- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Stock Price Plunges by 10%, Why Did Broadcom's Better-Than-Expected Earnings Report Become a "Tinder

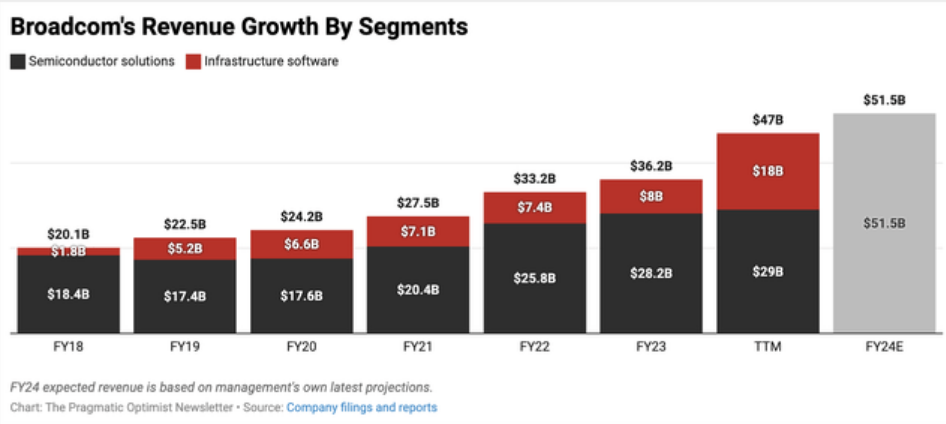

Broadcom Inc. (NASDAQ: AVGO), as a global leader in semiconductor and infrastructure software solutions, has long been a focus of investor attention. However, after recently announcing its financial report for the third quarter of the fiscal year 2024, despite the company reporting strong revenue growth, its stock price unexpectedly plummeted significantly.

This hardware manufacturer announced earnings for the third quarter that exceeded expectations, but then its stock price plummeted by 10%. Despite being driven by the continued prosperity of the artificial intelligence market, with a year-over-year revenue increase of 47% in the last quarter, the earnings report fell into a week of weak macro data.

Last week, chip stocks performed particularly poorly as investors panicked over poor labor market data. But in my view, Broadcom may be in a position to buy on the dip, as the company maintains high gross margins and generates a substantial amount of free cash flow, and after last week’s decline, the stock price has also become more affordable.

Financial Report Analysis

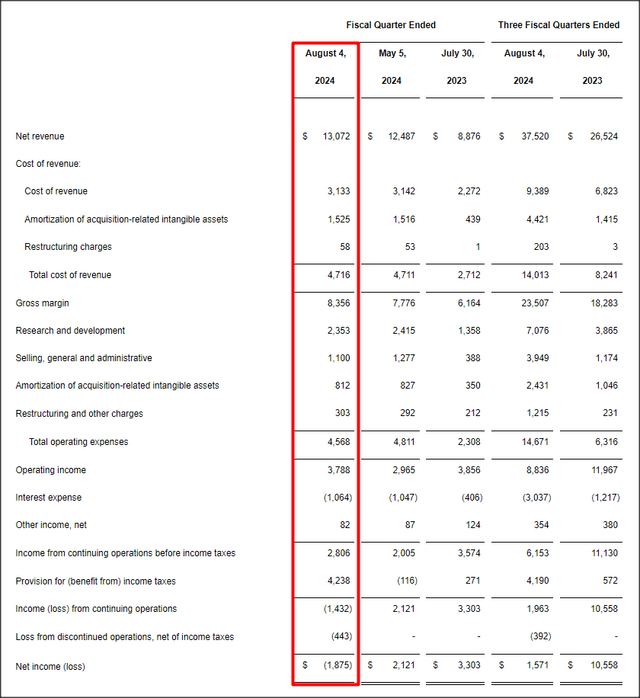

Broadcom Inc. (NASDAQ: AVGO) showed different growth dynamics in its business lines in its financial report for the third quarter of the fiscal year 2024.

The company’s total revenue reached $13.072 billion, a year-over-year increase of 47%, exceeding the market’s general expectations. This significant growth is partly due to the company’s active expansion in the fields of artificial intelligence and software solutions, especially the outstanding performance of VMware’s business, which has driven the rapid growth of the infrastructure software business. It is expected that the impact of the acquisition will continue into the next quarter, and then return to a normal growth rate.

