- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Dell's financial report is about to be released, AI-optimized servers perform well.

Summary

- Dell Technologies Inc. has been partnering with major GPU manufacturers to launch AI-optimized servers, which has the potential to transform its growth profile.

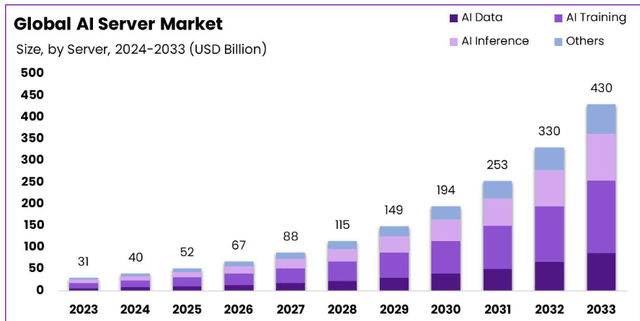

- The AI server market is expected to grow rapidly in the near future, driven by AI training, inference, and data.

- Dell’s Client Solutions Group is a mature market, but its commercial business has experienced decent growth due to superior pricing and total revenue per unit.

Dell Technologies Inc. (NYSE:DELL) offers storage, server, networking, PCs and workstations for both commercial and consumer customers. Recently, Dell has been partnering with major GPU manufacturers including Nvidia (NVDA) and Advanced Micro Devices (AMD) to launch AI-optimized servers. While AI-related business represents less than 5% of total revenue today, I anticipate the AI-optimized server and storage portfolio has the potential to transform Dell’s growth profile. I anticipate Dell will upgrade its full-year guidance.

Growth From AI-Optimized Server & Storage

Market.US predicts that AI server market will grow at a CAGR of 30.3% from 2023 to 2033, primarily driven by AI training, inference and data. AI servers are equipped with GPUs from third parties including Nvidia’s H100, H200, and AMD’s MI300X. As enterprises’ investment in AI is still in the early stages, I anticipate AI server market will continue its rapid growth in the near future.

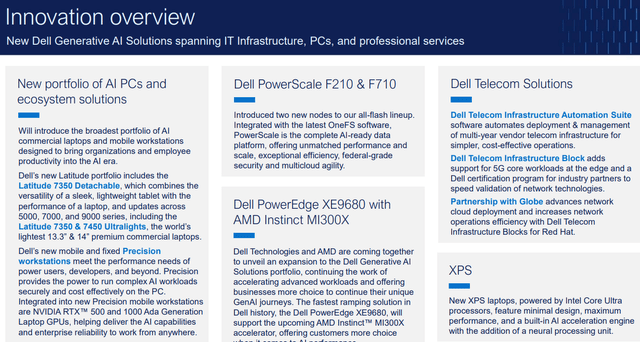

Dell has a broad range of AI server and storage portfolios, including PowerEdge XE9680, XE9640, XE8640 and R760xa products. Dell’s servers are compatible with major GPU providers including Intel (INTC), Nvidia and AMD. Dell exited their FY24 with a total backlog of $2.9 billion, with orders growing by 40% quarter-over-quarter, as they disclosed in the latest earnings call. I calculate that AI related businesses represent less than 5% of total revenue today; however, I am optimistic that their AI-optimized server and storage will grow by 15%+ in the near future for the following reasons:

- Most hyperscalers and enterprises are still leveraging AI primarily for training purposes. Once AI training is complete, the AI market will gradually shift more towards inference, improving workload efficiencies and enabling machine-to-machine interactions. At the AI inference stage, more AI-optimized servers are needed to interact with the end customers.

- As disclosed by the company, Dell owns almost 30% of market share in the mainstream server market. The leading position provides a strong foundation for capturing the fast-growing AI server market. Dell has done a phenomenal work partnering with major GPU providers through its innovative PowerEdge products. As depicted in the slide below, Dell has been launching a broad range of AI solutions across the IT infrastructure, PCs and professional services.

Client Solutions Group is a Mature Market

Dells’ Client Solutions Group (CSG) sells PCs, notebooks, desktops and workstations, servicing both consumer and commercial customers. The business is tied to the hardware refresh cycle, and most of its operations are in mature markets.

