- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

What to Do If You Enter the Wrong SWIFT/BIC Code During a Remittance?

In the globalized financial world, SWIFT/BIC numbers play a crucial role. They are not only the international identity of banks, but also the key to ensuring the safety and accurate transfer of funds. However, entering the wrong SWIFT/BIC number during remittance will undoubtedly bring us considerable trouble. This article will explore this issue in detail and provide corresponding remedial measures and follow-up operation suggestions.

First, let’s understand the impact of incorrect SWIFT/BIC numbers on remittances.

SWIFT/BIC number is the unique identifier for identifying the recipient bank when conducting international transactions between banks. If the number is entered incorrectly, the banking system may not recognize the recipient bank, resulting in the remittance not reaching the designated account. In some cases, even if the remittance is mistakenly sent to another bank, the funds will not be credited due to account info mismatch and will eventually be returned.

Faced with this situation, the remitter does not need to be overly anxious, as there are usually remedial measures. Once a SWIFT/BIC number input error is found, the following steps can be taken:

1.Contact the remittance bank:

Firstly, you should contact the bank that initiated the remittance as soon as possible and inform them of the SWIFT/BIC number error. Bank staff will provide corresponding assistance based on the status of the remittance. If the remittance has not been processed, they may help cancel or modify the transaction.

2.Provide the correct information:

Provide the bank with the correct SWIFT/BIC number and other necessary remittance information so that the bank can reprocess the transaction.

3.Monitor remittance status:

During bank processing, the status of remittances is continuously monitored to ensure that funds arrive at the correct destination smoothly.

4.Understand the refund policy:

If the remittance has been returned, learn about the bank’s refund policy and schedule to know when you can receive the refund.

5.Re-initiate remittance:

After resolving the error, reinitiate the remittance using the correct SWIFT/BIC number.

In dealing with this issue, the following points are crucial

When dealing with remittance issues caused by SWIFT/BIC number errors, there are several key points that need special attention.

Firstly, once a problem is discovered, action should be taken quickly because the remittance processing speed is very fast, and even a slight delay may lead the funds down the wrong path. Secondly, when providing a new SWIFT/BIC number, it is important to ensure the accuracy of the information to avoid making the same mistake again.

At the same time, it is very important to maintain close communication with the bank, which helps to understand every step of the remittance progress and timely grasp possible solutions. In addition, it is necessary to keep all communication records with the bank, whether it is phone calls, emails, or written communications, which may come in handy when dealing with problems. Finally, be patient, as dealing with such problems may take some time. Follow the bank’s guidance and patiently wait for the problem to be properly resolved.

Through these steps, problems that arise in remittances can be more effectively addressed, ensuring that funds arrive safely and accurately at their destination.

In order to prevent such problems from occurring, the following preventive measures can be taken in the future

Before making an international remittance, the sender should take a series of precautions to avoid potential problems caused by entering the wrong SWIFT/BIC number.

