- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

How to receive bank remittance? What information does the remitter need?

Whether it is immigration, overseas work or further education, everyone needs to come into contact with overseas remittance. Many people will choose to remit money through traditional telegraphic transfer. If you are receiving remittance through a bank for the first time, you may be confused because you need to prepare a lot of information. This article has sorted out the required information for various banks to remit money for your reference.

Inward remittance information

The sender needs to prepare some information before the remittance so that the bank can remit the money to the payee on time and accurately. The required information mainly includes the bank SWIFT code, the name of the receiving bank, the address of the receiving bank, the account number of the payee, the name of the payee, etc. The required information may vary slightly depending on the remittance area. You can refer to the following information required for the remittance of various banks.

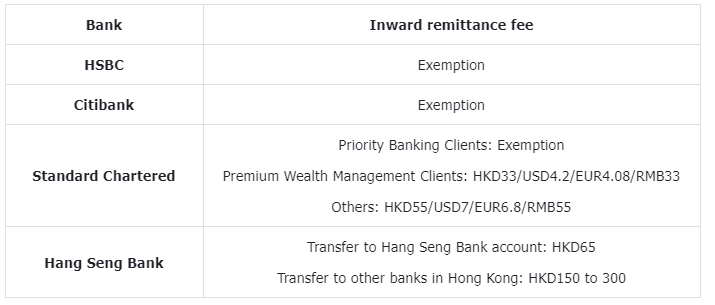

Inward remittance fee

The fees for inward remittance vary among major banks. Some charge a lump sum fee, while others charge by customer category. The following are detailed fees:

Inward remittance instruction

HSBC Inward Remittance Instruction

Users can instruct the remittance bank to use SWIFT MT103’s remittance instructions and submit the following remittance information to remit to the HSBC account:

- Remittance currency and amount

- Name of correspondent bank

- Bank Name: The Hongkong and Shanghai Banking Corporation Limited

- Bank Address: Head Office 1 Queen’s Road Central Hong Kong

- SWIFT Code:HSBCHKHHHKH

- Recipient’s household registration number (10 digits, 12 digits, the first 3 digits are the branch number)

- Name of payee

Standard Chartered Inward Remittance Instruction

If using Standard Chartered for inward remittance, customers must provide the following information:

- Bank Name: Standard Chartered Bank (Hong Kong) Limited

- Bank Address: Payment Centre, 15/F, Standard Chartered Tower, 388 Kwun Tong Road, Kwun Tong, Kowloon, Hong Kong

- SWIFT Code:SCBLHKHH

- Payee account number

- Name of payee

Hang Seng Bank Inward Remittance Instruction

The client must provide the following information to the remitter:

- Bank Name: Hang Seng Bank Limited

- Bank Address: 83 Des Voeux Road Central, Hong Kong

- SWIFT Code:HASEHKHH

- CHIPS No.: 010522 (applicable to remittances from the US only)

- Payee account number

- Name of payee

Wing Fung Bank Inward Remittance Instruction

Wing Fung Bank customers must provide the following information:

- Bank Name: BANK SINOPAC Hong Kong Branch

- Bank Address: 18/F, One Peking Road, Tsim Sha Tsui, Kowloon, Hong Kong

- SWIFT Code:SINOHKHH

- Payee name/address

- Payee account number

Send money using BiyaPay

Using traditional bank telegraphic transfer for remittance, you may have to spend a lot of time searching for various information of the receiving bank. If you want to transfer money to several bank accounts, different banks have different practices, which may bring many inconveniences to you . Moreover, using telegraphic transfer needs to be processed by the intermediary bank, and multiple handling fees may be charged.

In addition to traditional banks, you can also consider using the global multi-asset transaction wallet BiyaPay for remittance. It supports real-time exchange rate inquiry and exchange of more than 20 legal currencies and more than 200 digital currencies. You can make overseas remittances anytime, anywhere in most countries or regions around the world, with fast arrival speed and unlimited credit limit.

BiyaPay integrates local transfer methods in most regions, which can achieve zero cost in the middle of bank remittance, thus saving costs. Its process is simpler and faster, only a few buttons are needed, and overseas bank accounts are bound to achieve instant remittance, which can also save a lot of time costs.

Conclusion

The above is a brief introduction to the information required for bank remittance. You can refer to it yourself, and you can also choose other remittance methods according to your own needs. I hope this article is helpful to everyone.