- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

How NVIDIA Achieved 100x Growth & Finding Similar Stocks

Recently, NVIDIA, a leading player in AI, reported its first-quarter earnings, which significantly exceeded expectations, leading to a substantial rise in its stock price.

On May 28, at the close of the US stock market, NVIDIA’s shares surged nearly 7% to $1128, reaching a new all-time high. Its market capitalization also surpassed $2.8 trillion, just $100 billion shy of overtaking Apple’s $2.9 trillion market cap, and is quickly closing in on $3 trillion. A decade ago, in 2014, NVIDIA’s stock price was below $10, marking a more than hundredfold increase over ten years.

So, how did NVIDIA achieve such phenomenal growth, and how can we identify the next stock with similar potential?

The concept of a hundredfold stock might seem out of reach to many investors. Most people have never even considered owning such a high-growth stock. This is largely due to a lack of thorough research; what our minds cannot perceive, our eyes cannot see. To address this, a study was conducted on the 365 hundredfold stocks in the US market from 1962 to 2014, and their characteristics were compiled into a book titled “100 to 1 in the Stock Market.”

Today, let’s discuss the common traits of hundredfold stocks and the investment strategies that can help identify them. When you come across stocks that exhibit these traits in the future, make sure not to let them slip away.

The Essence of Hundredfold Stocks — Rapid Growth

We all know that towering trees grow from tiny seeds, and hundredfold stocks inevitably start as small companies. Take Apple, for instance; it was once a hundredfold stock. Today, its market value is almost $3 trillion. However, before Apple became such a stock, it operated within a market value range of $50 billion to $60 billion for sixteen years, at one point dropping to below $20 billion. So, can Apple, now with a market value of $3 trillion, still increase a hundredfold? While theoretically possible, the mathematical odds are daunting.

Let’s assume Apple’s market value increases a hundredfold in the next twenty years. If the U.S. GDP continues to grow at an average rate of about 3% per year, then in twenty years, Apple’s market value would be more than six times the U.S. GDP. Therefore, while not impossible, this scenario is highly unlikely.

Research in the book shows that these hundredfold stocks typically had a market value of around $1 billion before their rapid growth phase, with median revenues of $175 million. These two metrics are crucial.

Currently, in the U.S. market, there are over 7,100 companies with a market value of less than $2 billion. Among them, more than 1,600 companies have annual revenues exceeding $100 million. This represents a vast market, a significant gold mine waiting to be explored. Undoubtedly, the next Apple or NVIDIA will emerge from this group of stocks.

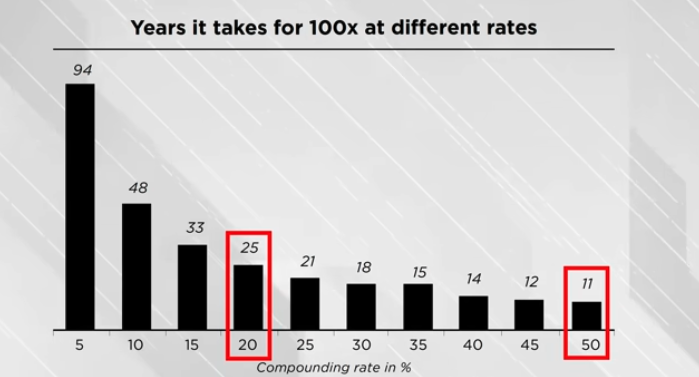

Achieving hundredfold returns necessitates rapid growth, and the higher the compound growth rate, the shorter the time required. This chart demonstrates that at a 20% annual compound growth rate, it would take twenty-five years to achieve hundredfold returns. At a 50% compound growth rate, it would take eleven years. The author’s research on 365 hundredfold stocks revealed that about half took 16 to 30 years to achieve this milestone, while the fastest did so within ten years.