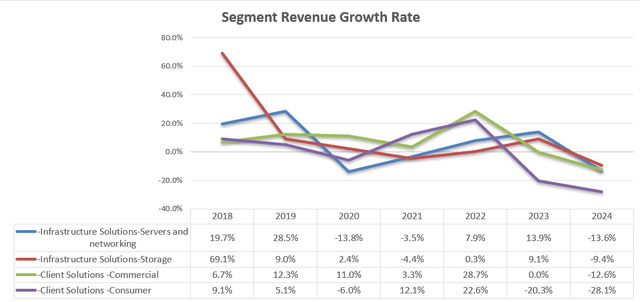

Dell has been focusing on their commercial side of CSG business, which makes strategic sense. 80% of Dell’s units are in the commercial end-market. As disclosed by the company, Dell held 23% of commercial PC market share in FY23, a notable improvement from 16% in FY13. As illustrated in the chart below, Dell’s commercial business has experienced decent growth over the past few years.

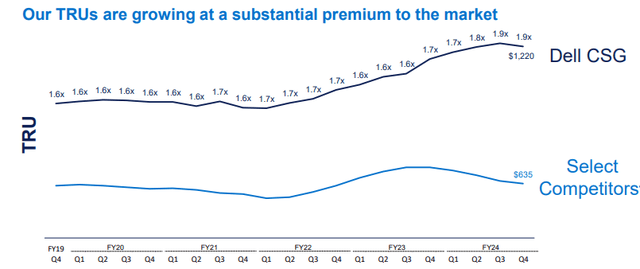

The robust commercial business growth is primarily driven by their superior pricing and total revenue per unit (TRU). As shown in the chart below, Dell generates around $1,220 TRU, 1.9x that of their competitor’s TRU. This is due to Dell’s focuses on large enterprises, and premium PC and workstation solutions.

Having said that, since the PC is a mature business, I forecast CSG will deliver LSD type of growth in the long term. In other words, I don’t anticipate CSG could become a structural growth driver for Dell’s long-term growth.

Q1 FY25 Preview and FY25 Outlook

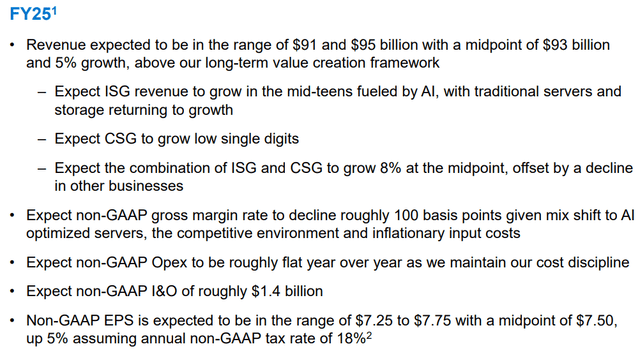

In Q4 FY24, Dell forecasted that its revenue would grow by 3% in Q1 FY25 and 5% for the full year at the midpoint. Overall, I think their FY25’s guidance is quite conservative, and most likely, they will upgrade its full-year guidance in the upcoming quarter, in my view. Nvidia announced their Q1 FY25 results on May 22 with data center business growing by 427% year-over-year. The strong growth in data center was propelled by strong AI computing and strong demands for H100 and H200. Additionally, during the earnings call, Nvidia disclosed that Dell would be bringing Nvidia’s new Ethernet switch, Spectrum-X, to the market. The strong growth in the data center business and distribution of new products through Dell could potentially lead to a strong quarter and FY25 for Dell.

For their FY25’s growth, the following factors need to be considered:

- Client Solutions – Consumer Business: After two-year sluggish demands for PCs, I anticipate the PC market will begin to recovery in FY25. Microsoft (MSFT) has announced that Windows 10 will reach end of support on October 14, 2025, which could stimulate the hardware upgrade in the near future. As such, I anticipate the Client Solutions – Consumer Business will at least grow by 5% in FY25.

- Client Solutions – Commercial Business: In addition to the potential tailwinds from Windows 10, the commercial business could be driven by demands for edge AI computing. As discussed earlier, AI is poised to enter inference stage in the future, following the completion of AI trainings. AI edge computing could generate additional demands for PCs and workstations.

- Servers, Networking and Storage: I anticipate the market will grow rapidly over the next few years, as analyzed previously. I forecast Dell will grow by 15%+ in the near term.

Putting all the pieces together, I anticipate Dell can grow their revenue by 8.5% in FY25. As such, I think its original guidance is quite conservative for the revenue growth rate.

