- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Dell's quarterly earnings outshine NVIDIA's, boosting its stock. Can it continue to break new ground

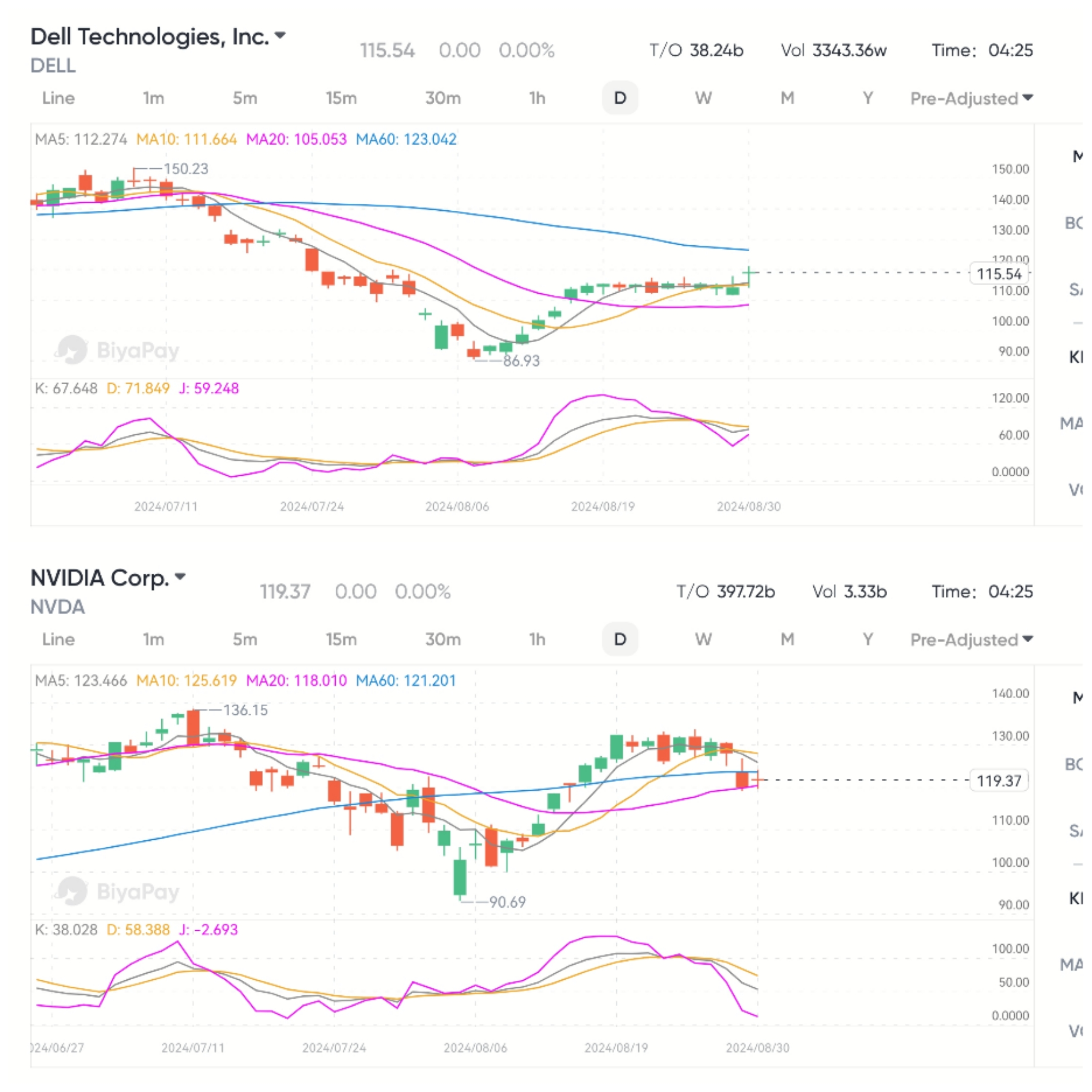

Dell released its Q2 financial report last Thursday, with impressive performance that exceeded Wall Street’s expectations and became a major beneficiary of the benefits brought by AI. The stock rose more than 3% in after-hours trading and continued to rise on Friday. Although the overall stock price rose slightly last week, it was enough for Dell to surpass the AI star company NVIDIA that everyone initially focused on. NVIDIA fell more than 8% last week and then rebounded due to its Q2 performance showing a decline in gross profit margin.