Value-Added Growth

The author introduces a crucial concept: value-added growth. He argues that if a company’s sales revenue doubles but its outstanding shares also double, the per-share growth is nullified, resulting in no value addition. Additionally, companies that boost revenue by lowering prices exhibit low-quality growth. Similarly, increasing earnings per share by reducing the number of shares through buybacks does not constitute value-added growth. The goal is to find stocks where both revenue and earnings per share grow simultaneously. For fast-growing companies, the focus should not be strictly on high profits but rather on observing the company’s profitability, such as operating profit margins and cash flow generation capabilities. If both indicators are not positive, it indicates that the company is not profitable, either due to a flawed business model or poor management. In essence, these indicators help filter out most pseudo-growth companies and those with limited growth potential. Financial metrics are outcomes of a company’s operations; thus, understanding the business process is more critical.

High-Potential Businesses

In the quest for hundredfold stocks, we aim to identify companies with substantial growth potential, significantly enhancing their chances of becoming hundredfold stocks. So, what defines a high-potential business? Great businesses typically feature undifferentiated products and a vast user base. Take Apple, for instance. Your iPhone and my iPhone, if they are the same model, are identical, exemplifying undifferentiated products. Statistics show that 1.36 billion people globally use Apple phones, and Apple continually updates and releases new products, expanding its user base. This represents the broadest user base. Generally, avoid investing in businesses whose products or services you cannot personally experience or assess, as the risks of such businesses are incalculable. The unknown risks are the most significant and potentially lethal.

Dual Engines of Growth

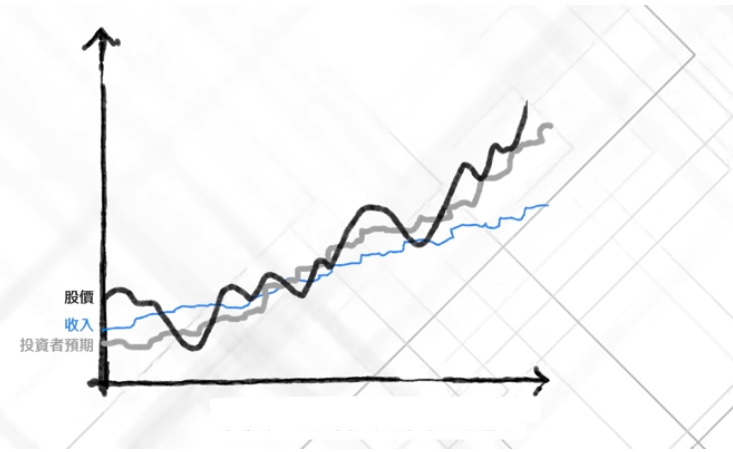

The dual engines concept refers to revenue growth and valuation multiple growth. Mathematically, if a company’s revenue increases from $100 million to $1 billion, its market size grows tenfold. If its earnings per share also grow tenfold, its market value should increase tenfold. However, in practice, the scenario is more complex due to human irrationality. Rapid revenue growth in a company raises investor expectations. Investors’ optimism reflects in more aggressive investment decisions, causing the stock price to rise faster than the revenue growth, creating a multiple effect. This phenomenon is known as the valuation multiple. The interplay of a company’s revenue growth and multiple effects can swiftly transform a stock into a hundredfold stock.

Our main focus today—NVIDIA—has achieved a remarkable rise, going from a market cap of $10 billion to $1 trillion in under a decade, making it one of the fastest-growing hundredfold stocks in recent history. In 2013, NVIDIA’s revenue was around $4.3 billion, with a market cap of approximately $8 billion, giving it a price-to-sales (PS) ratio of about 2. By the second quarter of 2023, NVIDIA’s revenue had increased to $29.5 billion, just six times its 2013 level, but its market cap had skyrocketed a hundredfold. How did this happen? The PS ratio surged from about 2 in 2014 to around 40, a twentyfold increase in valuation multiple. The combination of revenue growth and multiple expansion led to a hundredfold increase in market cap, illustrating the dual-engine effect. One engine is the company’s intrinsic quality, and the other is investor sentiment. Not all growth stocks can become hundredfold stocks. Many stocks are overvalued from their IPO, and with high valuation multiples, they struggle to achieve rapid appreciation through revenue growth alone, as they lack the multiplier effect. Therefore, identifying high-growth companies with substantial market potential but low valuations allows investors to experience the powerful lift of the dual engines.