In terms of AI business, Broadcom reported a continuous increase in AI-related revenue, with strong demand for its network and custom chip products among hyper-scale cloud customers, bringing a year-over-year increase of 43%. However, the revenue performance of non-AI business was relatively weak, especially the decline in revenue from broadband and traditional semiconductor solutions.

Although the deceleration of non-AI business has dragged on the company’s overall profit performance, the company’s CEO, Hock Tan, expressed optimism in a conference call that non-AI business has bottomed out and is expected to recover:

In summary, here are the trends we see in the semiconductor field.

Overall, our non-artificial intelligence market has bottomed out, and we expect a recovery in the fourth quarter. Artificial intelligence demand remains strong, and we expect AI revenue to increase by 10% sequentially in the fourth quarter, reaching over $3.5 billion. This would mean that AI revenue for the fiscal year 2024 will reach $12 billion, higher than our previous expectation of over $11 billion.

And Seeking Alpha analyst Utam Dayi said that Broadcom continues to maintain its dominant position in the custom AI chip market, which, driven by AI, has boosted the company’s prospects:

We expect semiconductor revenue of about $8 billion in the fourth quarter, a year-over-year increase of 9%. For infrastructure software, we expect revenue of about $6 billion. Therefore, we expect a consolidated revenue of about $14 billion in the fourth quarter, a year-over-year increase of 51%.

In terms of free cash flow, Broadcom continues to demonstrate its financial robustness, with free cash flow of $479 million in the third quarter, a year-over-year increase of 4%, and a free cash flow margin of 37%. Broadcom’s strong free cash flow limits investment risks and can also support the company’s stock price in the long run, especially if the company returns a higher percentage of free cash flow to shareholders (through higher dividends or a new stock buyback plan).

But the key performance indicator for the hardware manufacturer is still the gross margin, and Broadcom’s performance in this area has greatly improved: the company benefited from the strong demand for artificial intelligence components and other custom products last quarter, with a gross margin of $8.4 billion, a year-over-year increase of 36%. The gross margin of this hardware manufacturer was 64% last quarter and 62% in the previous quarter.

In summary, Broadcom’s financial report reflects its strong momentum in high-growth areas and challenges in some traditional business lines. Despite the complex market response, Broadcom’s management remains optimistic about the company’s long-term growth and market position.

However, the market is currently worried about the high valuation of the semiconductor industry and the uncertainty of future growth expectations, especially when the high input-output ratio in the AI field may not meet expectations. The prosperity of the entire semiconductor industry may face a correction after reaching a cyclical peak, which may also intensify market unease.

Although the financial report shows that the company’s performance is excellent, with revenue increasing by 47% year-on-year to $13.072 billion, and non-GAAP diluted EPS increasing by 18% year-on-year to $1.24, exceeding market expectations, the stock market’s reaction to the financial report is that the stock price fell by 10% the day after the financial report was released. What factors are hidden behind this seemingly contradictory phenomenon?

Why is the performance being wrongly killed?

The performance of non-AI business drags down

Although Broadcom has achieved significant growth in AI-related products, the performance of the non-AI department is relatively weak, especially in the fields of broadband and traditional semiconductor solutions. Specifically, broadband revenue decreased by 49% year-on-year, and non-AI network revenue decreased by 41% year-on-year, which offset the growth in the AI field.

The market may be disappointed that these departments failed to meet the broader expectations of recovery. Although CEO Tan said that these businesses have bottomed out, this optimistic statement failed to alleviate market concerns about these departments continuing to drag down overall performance in the short term.

Market expectation gap

After significant price increases in the previous quarters, investors have very high expectations for the performance growth of the semiconductor industry.

When Broadcom released its performance forecast, although the indicators exceeded past performance, they failed to meet the highest expectations set by the market, especially in high-growth areas such as AI.

Impact of industry trends

Looking at the performance of semiconductor companies after the release of earnings this earnings season, it was found that most semiconductor companies, even if their performance exceeded expectations, did not perform well after the performance. Specifically:

NVIDIA announced a strong second-quarter report, with revenue and net profit both significantly exceeding market expectations, but the stock price fell nearly 7% after the market on the day of the announcement, and closed down 6.38% the next day.