Next, we will review Dell’s impressive performance in the second quarter and list some of its growth potential and future risks to prepare for investment.

The second quarter financial report is impressive

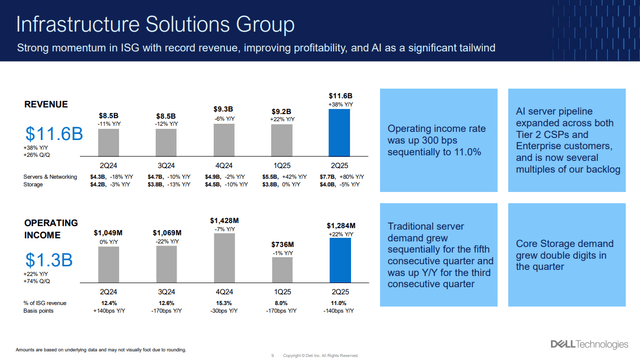

Dell’s Q2 results were encouraging. Revenue grew 9% YoY and 13% QoQ, and operating income and free cash flow were also strong at $1.30 billion each, but the best news was in the details.

Infrastructure Solutions Group (ISG), which serves data center customers, reported sales of $11.60 billion, up 33% year over year, driven by an 80% increase in server and networking revenue.

The rise of AI server business brings favorable demand

Statista predicts that global data center revenue will grow by 50% within five years , from $416 billion this year to $624 billion in 2029, with server and storage sales increasing from $176 billion to $308 billion. This is a huge opportunity for Dell.

Dell is the main supplier of the xAI program, which aims to build “the world’s largest supercomputer” and will provide server racks. Its main competitor, Supermicro, is also involved in the construction, but it seems to have encountered some difficulties recently. A severe short report recently released by Hindenburg Research has damaged its reputation, and its subsequent announcement of delaying the annual 10-K report has caused its stock price to plummet , which is good news for Dell and may allow it to dominate and further increase its market share.

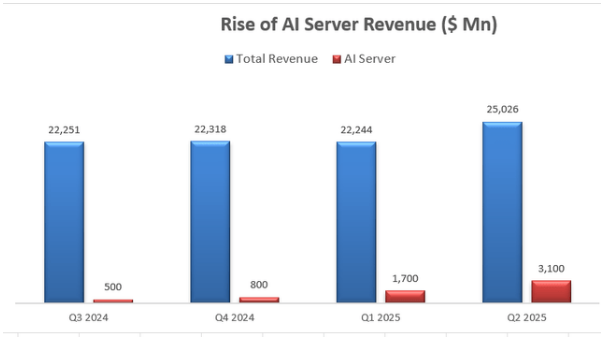

In addition to the favorable demand, Dell also has other advantages. The rapid growth of artificial intelligence server revenue has created huge potential for it. As shown in the figure below, artificial intelligence server revenue accounted for about 12.4% of total revenue this quarter, compared to only 2.2% three quarters ago. Dell’s backlog of orders reached a record $3.80 billion at the end of this quarter, which is remarkable.

Dell’s artificial intelligence servers are expected to continue to grow rapidly and contribute significantly to overall revenue growth going forward for the following reasons:

- Dell has technological advantages in the computing, networking, storage, and PC markets, and will support AI training and inference in the future. Dell’s overall AI product portfolio can provide solutions from desktop/edge to data center/cloud. In addition, Dell has been expanding partnerships with major AI suppliers such as Nvidia, AMD, and Intel to drive demand and expand revenue.

- Dell and HP Enterprise (HPE) have a considerable market share in the traditional server market. Dell can leverage its existing distribution network, technology, and customer base to expand its server products to AI workloads and data centers. Their rack-level solutions can leverage the latest GPUs from Nvidia, AMD, and Intel to help their customers improve computing power and energy efficiency.

