- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Summary of SWIFT English Receiving Information Addresses for Overseas Bank Accounts in Hong Kong and

Many bosses have a demand for overseas Asset Allocation. As the pillar of their family and the helmsman of their own family, they need to plan their own Asset Allocation from the perspective of their own family’s long-term development, to isolate risks and ensure asset appreciation for their wealth. Opening accounts for US and Hong Kong stocks, connecting with various Hong Kong banks/branches/Customer Managers for card opening, setting up offshore companies, handling accounts in Hong Kong, and connecting with trusts are all indispensable parts of overseas Asset Allocation.

Therefore, the most essential tool in cross-border asset allocation is offshore bank accounts. I have previously shared many account opening strategies for Hong Kong banks. Today, I will share with you the bank account info needed for daily transfers to various Hong Kong and Singapore banks.

Basic information about bank telegraphic transfer

Nowadays, more and more people are opening overseas bank accounts for global allocation. However, many people do not know where to check their payment information after obtaining their overseas accounts.

Whether it is a company account or a personal account, the bank’s payment information will be used, and this information usually needs to be filled in English. Many times we are not very clear about it.

Therefore, we have compiled a list of mainstream bank payment information in Hong Kong and Singapore for everyone to check at any time when needed.

Everyone can also save their own bank payment information for future transfers or to friends!

Let’s first take a look at the composition of overseas bank payment information.

1. Name of the payee (Name)

- Own name, Hong Kong and Macao travel permit or passport English name/Pinyin.

2. Receiving account number ( Bank Account No )

- In the Chinese mainland, the bank card number is the online banking account, but the overseas card is different, the two are separated.

- When we transfer money, the account number we fill in is usually the online banking account of the overseas account, not the bank card number.

- The bank card number of the overseas account is only displayed on the documentation when withdrawing cash or swiping the card at an overseas ATM.

- Therefore, for overseas accounts, the bank card number is not very useful. It is mainly enough to remember the online banking account number!

- This can be a comprehensive household registration or a corresponding foreign currency account, which is the account number corresponding to Hong Kong dollars, US dollars, euros, pounds sterling, and Japanese yen in online banking.

3. Bank Name

- The name of the corresponding bank.

4. Bank Address

- Corresponding bank address.

5. International remittance code (Swift Code)

- Generally, international remittance codes refer to Swift Code.

6. Bank Code

- Corresponding to bank-specific codes.

Let’s get to the point and take a look at some key payment information from mainstream banks in Hong Kong and Singapore!

Bank international telegraphic transfer global mainstream identification code

1、SWIFT CODE

In international telegraphic transfer, SWIFT CODE is essential.

SWIFT is the English abbreviation for Society for Worldwide Interbank Financial Telecommunication. The member banks of the association have their own specific SWIFT codes, also known as BIC bank identification codes.

The identification code is used for international financial transactions and to identify designated banks.

SWIFT CODE consists of 8 or 11 characters and can be divided into 4 parts to identify banking institutions, countries, locations, and branches.

The first four digits are the abbreviation of the receiving bank, the fifth and sixth digits are the country code, and the seventh to eleventh digits are the regional identification code.

For example, the SWIFT CODE of Citibank Hong Kong Branch is CITIHKHX.

In short, SWIFT CODE is equivalent to a bank’s ID number, and each bank usually has its own independent SWIFT CODE.

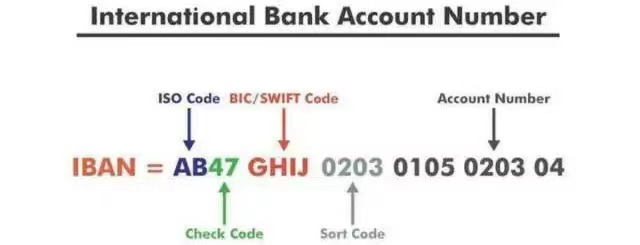

2、IBAN

IBAN is mainly applicable to European countries.

IBAN is an abbreviation for International Bank Account Number, developed by the European Committee for Banking Standards (ECBS) to identify bank accounts.

SWIFT CODE only provides information for Financial Institutions, while IBAN not only provides information for Financial Institutions, but also provides information for receiving accounts.

Usually, bank accounts in Europe and some other regions have IBAN numbers.

Therefore, when making payments to these countries and regions, it is necessary to pay attention to filling in their IBAN numbers. If payment is not made using an IBAN account in the Eurozone, additional manual intervention fees may be charged.

