- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

The Buffett Shareowner Conference is coming soon! Take you to understand his investment kingdom and

As a globally renowned investment event, the Buffett Shareowner Conference will be held in Omaha, US on May 4th, 2024 . Every year at this time, investors from all over the world gather in Omaha to listen to the latest market views of “Stock God” Buffett and the investment bible.

Unlike previous years, this time there is no “golden partner” Charlie Munger to accompany him. The two core figures of Berkshire, Greg Abel and Ajit Jain, will attend with Buffett.

In the shareowner letter released in February this year, Buffett talked about his investment logic in heavy-weighted stocks such as Apple and Western Petroleum, as well as the five major Japanese trading companies, clarified the successor of Berkshire Hathaway, and expressed deep condolences to his dear friend Munger. Today, the editor will take you deeper into the investment kingdom that Buffett and Munger have devoted their lives to building - Berkshire Hathaway. What are the successful investment secrets worth learning from Berkshire Hathaway’s development process spanning more than half a century?

What kind of company is Berkshire?

Berkshire Hathaway was taken over by Warren Buffett in 1956. It is a diversified investment holding group that operates insurance and other businesses. Its headquarters is located in Buffett’s hometown of Omaha. Currently, the company’s market value has exceeded $800 billion and its stock price is about $600,000 per share.

In the end, Berkshire Hathaway is similar to a fund company, except that it only publishes one fund, which is the stock of Berkshire Hathaway. In the past 10 years, Berkshire Hathaway has achieved a compound annual growth rate of 13.09%. Globally, it outperforms mainstream indices such as the S & P 500, MSCI Global, and the Shanghai and Shenzhen 300, and the excess returns from active management are very significant.

From the initial textile company, it has developed into a company with businesses covering multiple industries such as insurance, railways, energy, and manufacturing. Currently, Berkshire Hathaway directly or indirectly controls more than 500 companies, making it a highly dispersed business.

Of course, Berkshire’s success is inseparable from its unique business model and investment philosophy.

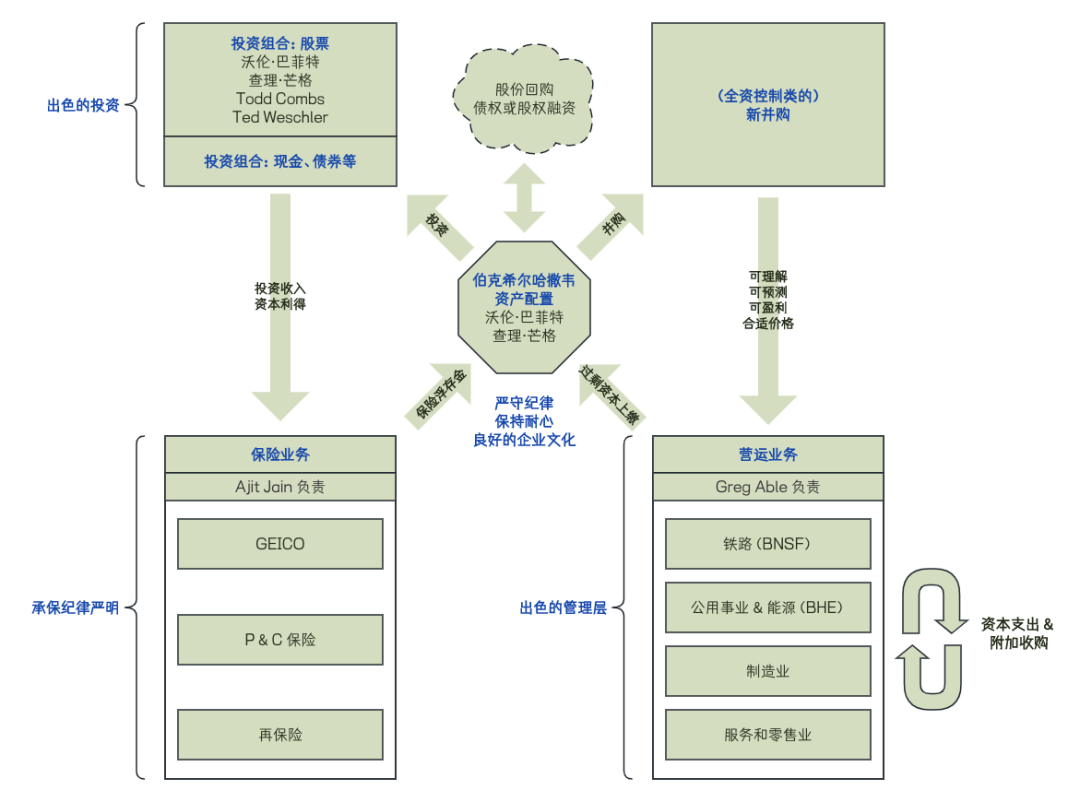

First, there is the leverage of the insurance business. Berkshire’s insurance business provides it with a stable and low-cost source of funds. Buffett uses these funds to invest and amplify the investment effect, which is one of the core growth of Berkshire’s business.

