- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

The Fed is about to cut interest rates, and Ray Dalio, the founder of Bridgewater Associates, teache

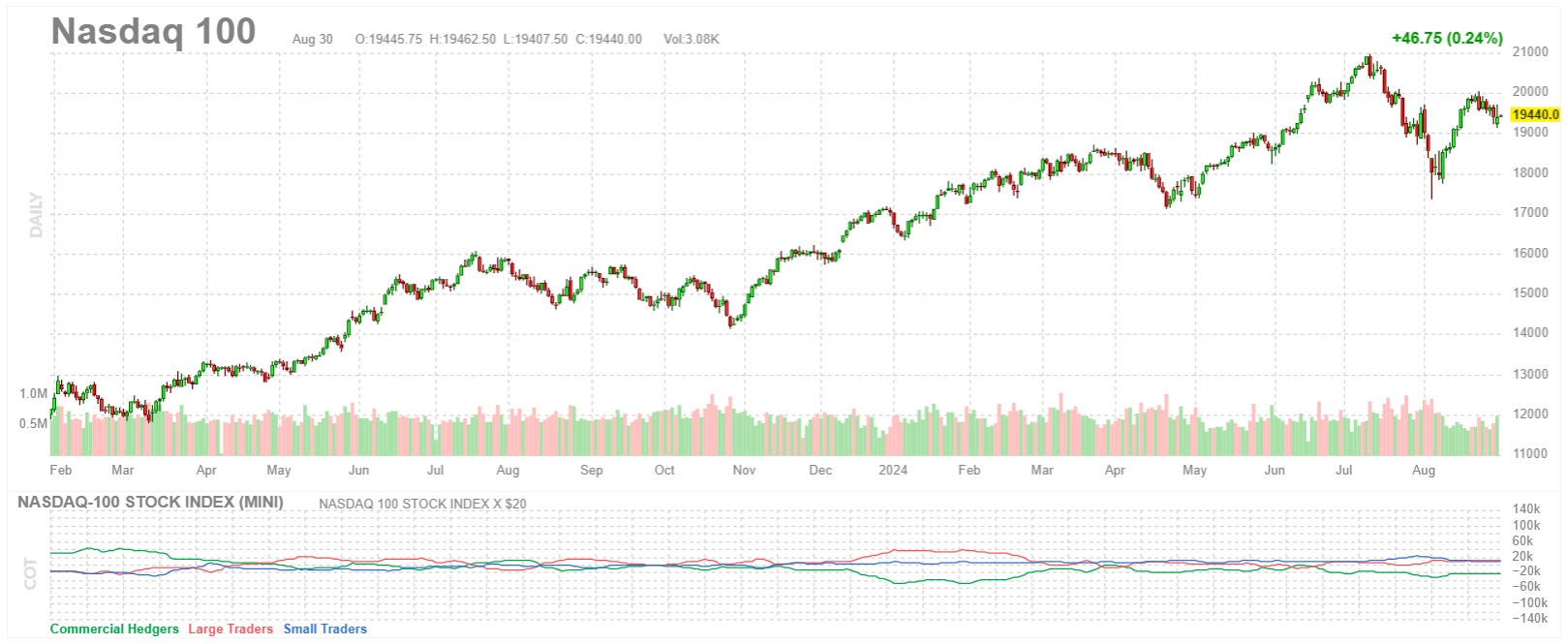

Recently, a well-known financial blog stated that the Federal Reserve will start trying to cut interest rates by 25 basis points for the first time and remain cautious. The article states that after the Fed starts the first rate cut, it may trigger a market crash, and the “Black Swan” catalyst should be viewed with caution.

Interest rate cut is a sword hanging over the heads of all US stock investors. For more than six months, the expectation of a 25 basis point rate cut has been digested by the market. The trading atmosphere seems to indicate that a significant rate cut is imminent. But when will the rate cut be announced? No one knows.

In this uncertain market environment, how should ordinary investors respond? Is there an investment strategy that can ensure the ROI of ordinary investors while also reducing overall drawdowns when the market falls?

What is “all-weather strategy”?

The All Weather Strategy was proposed by Ray Dalio, founder of Bridgewater Associates, in 1996. It integrates macroeconomic analysis, asset selection, and risk management, and is a long-term investment mechanism.

Before the launch of this strategy, most fund managers and investors would first anticipate the macroeconomic environment before investing, and then make assets or investments based on the characteristics of economic cycles and asset classes. However, the problem with this model is that the judgment of economic cycles has a certain lag, and even the smartest person cannot always be correct.

Dalio hopes to find an asset portfolio that can cope with various economic cycles, and will have a good performance experience under any economic cycle. This is the origin of the all-weather investment strategy.