The Moat of a Company

Taking advantage of discounted opportunities during bear markets is crucial. For example, NVIDIA’s valuation multiple was in single digits in December 2018 and October 2022, which were key opportunities to invest, thanks to its strong moat. In historical terms, a moat was a defensive structure to fend off invaders. In modern business, it refers to a company’s ability to protect its market share and economic interests from competitors. Companies with a solid economic moat usually show high returns on capital. Consistently high capital returns are a sign of a robust economic moat. An economic moat protects both the company’s business interests and the investors’ interests. Charlie Munger once said:

In the long run, a stock’s returns are unlikely to exceed the business’s returns. If a business has only achieved a 6% return on capital over forty years, even buying it at a low price and holding it for that period would struggle to surpass a 6% return. On the other hand, if a business consistently achieves an 18% return on capital over twenty to thirty years, even paying a seemingly high price would still yield good results.

Thus, Munger adds return on capital as a crucial screening metric. NVIDIA became a hundredfold stock within ten years by maintaining a long-term shareholder return rate of around 15% to 20%. This indicates that NVIDIA has a strong economic moat.

The Essence of Great Companies

Every great company has a great leader. For Walmart, it was Sam Walton; for Apple, it was Steve Jobs. These leaders, as founders and key operators during the company’s peak, aligned their interests entirely with the company’s success. If the company performed well, they benefited the most. As investors, we need to find such companies. We should look for companies where the management, board, and CEO have their compensation tied to the company’s performance, or have proper incentive mechanisms. This alignment ensures their decisions benefit both themselves and the shareholders. By following these guidelines, we can identify companies that meet these criteria efficiently.

How to Invest in Hundredfold Stocks?

The real challenge lies ahead! As mentioned, about half of the 365 hundredfold stocks studied took 16 to 30 years to achieve such growth, with the fastest taking 8 to 10 years on average. The biggest test for investors is the ability to hold on long-term. The author introduces the “coffee can” concept, suggesting that once you find a valuable stock, you should store it away and forget about it for many years, allowing it to grow in value. The hardest part of long-term holding is dealing with the psychological stress during market downturns. A stock held for over ten years will likely go through at least two major bear markets. Even NVIDIA, which grew a hundredfold in just ten years, experienced price drops of more than 50% twice during that period. Finding a hundredfold stock is one challenge, but achieving hundredfold returns is another. Additionally, choosing the right trading platform and a reliable way to fund U.S. stock accounts is crucial. We all know that after identifying a great stock, a stable and secure platform is needed for investment. Charles Schwab, a globally renowned brokerage, offers a bank account along with the brokerage account, providing stability and security.

For funding and withdrawals, BiyaPay offers an excellent solution—you can deposit digital currency (USDT) into the multi-asset wallet BiyaPay and then convert it to fiat currency for transfer to Charles Schwab, where you can invest in U.S. stocks. Additionally, you can directly search for stock codes on BiyaPay to buy and hold stocks for the long term.

Warren Buffett once said that the stock market transfers money from the impatient to the patient. Therefore, conducting thorough research, making purchases, and holding long-term is the simplest way to profit from hundredfold stocks. However, this is easier said than done. Human nature tends to seek profit and avoid loss. When stock prices drop significantly, it’s crucial to discern whether the issue lies with the market or the company. Not all stocks with hundredfold potential will ultimately achieve it. Considering the risks and rewards associated with potential hundredfold stocks, my strategy might be: Select ten stocks that meet the criteria for hundredfold growth, invest $10,000 in each, and rely on luck for the outcome. If even one of these stocks achieves hundredfold returns, it will be an outstanding investment. My maximum risk is losing the $100,000 investment.

Conclusion

This concludes the discussion on hundredfold stocks. To recap the key points for investing in hundredfold stocks:

- Small companies with significant business potential;

- High growth;

- Low valuation;

- A strong economic moat and high shareholder returns;

- Management and owners who prioritize investors’ interests;

- Select a secure and reliable trading and funding platform;

- Invest an amount you can afford to lose and leave the rest to luck.