TSMC announced a strong second-quarter report, both performance and guidance were very optimistic, but the stock price closed down 1.38% after the performance.

ASML’s second-quarter report was strong and exceeded market expectations, but the third-quarter revenue guidance was lower than expected, and the stock price closed down 12.74% after the performance.

High base number leads to inevitable slowdown in performance growth

The semiconductor industry is a cyclical industry, and 2023 and 2024 are the explosive high-growth cycles of the industry. After experiencing explosive growth, the challenges faced by the industry will become more apparent.

The industry has experienced unprecedented demand growth due to the acceleration of global digitization and the rapid development of key technologies such as 5G and AI. This has led to a situation of supply not meeting demand, further promoting rapid capacity expansion and rapid technological progress. However, as these conditions change, it is expected that from 2025, the industry will enter a new stage:

Continued increase in chip supply

In response to the high demand in the previous years, global semiconductor manufacturers have begun to expand production on a large scale, and new production lines and factories are expected to be put into operation in the next few years. This will significantly increase the supply of chips and alleviate the previous supply tension.

After 2025, with the continued increase in chip supply, coupled with the cooling of industry demand and the high base number issue, the growth rate of semiconductor industry revenue will inevitably slow down.

Company response measures

Faced with the dual challenges of industry cyclical fluctuations and rapid technological development, Broadcom has taken a series of strategic measures to maintain its market leadership and ensure long-term business growth.

Firstly, Broadcom continues to increase its investment in research and development in key technology fields such as artificial intelligence, 5G, and cloud computing. Specifically, there are: cooperation with Apple in 2023 to develop 5G radio frequency and other components; acquisition of VMware in 2022 to expand the field of cloud computing; rumors of cooperation with OpenAI in 2024 to develop AI chips.

Through these investments, Broadcom can not only maintain its technological leadership in the high-performance computing market but also explore new market opportunities, thereby promoting future business growth.

In addition, Broadcom has significantly enhanced its competitiveness in the field of infrastructure software by integrating VMware.

This strategic move not only expands the company’s product line but also strengthens its software business, enabling Broadcom to span the full range of technology fields from hardware to software, from storage solutions to network security. This diversification strategy significantly reduces dependence on a single market, enhancing business stability and market adaptability.

The integration of VMware’s technology not only increases the added value of products but also enhances customer stickiness and satisfaction, providing support for Broadcom to maintain a leading position in the fierce market competition. Against the

backdrop of increasing global market uncertainty, the ability to provide comprehensive solutions across multiple technology and market fields is key for Broadcom to maintain its market leadership and achieve stable growth.

Finally, Broadcom has also demonstrated forward-looking thinking in optimizing supply chain operations. The company has effectively responded to global supply chain challenges by establishing closer cooperation with suppliers and increasing production flexibility. This not only ensures production efficiency but also helps the company to respond quickly in the face of potential supply disruptions, maintaining business continuity.

Investor advice

Stock valuation

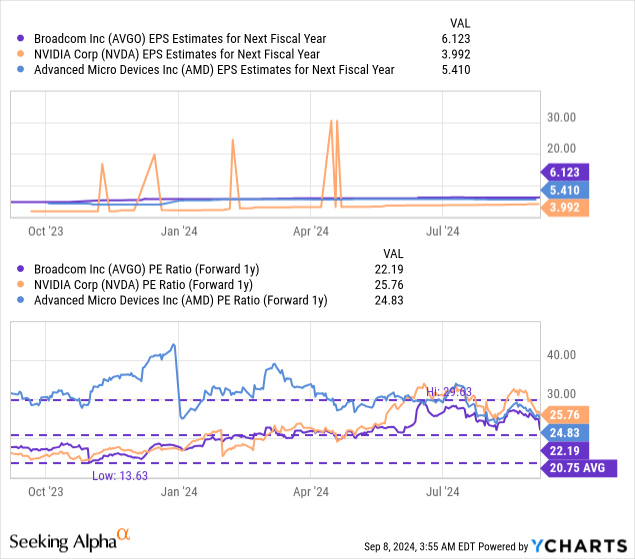

Broadcom’s valuation is no longer as high as it was a few months ago when optimism for AI hardware manufacturers such as NVIDIA (NVDA) or Super Micro Computer (SMCI) reached its peak.