The theoretical basis of all-weather strategy

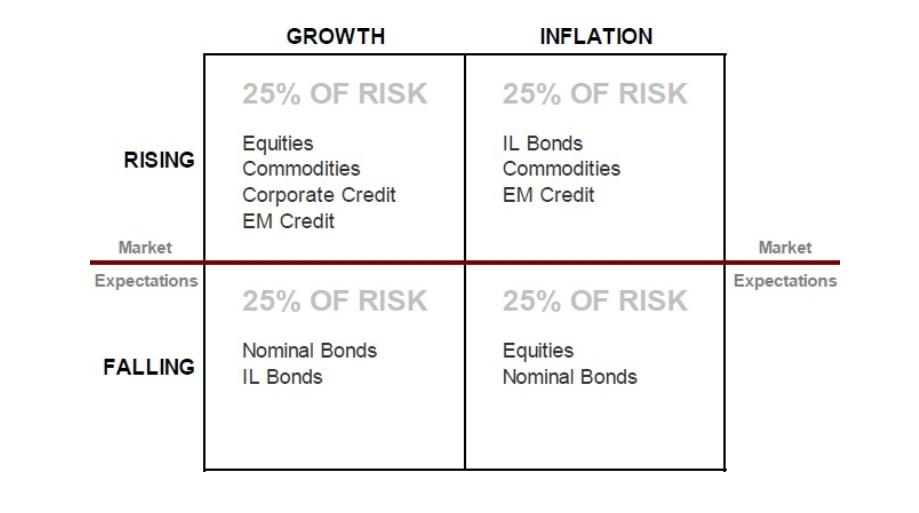

Dalio believes that the factors driving up asset prices are economic growth and inflation . Based on this, he divides macroeconomics into four states: economic growth exceeding expectations , economic growth below expectations , inflation exceeding expectations , and inflation below expectations .

At the same time, based on the historical performance of major asset classes, find the best performing major asset classes under the above macroeconomic conditions.

Under different economic cycles, the performance of major asset classes is completely different.

- During the economic upswing, assets performed well, but stocks performed the best

- During an economic downturn, stocks perform the worst, but bonds perform well.

- During the period of rising inflation, the performance of commodities and inflation-linked bonds will be good

- During the downward cycle of inflation, stocks and ordinary bonds will perform well, but commodities will perform poorly

If we want to summarize it simply, there are actually two parts:

- Multi-Asset Allocation ensures that the East is not bright and the West is bright.

- Based on risk allocation, avoid traditional asset portfolios that overly emphasize equity assets and lead to risk loss of control.

The core of this strategy is to build an investment portfolio that can maintain stable performance in various economic environments and market cycles, thereby achieving the goal of “all-weather” adaptation to the market.

There is no need to actively change funds or observe the market. It is the most suitable investment method for lazy people, and the risk is controllable. Unless there is a triple kill of stocks, bonds, and gold, it is generally difficult to experience a significant decline.

The conventional all-weather strategy portfolio includes: 25% stocks + 25% gold + 25% long-term bonds + 25% short-term bonds.

How to implement?

So how to choose the target for the above strategies? Below is a recommended set of typical cases.

Entry Edition

- S & P 500 ETF (SPY) (25%)

- Long-term Treasury ETF (TLT) (25%)

- Short-term Treasury ETF (BIL) (25%)

- Gold ETF (GLD) (25%)

- S & P 500 (SPY): Tracking the S & P 500 index, Buffett has always advised everyone that the best choice for ordinary people is to allocate the S & P 500 for the long term

- US 20 + Year Long Term Treasury (TLT) Holding government bonds for more than 20 years is the main trend. During an economic recession and expected interest rate decline, long-term bonds will take off, thus forming a certain hedging effect with stocks. 20-Year bonds are more affected by interest rate fluctuations, but the hedging effect is also good.

- US 1-3 month Treasury note (BIL) (25%)

Holding short-term bonds within 3 months can also be understood as assets such as money market funds . Renowned private equity fund founder Bridgewater Associates once said that cash is garbage, but after 22 years of long-term bonds being hit hard, coupled with the soaring cash interest rate, he had to change his tune and say that cash assets can be allocated and paid attention to. And Buffett is now selling Apple to hold cash assets. Of course, the purpose of holding cash is not to preserve value, but to calmly seek the next allocation opportunity when facing risks. - SPDR Gold Trust (GLD)

GLD tracks the price trend of gold spot. Gold can not only withstand inflation, but also effectively avoid extreme market risks. During economic downturns or wars, gold is often sought after. At this time, it can also form a good hedging effect with stocks.

In principle, holding the above four funds for rebalancing can be done.