- According to the management, the main customers of Dell AI servers are still large-scale enterprises, and the number is increasing. Enterprise customers will gradually expand their data center capabilities and become the main buyers of AI servers in the future. When AI enters the inference stage, the demand for EdgeComputing will be greater, and more servers and storage products will be needed.

Valuation is optimistic, and the stock price is attractive

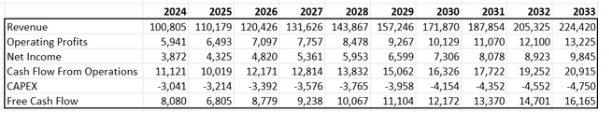

Driven by strong growth in the server and networking business, this article predicts that Dell’s revenue will grow by 14% in fiscal year 24. For normalized revenue growth starting from fiscal year 2025, we assume that servers and networking will grow by 20% annually, storage will grow by 5%, and client solutions will grow by 5%. Therefore, normalized revenue growth is expected to be 9.3% starting from fiscal year 2025.

Due to the low gross profit margin of selling AI servers to large-scale enterprises, Dell may face 10bps gross profit margin resistance in the near future, but the operating leverage of sales, general and administrative expenses will bring 10bps profit margin improvement, offsetting this resistance.

Based on these assumptions, the DCF summary is as follows:

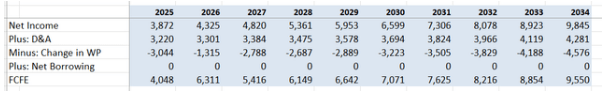

The calculation of free cash flow generated by equity is as follows:

Assuming the risk-free interest rate is 3.8%, the Beta Index is 0.9, and the equity stake Risk Premium is 7%, the equity stake cost is calculated as 10%. Excluding all future FCFE, Dell’s one-year target price is calculated as $190 per share. Combined with the current stock price, it can be found that the current stock price is severely undervalued and has great attractiveness based on future expectations.

Despite the bullish outlook, risks remain

All stocks have risks, and Dell is no exception. This industry is fiercely competitive, with its largest business being personal computers. However, this market is highly cyclical, requiring high product updates and innovation, and continuously increasing research and development investment to maintain product competitiveness. Some predict that performance updates related to operating systems and artificial intelligence will drive a new round of upgrade cycles, which also poses a challenge to Dell.

Furthermore, Dell is facing a layoff crisis. According to relevant coverage, Dell plans to lay off 12,500 people in 2024, accounting for about 10% of the total number of employees, as part of the sales team restructuring. Dell’s goal is to create a business group focused on artificial intelligence and cut some low-growth business units. The management confirmed the restructuring in the financial report, indicating that the company is optimizing its sales coverage to better focus on artificial intelligence from the second half of this year, with an expected layoff cost of $328 million. In the short term, the layoff crisis will have a certain negative impact on Dell’s stock price, but in the long term, the restructuring plan may accelerate Dell’s overall revenue growth in the future.

How do investors layout?

In addition to some of the growth potential mentioned above, Dell’s shareowners also enjoy other benefits. Its dividend has increased by 20% this year, and the current dividend yield is 1.5%. The management’s goal is to increase the dividend by at least 10% per year until the 2028 fiscal year. For today’s Dell investors, regardless of how its stock price grows in the future, they can obtain at least a 2% cost return.

Therefore, if you have investment intentions, you can consider buying at BiyaPay. Of course, you can also further monitor the market trend and wait for a more suitable opportunity.

In addition, if you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. You can recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities firms to buy stocks. The deposit speed is fast and there is no limit, so you won’t miss investment opportunities.

Another point is that the company is more active in stock buybacks, repurchasing $700 million in the last quarter and $3.60 billion in the past 12 months, accounting for about 4.5% of the current market value. With the increase in buybacks, the number of outstanding stocks is rapidly decreasing, which will have a positive impact on its stock price.

However, as investors, we can not ignore the relevant risks, although Dell’s growth potential is huge, its future development is also challenging, we must pay attention to the relevant market in a timely manner, do a good job in threat and risk assessment and investment judgment.