Second, there is Buffett’s “Competitive Edge” Value Investment philosophy. That is, looking for companies with lasting competitive advantages to invest in, these advantages can protect the company from the erosion of competitors.

Furthermore, emphasize the “margin of safety” . That is, the price paid at the time of investment is much lower than the intrinsic value of the company, thereby reducing risk and increasing returns.

Then, there’s the diversified business portfolio. Berkshire’s business covers multiple industries from insurance to railways, from energy to retail. This business structure not only spreads risk, but also provides the company with multiple sources of revenue.

So how is Buffett’s portfolio built?

In February this year, Berkshire Hathaway released its Q4 and full-year 2023 financial report. The data showed that Berkshire’s Net Profit for the full year of 2023 was $96.223 billion, exceeding market expectations and showing a significant improvement compared to the net loss of $22.80 billion in 2022.

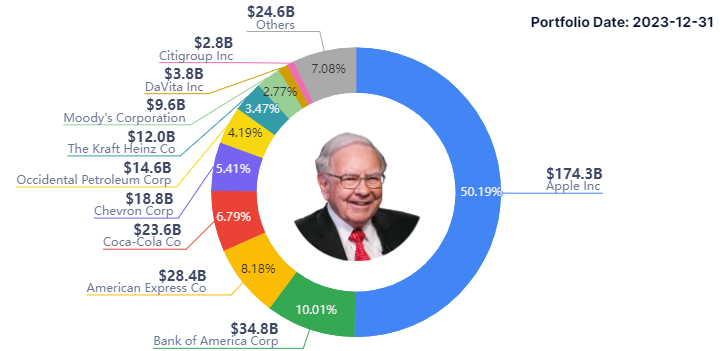

According to Berkshire’s latest disclosure of stock holdings, about 79% of the fair price of the investment portfolio is concentrated in five companies, namely Apple (174.30 billion yuan), US Bank (34.80 billion yuan), US Express (28.40 billion yuan), Coca-Cola (23.60 billion yuan), Chevron (18.80 billion yuan), followed by Western Petroleum, Kraft Heinz, Moody’s, DaVita, and Citigroup.

Currently, Apple is still Berkshire Hathaway’s largest holding, with a market value of $1743.47, accounting for 50.19%. Looking at the timing of his holdings in recent years, Buffett has shown a clear preference for Apple. Although Buffett reduced his holdings of 10 million shares of Apple stock in the fourth quarter of last year, Apple is still the current largest holding.

Buffett’s top 10 holdings

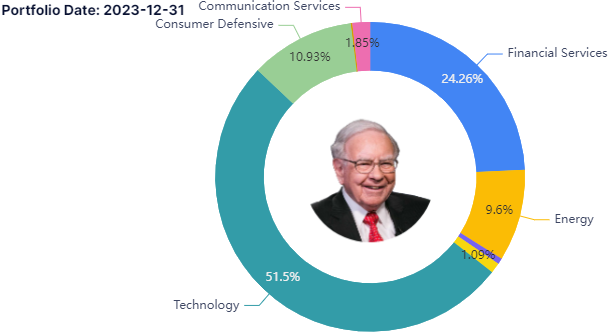

From the perspective of industry distribution, Buffett’s current portfolio holdings are mainly distributed in the following industries:

Information technology (51.5%): Since 2011, technology stocks have significantly increased their proportion in Buffett’s investment portfolio, and now account for almost half of Berkshire’s holdings, mainly in Apple.

Financial industry (24.26%): After 2019, Buffett’s holdings in the financial industry have decreased, and the current heavy holdings are mainly concentrated in several companies such as US Bank, US Express, Moody’s, and Citigroup.

Consumer industry (10.93%): Daily consumer stocks are also one of Buffett’s long-term heavy positions in industries, such as Coca-Cola, Kraft Heinz, etc. However, from historical data, the market value of daily consumer stocks shows a downward trend.