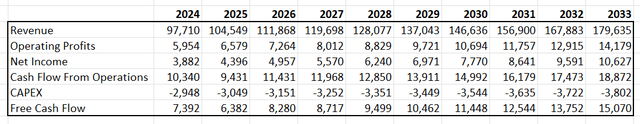

Valuations

For normalized revenue growth, I anticipate Dell’s Client Solutions will grow by 3% annually, as PCs, workstations are mature business in nature. Through the cycle, the PC market is most likely to grow at LSD in the future. As such, the normalized revenue growth is calculated to be around 7%, assuming 15% growth from servers/storage and 3% from PCs.

I forecast Dell’s margin expansion will primarily come from gross profits and SG&A expenses. Dell has been implementing its cost-optimization initiatives over the past few years. In addition, Dell has been steadily improving its revenue per unit for its commercial PC business, as discussed earlier.

I calculate that Dell can generate operating leverage from its gross profits by 10bps annually, and another 10bps from SG&A leverage. The total operating expenses are forecasted to grow by 6.7% in the model.

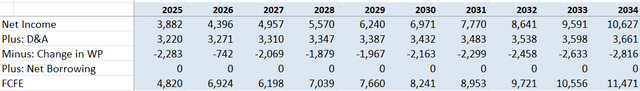

The free cash flow from the equity is calculated in the table below:

The cost of equity is calculated to be 10.6% assuming: risk-free rate 4.5% (US 10Y Treasury Yield); beta 0.87 (SA); equity risk premium 7%.

Discounting all equity stake free cash flow, the one-year target price is calculated at $205 per share. The current stock price means that the future free cash flow is less than 18 times, which is quite cheap compared to other growth companies.

This also indicates that based on its valuation, it is worth choosing a platform for investment. As a reference, you can choose BiyaPay, search for the DELL stock code on the platform, and trade online in real-time. Of course, if you have difficulties with deposits and withdrawals, you can also use this platform as a professional tool for depositing and depositing US and Hong Kong stocks. Recharge digital currency and exchange it for US dollars or Hong Kong dollars, withdraw it to your bank account, and then deposit it into other securities firms to buy this growth stock. Compared with other platforms, the arrival speed is faster and there is no limit.

Dell Market Trend

Key Risks

1.Consumer PC business

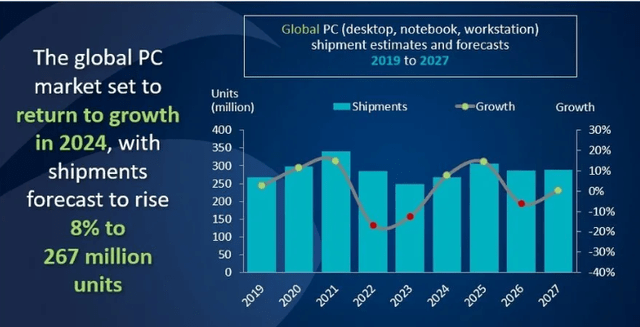

The consumer PC business represents around 10% of total revenue, and the revenue has declined by 28% in FY24 and 20% in FY23, after the global pandemic. Toms’s Hardware predicts that the global PC market will return to growth in 2024 and 2025. As illustrated in the chart below, the global PC market exhibits high volatility due to its ties with consumer refreshment cycles. As such, Dell’s investors need to be comfortable with the volatility inherent in the company’s PC business.

2.Commoditization of AI Server and Storage

While I believe AI servers and storage will experience rapid growth over the next few years, it is important to acknowledge that the market will eventually get commoditized, similar to other types of IT hardware. However, this is a long-term risk for Dell, and I anticipate Dell can enjoy the rapid AI growth for several years, as the enterprise AI market is still in the early stage.

3.Debt Level

Dell had around $26 billion in total debts in FY24, implying 3.1x of gross leverage. The leverage level is quite high compared to other technology companies. The company needs to reduce its debt levels to optimize its balance sheet.

Conclusion

Although Dell’s development has been affected by some of the risks mentioned earlier, it has closely followed the development trend of the artificial intelligence server market and has been collaborating with major GPU manufacturers to launch servers optimized for AI, which has accelerated its long-term growth momentum. Secondly, in terms of valuation, compared to other growth stocks, it also has a competitive advantage, and the market has good expectations for its financial report release. The future stock price multiple will also rise, making it a worthwhile investment choice.

Source: Seeking Alpha

Editor: BiyaPay Finance