Advanced version

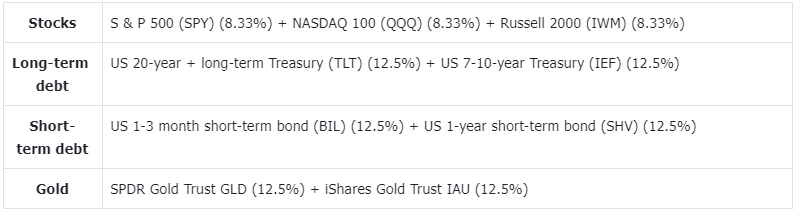

If you are worried about being too concentrated, you can also diversify and allocate some other varieties in each major category of stocks, bonds, cash, and gold to further stabilize fluctuations. Here, we will add a more dispersed version of the all-weather permanent portfolio.

The stock part , in addition to the S & P 500, also added the strongest technology bull index Nasdaq, as well as the small-cap stock index Russell 2000, diversified allocation.

Long-term debt part , feel that the duration of 20 years is too long, you can also add some 7-10 years.

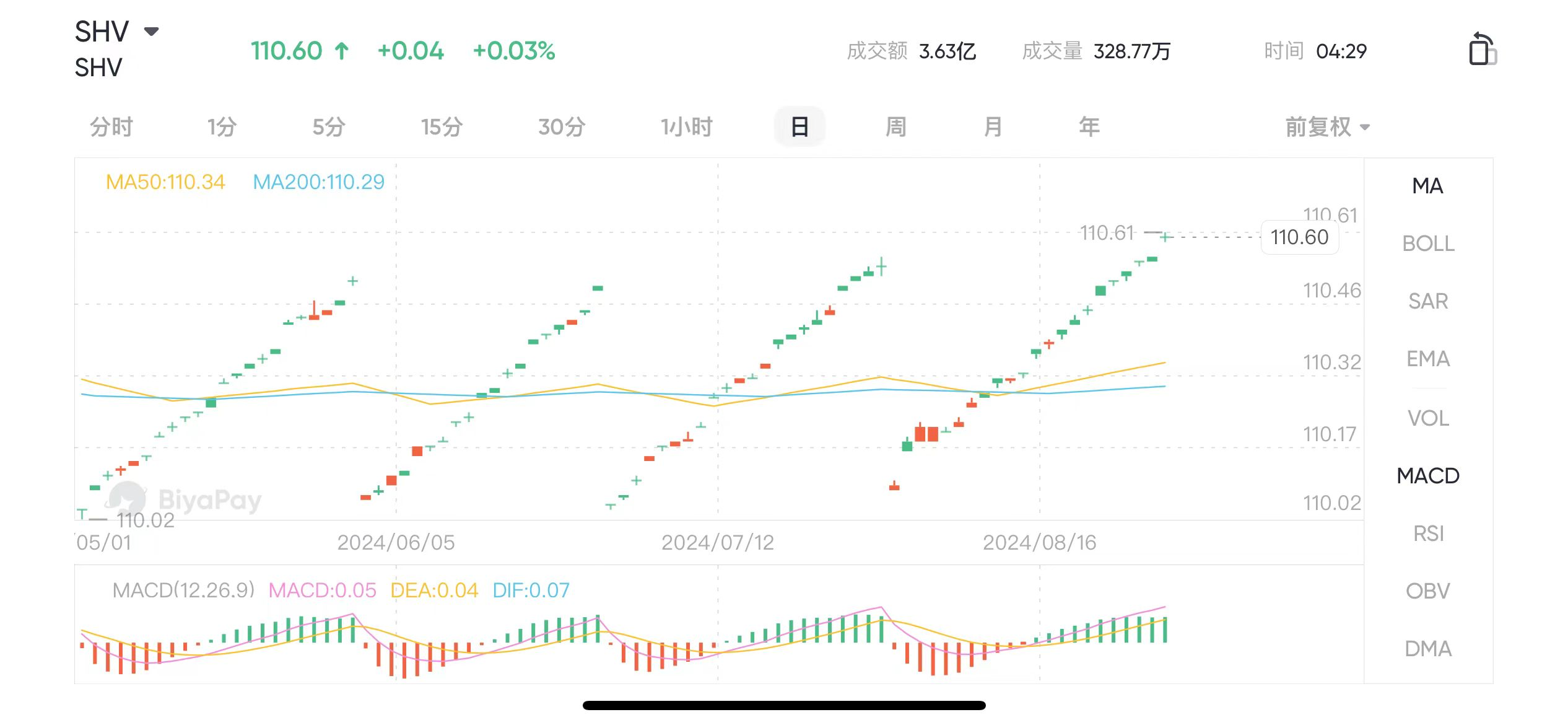

Short-term debt and gold part , if you think one is too concentrated, you can also choose to supplement the other direction of similar targets.

Summary

Overall, the construction of overseas all-weather is roughly done. We can trade on legitimate and safe US stock investment platforms such as Interactive Brokers and BiyaPay, and regularly rebalance according to this ratio. By reducing the proportion of high holdings and increasing the proportion of low holdings, we can return to the original allocation and achieve very smooth investment performance.·