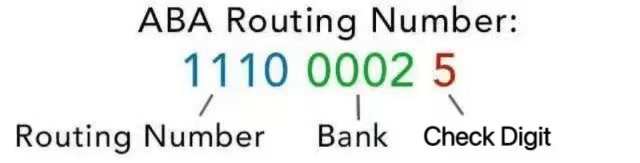

3、ABA

US bank transfers require an ABA Routing Number.

ABA Routing Number is a bank account number developed by the American Bankers Association. It is usually only available in US banks and is mainly used for routing confirmation of transactions, transfers, clearing, etc. related to banks. It consists of 9 digits (8 content digits + 1 verification code).

Simply put, ABA ensures that the money you transfer will go to which bank, mainly used in the US and North America. Banks in other countries do not have ABA.

4、Sort Code

Sort code is a 6-digit clearing code for the United Kingdom, which is usually included in the borrower’s IBAN account.

Neither domestic nor Hong Kong banks have a SORT CODE, only United Kingdom banks do. Therefore, if you want to transfer pounds to the United Kingdom, in addition to filling in the receiving account information normally, you also need to fill in the Sort Code of the United Kingdom account.

After understanding the above international telegraphic transfer identification codes and applicable countries, let’s take a look at the payment information of mainstream banks.

Hong Kong mainstream bank collection information

1. Standard Chartered Hong Kong

- Bank Name:Standard Chartered Bank (Hong Kong) Limited

- Swift Code:SCBLHKHH

- Bank Code:003

- Bank Address:Standard Chartered Tower, Floor 15,388 Kwun Tong Road, Kwun Tong

2. HSBC Hong Kong

- Bank Name:THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED

- Swift Code:HSBCHKHHHKH

- Bank Code:004

- Bank Address:1 Queen’s Road, Central, Hong Kong

3. OCBC Bank

- Bank Name:OBCB Wing Hang Bank Limited

- Swift Code:WIHBHKHH

- Bank Code:035

- Bank Address:161 Queen’s Road Central, Hong Kong

4. China CITIC Bank (International)

- Bank Name:CHINA CITIC BANK INTERNATIONAL LIMITED

- Swift Code: KWHKHKHH (If 11 digits are required, XXX can be added after it)

- Bank Code:018

- Bank Address:61-65 DES VOEUX ROAD, CENTRA

5. Bank of China Hong Kong

- Bank Name:BANK OF CHINA (HONG KONG) LIMITIED, HONG KONG

- Swift Code: BKCHHKHH (If 11 digits are required, XXX can be added after it)

- Bank Code:012

- Bank Address:Bank of China Tower, 1 Garden Road, Central, Hong Kong

6. ICBC Asia

- Bank Name:INDUSTRIAL AND COMMERCIAL BANK OF CHINA (ASIA) LIMITED

- Swift Code: UBHKHKHH (If 11 digits are required, XXX can be added after it)

- Bank Code:072

- Bank Address:33rd Floor, ICBC Tower, 3 Garden Road, Central, Hong Kong

7. Construction Bank Asia

- Bank Name:CHINA CONSTRUCTION BANK (ASIA) CORPORATIONLIMITED

- Swift Code: CCBQHKAX (If 11 digits are required, XXX can be added after it)

- Bank Code:009

- Bank Address:20/F, CCB Centre, 18 Wang Chiu Road, Kowloon Bay,Kowloon,Hong Kong8. Merchants Wing Lung

- Bank Name:CMB WING LUNG BANK LIMITED

- Swift Code: WUBAHKHH

- Bank Code:020

- Bank Address:45 DES VOEUX ROAD CENTRAL,HONG KONG

9. China Merchants Bank of Hong Kong

- Bank Name:CHINA MERCHANTS BANK (HONG KONG BRANCH)

- Swift Code: CMBCHKHH (If 11 digits are required, XXX can be added after it)

- Bank Code:238(Branch Code:860)

- Bank Address:28/F, Three Exchange Square, 8 Connaught Place, Hong Kong10. DBS Bank Hong Kong

- Bank Name:DBS Bank (Hong Kong) Limited

- Swift Code:DHBKHKHH

- Bank Code:016

- Bank Address:G/F, Central Centre, 99 Queen’s Road Central, Central

11. Citibank Hong Kong

- Bank Name:Citibank (Hong Kong) Limited

- Swift Code: CITIHKAX

- Bank Code:250;Branch code: 390

- * Citibank N.A. customers, using branch number 790, Swift Code: CITIHKAXIPB

- Bank Address:Citi Tower, 83 Hoi Bun Road, One Bay East

12. Hang Seng Bank of Hong Kong

- Bank Name:HANG SENG BANK LIMITED

- Swift Code: HASE HKHH (if 11 digits are required, XXX can be added after it)