Last week was a particularly bad week for Broadcom’s earnings release, as the market was hit by a poor employment report for August, and the employment data for July was revised downward.

However, Broadcom’s 10% drop on Friday has made the stock more affordable for investors: since my last recommendation, Broadcom’s stock price has fallen about 20%, and I believe investors are now facing an attractive buying opportunity on the dip.

Broadcom’s expected price-to-earnings ratio is 22.2 times, about 7% higher than last year’s average price-to-earnings ratio, but far below the nearly 30 times expected price-to-earnings ratio we saw earlier this year. Compared with other fast-growing chip companies such as NVIDIA and AMD (AMD), Broadcom’s current valuation ratio is more attractive.

I believe that, given Broadcom’s strong underlying free cash flow profitability and its ability to expand gross margins quarter by quarter, its price-to-earnings ratio can reach 25 times. A 25 times fair value price-to-earnings ratio means that its intrinsic value is about $153 per share (based on the expected average earnings per share of $6.12). Given that the company’s stock price is below the fair value expectation and that the company has issued a robust revenue guide for the next fiscal quarter, I believe it is reasonable to upgrade the rating to buy.

Long-term growth factors and risk assessment

Broadcom’s continuous innovation and market expansion in artificial intelligence, data center hardware, and network solutions are expected to drive further growth in revenue and profits in the coming years.

Especially as the global deployment of 5G technology accelerates and the demand for enterprise software grows, the company’s products and services are at the forefront of market demand. Investors can use multi-asset trading wallets like BiyaPay to regularly monitor stock prices and buy or sell stocks at the right time.

Among them, BiyaPay can not only recharge usdt to trade US stocks and Hong Kong stocks but also supports recharging usdt to withdraw US dollars and Hong Kong dollars to bank accounts, and then withdraw local currency to other securities for investment. This method can be said to be fast, without limit, without any cash-in and cash-out troubles, and can also pay attention to the stock market dynamics at any time.

The attractive points of Broadcom’s stock are not only these, but also the dividends. Broadcom’s dividend yield has been at a relatively high level in the industry, currently about 1.5%. The company is also actively repurchasing shares, reflecting the management’s confidence in the company’s value and its commitment to improving shareholder returns.

Broadcom has significantly expanded its business in the fields of software-defined data centers and cloud computing through the acquisition of key technology companies such as VMware, enhancing its competitiveness in the global market. These strategic acquisitions have not only improved Broadcom’s product portfolio but also optimized its ability to respond to rapidly changing market demands.

Through technological leadership and strategic cooperation, Broadcom has further consolidated its market position and quickly adapted to changes in technology and the market. Especially the company’s investment in 5G and AI fields is expected to bring new growth momentum for Broadcom as these technologies are commercialized.

Overall, Broadcom’s strategy—from active acquisitions to significant R&D investments—has not only strengthened its leadership in the global semiconductor and software markets but also provided strong market adaptability and future growth potential, creating continuous value for investors and partners.

These factors make Broadcom attractive to investors seeking stable returns and long-term appreciation.

However, despite the broad prospects, the risks it faces cannot be ignored.

As the market enters the usual September downturn, Broadcom’s valuation may face compression, and its price-to-earnings ratio is expected to be adjusted to close to the 17-18 times of the S&P 500 index.

This adjustment mainly reflects the seasonal changes in market sentiment, which may lead to an adjustment of Broadcom’s target stock price to about $125-128. In addition, the company’s recent integration of VMware has attracted market attention to its software operating model, which may lead some customers to switch to competitors such as Nutanix, although this move has also brought some positive effects.

Hock Tan’s dominant growth strategy, especially through strategic acquisitions, has proven to be very effective in enhancing Broadcom’s market position. This strategy not only strengthens the company’s pricing power and profit expansion ability but also helps Broadcom to provide customized solutions in the large enterprise and hyperscale enterprise markets. Although some media have questioned the stability of the VMware integration, which may temporarily put pressure on Broadcom’s stock price, this pullback will only provide potential buying opportunities for investors.

In summary, despite external risks, Broadcom’s comprehensive strategy and operational efficiency enable it to not only maintain a robust financial position but also find growth opportunities from industry challenges. Investors can look forward to Broadcom continuing to promote technological innovation and market expansion while maintaining its competitive advantage in the global market.