year, although the stock market pushed up the prices of many semiconductor stocks due to the artificial intelligence boom, Intel did not fully benefit. As a company with a rich brand and market influence, Intel still has the ability to research and innovate, and may launch disruptive products in the future. Investors need to pay attention to these trends to evaluate the possibility of short-term rebound and its impact on investment strategies.

A strong PC market recovery or renewal cycle could have a positive impact

Intel’s performance in the PC market has come under pressure from competitors in recent years, especially the rise of AMD, which has led to a decline in market share. However, recent quarterly data shows that Intel’s PC market share has rebounded. From 2012 to 2024, Intel’s share of the x86 computer CPU market once dropped to about 60%, but it has now rebounded to 63.5%. This rebound in market share reflects the company’s signs of recovery in the PC market.

If the PC market continues to recover strongly in the future or enters a new update cycle, it may have a positive impact on Intel. Especially in the context of the company’s strategic adjustment and product updates, strong market demand can help Intel enhance its market position and improve the company’s financial performance.

The challenges faced cannot be ignored and should be carefully evaluated

Although Intel has potential investment opportunities, its short-term stock price fluctuations also bring significant risks that cannot be ignored. The company’s financial difficulties and sustained profitability have made its stock price face greater uncertainty. After experiencing significant financial losses and profit expectations being lowered, investors may face sustained market turmoil, which is particularly unfavorable for short-term investors.

In addition, Intel may face further financial pressure and business adjustments in the short term when facing fierce market competition and internal structural adjustments, which may lead to additional fluctuations in stock prices. Especially in an unstable economic environment, the challenges faced by the company may intensify, causing additional pressure and uncertainty for investors.

For investors, short-term fluctuations in Intel’s stock price may lead to instability in asset value, making investment decisions more complex. During the company’s strategic adjustment and restructuring process, although these measures may lay the foundation for the company’s future stability, they may cause market anxiety in the short term and further exacerbate stock price fluctuations. In this case, investors need to find a balance between managing risks and seeking returns to ensure the protection of their investments in market uncertainty.

In addition, Intel’s long-term challenges in technology updates and market competition cannot be ignored. The company needs to overcome the problem of technological lag, increase market share, and effectively execute its strategic plan. If these challenges are not effectively addressed, investors may face uncertainty in long-term investment returns.

Overall, Intel does face a series of challenges, but it is also actively responding to them. Intel’s investment opportunities and challenges coexist. Market undervaluation and seasonal rebounds may provide short-term opportunities for investors, but they need to be wary of the uncertainty brought by short-term stock price fluctuations and long-term strategic adjustments. Investors should develop flexible investment strategies based on weighing opportunities and risks, closely monitor the company’s financial situation and strategic execution, and optimize investment decisions.