- Bank Code:024

- Bank Address:83 Des Voeus Road Central, Hong Kong

13. Nanyang Commercial Bank

- Bank Name:Nanyang Commercial Bank, LimitedBank

- Swift Code: NYCBHKHHXXX

- Bank Code:151

- Bank Address:151 Des Voeux Road Central, Hong Kong

14. Bank of East Asia, Hong Kong

- Bank Name:The Bank of East Asia, Limited

- Swift Code: BEASHKHH

- Bank Code:015

- Bank Address:10 Des Voeux Road, Central, Hong Kong15. Daxin Bank

- Bank Name:Dah Sing Bank, Ltd

- Swift Code:DSBAHKHH

- Bank Code:040

- Bank Address:Everbright Centre, Floor 34, 108 Gloucester Road, Hong Kong

16. ZhongAn Bank

- Bank Name:ZA Bank Limited

- Swift Code:AABLHKHH

- Bank Code:387

- Bank Address:Core F, Cyberport 3, 100 Cyberport Road, Hong Kong

17. Tianxing Bank

- Bank Name:Airstar Bank Limited

- Swift Code:AIRRHKHHXXX

- Bank Code:395

- Bank Address:SUITES 3201-07, TOWER 5, THE GATEWAY, HARBOUR CITY, KOWLOON, HONG KONG

18. Furong Bank

- Bank Name:Fusion Bank Limited

- Swift Code:IFFUHKHHXXX

- Bank Code:391

- Bank Address:2F, INNOCENTRE,72 TAT CHEE AVENUE,KOWLOON,Hong Kong

19. Huili Bank

- Bank Name:Welab Bank Limited

- Swift Code:WEDIHKHHXXX

- Bank Code:390

- Bank Address:FLOOR 23,K11 ATELIER KING’S ROAD, 728 KING’S ROAD, QUARRY BAY, Hong Kong

20. Ant Bank

- Bank Name:Ant Bank(Hong Kong)Limited

- Swift Code:ASEHHKHH

- Bank Code:393

- Bank Address:FLOOR 23, TOWER ONE, TIMES SQUARE, 1 MATHESON STREET, CAUSEWAY BAY, HONG KONG

Payment information from mainstream banks in Singapore

1. United Overseas Bank of Singapore

- Bank Name:United Overseas Ltd

- Swift Code:UOVBSGSG

- Bank Code:7375

- Bank Address:80 Raffles Place UOB Plaza1,Singapore 048624

2. Singapore Overseas Chinese Bank

- Bank Name:Oversea-Chinese Banking Corporation Limited Singapore

- Swift Code:OCBCSGSG

- Bank Code:7339

- Bank Address:63 Chulia Street 10-00, OCBC Centre East, Singapore 049514

3. DBS Bank of Singapore

- Bank Name:DEVELOPMENT BANK OF SINGAPORE BANK LIMITED

- Swift Code:DBSSSGSG

- Bank Code:7171

- Bank Address:12 Marina Boulevard, DBS Asia Central,Marina Bay Financial Centre Tower 3,Singapore 018982

4. Singapore Standard Chartered

- Bank Name:STANDARED CHARTERED BANK

- Swift Code:SCBLSGSG

- Bank Code:7144

- Bank Address:Marina Bay Financial Centre (Tower 1,8 Marina Bivd,Level 1)

5. Citibank Singapore

- Bank Name:Citibank Singapore

- Swift Code:CITISGSLXXX

- Bank Code:9201

- Bank Address:8 Marina View, Asia Square Tower 16. HSBC Bank of Singapore

- Bank Name:The Hongkong and Shanghai Banking Corporation Limited,Singapore

- Swift Code:HSBCSGSG

- Bank Code:7232

- Bank Address:HSBC, 20 Pasir Panjang Road (East Lobby) #12-21, Mapletree Business City, Singapore 117439

Written at the end

The above is some information required for remittance, some of which are necessary. I hope it will be helpful to everyone. As for some corresponding information of other banks, you can check their respective official websites separately. Of course, there are also more efficient and comprehensive inquiries. The editor used the official website of BiyaPay to check the above information, which can be done in one stop.

Biyapay is a remittance agency that focuses on international remittances. By this year, BiyaPay supports real-time exchange rate queries and exchanges for more than 20 legal currencies and more than 200 digital currencies, as well as real-time transactions for investment products such as US and Hong Kong stocks. As of December 2023, BiyaPay’s daily trading volume for US and Hong Kong stocks has exceeded 10 million US dollars, and the total remittance transaction volume has exceeded 1 billion US dollars, gradually developing into a multi-asset trading platform trusted by global users. Interested parties can check it out.