Energy industry (9.6%): Since 2021, Buffett’s holdings in the energy industry have increased, including companies such as Western Petroleum and Chevron. Buffett has also publicly expressed optimism about the future of energy stocks.

Distribution of Buffett’s holdings in various industries

From Berkshire’s heavy holdings and industries, we can see Buffett’s Value Investment and long-term investment philosophy, as well as his sensitivity and adaptability to market changes. His investment decisions are usually based on in-depth analysis of the company’s fundamentals and understanding of industry trends. So, how can investors use Buffett’s investment philosophy to make money in the US stock market?

First, choose a good company that creates value; secondly, choose a company with a valuation safety margin.

Buffett once said that life is like a snowball, and the most important thing is to discover very wet snow and long slopes. The editor believes that it is precisely because Buffett’s investment strategy has always been stable and long-term, that he is good at finding undervalued value targets in market downturns, and will look for companies with strong competitiveness and reasonable prices worldwide for investment.

Of course, no matter how skilled the stock god is in investing, he may miss some good investments and make mistakes. After all, there is no correct answer to investing itself. We don’t need to judge the right or wrong of the stock god’s investment ideas, nor do we need to force ourselves to copy them. We can integrate Buffett’s investment philosophy into our own investments and continuously improve it over time.

As of the close of trading on Friday, April 26th, the S & P 500 index and Nasdaq rose by 2.7% and 4.2% respectively this week, ending their recent consecutive declines. The Dow Jones index also rose slightly by 0.7%. In the midst of the financial report season, the performance of major technology companies this week did not disappoint the market, especially the financial reports of Google and Microsoft, indicating that the rise driven by artificial intelligence still has great potential, and the US stock market has once again entered an upward trend.

However, the data release that the market will pay attention to next week is also intensive. On April 30th, Amazon announced its latest quarterly report. The popular company that released its financial report on the same day was AMD, the second-ranked chip company. Starbucks, McDonald’s, and Coca-Cola’s financial reports also have a strong guiding role. On May 2nd, Apple released its latest quarterly report. Coinbase, which has recently risen sharply, also released its financial report on the same day.

Starting from practice, how to invest in US stocks?

Investing in US stocks first requires finding investment channels that suit one’s risk preferences. Secondly, although US stocks have a positive momentum effect, it is also possible to choose a better time to enter the market.

In the choice of investment channels, Xiaobian recommends Interactive Brokers, Jiaxin and BiyaPay. Among them, Interactive Brokers and Jiaxin are US brokers, but the Chinese service experience is worse, but their transaction fees are really low. Then there is BiyaPay, which is a wallet broker, similar to Alipay in Chinese mainland. Online account opening, Chinese and English dual interface services. Moreover, their trading varieties are very rich, not only can trade US stocks, Hong Kong stocks, digital currencies, etc. can also be traded, which can be regarded as a relatively strong company.

In addition, there is a benefit to trading US stocks through the BiyaPay App, that is, there is no need for overseas bank cards, and you can directly exchange currency in BiyaPay. Deposit Jiaxin also supports telegraphic transfer and ACH two ways, ACH deposit bank zero handling fees, same-day arrival, the main fast and convenient.

So, what exciting highlights will there be at this year’s Shareowner Conference?

1. How to use a large sum of cash?

Berkshire currently has about $167.60 billion in cash and equivalents on its books, breaking the record high of $157.20 billion last quarter. Who will be the next investment target for these funds has become a topic of concern for many investors.

2. Will you continue to be optimistic about the Japanese stock market?

Since last year, Buffett has continuously increased his holdings in Japanese stocks and publicly expressed his optimism about them. It is expected that Berkshire Hathaway will “indefinitely” maintain its investment in the five major Japanese trading companies. Thanks to the continuous rise of Japanese stocks, Buffett’s forward-looking investment can be said to have yielded fruitful results. At this shareowner conference, Buffett may further respond to the topic of investing in the Japanese stock market.

3. How to View the US Economy and the Federal Reserve’s Monetary Policy?

Every year at the Shareowners Conference, Buffett will express his views on the US Macroeconomic and Monetary Policy, and investors are also looking forward to hearing Buffett’s views on the economic situation and future market trends.

4. What life advice do you have for investors?

Investment insights and experience sharing are always a part of the annual Shareowner Conference. Some of these insights are about wisdom in dealing with the world, some are about cyclical patterns, and some are about life philosophy. Although Buffett’s success is difficult to replicate, investors can learn some methods and concepts from it, and avoid detours in investment and financial management.

Finally, let’s wait and see for this year’s Buffett Shareowner Conference!