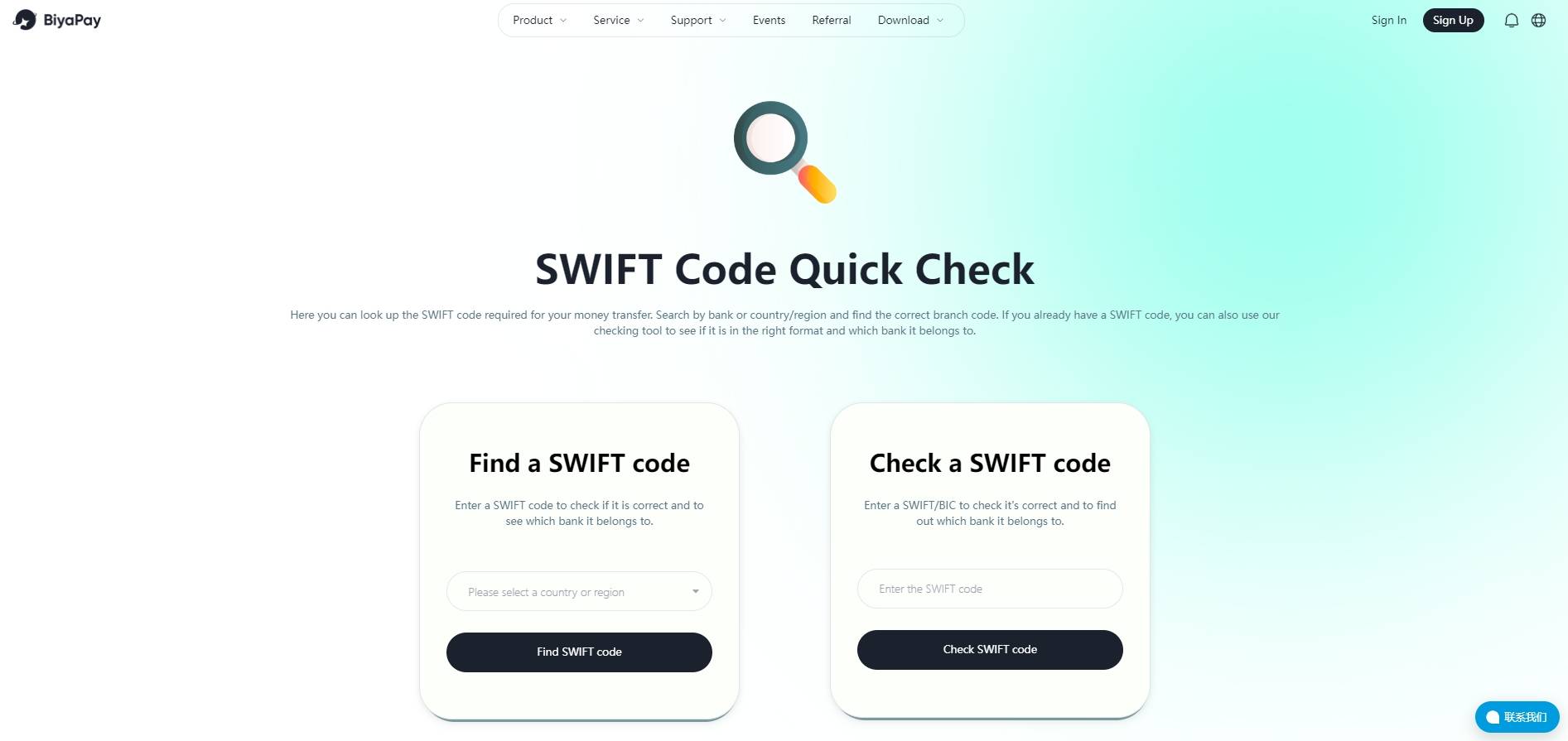

Firstly, double checking is a crucial step to ensure that the information has been carefully checked before entering the SWIFT/BIC number to ensure its accuracy. Secondly, you can obtain the SWIFT/BIC number through the bank’s official website or directly contact the bank’s customer service. You can also search by bank or country/region on BiyaPay’s official website to obtain the correct SWIFT CODE. If you already have the bank’s international code, you can also use its query tool to verify it. This can avoid incorrect third-party information sources.

In addition, it is essential to understand and be familiar with the bank’s remittance policy, including the processing time, required fees, and possible processing procedures in case of errors. Through these measures, we can minimize the possibility of errors and ensure the safe and efficient arrival of funds.

When making overseas remittances, in addition to the required SWIFT code, it is also necessary to choose a suitable remittance tool.

You can use the global multi-asset trading wallet BiyaPay for overseas remittances, which not only simplifies the remittance process, but also ensures the security of funds and the convenience of transactions. Its functions include global payment and international remittance, as well as major investment services such as US/Hong Kong stocks, options, and digital currencies. It supports real-time exchange rate queries and exchanges for more than 20 legal currencies and more than 200 digital currencies, allowing local remittances to be made anytime, anywhere in most countries or regions around the world, with fast arrival speed, low handling fees, and unlimited amount.

Moreover, BiyaPay provides competitive exchange rates to reduce remittance costs, with low procedure fees and no other hidden fees. It has obtained financial licenses such as the US, Canada, US SEC, and New Zealand, making your digital currency to fiat currency exchange safer and more legal, avoiding the risk of being frozen over the counter. With complete KYC certification and professional and legal offshore accounts, every remittance is taken seriously, allowing users to transfer every penny with peace of mind. This greatly improves the efficiency and security of international remittances, making cross-border fund flows smoother.

Finally, it is worth noting that although incorrect SWIFT/BIC numbers may cause problems with remittances, most problems can be solved through timely communication and correct remedial measures. Through the above content, the editor hopes that everyone can better understand the importance of SWIFT/BIC numbers and how to effectively respond when encountering problems. Help everyone minimize the impact of errors and ensure the safety of their funds.