- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Pinduoduo's Earnings Explode, but Why Hasn't the Stock Price 'Taken Off'? Is Now the Time to Get on

Pinduoduo has once again “shocked” Wall Street!

The financial report released on March 20 showed that the company achieved earnings per share of 17.32 yuan in the fourth quarter of 2023, with total revenue of 888.81 billion yuan. Analysts surveyed by FactSet had previously expected Pinduoduo to earn 11.28 yuan per share with revenue of 795 billion yuan for the quarter.

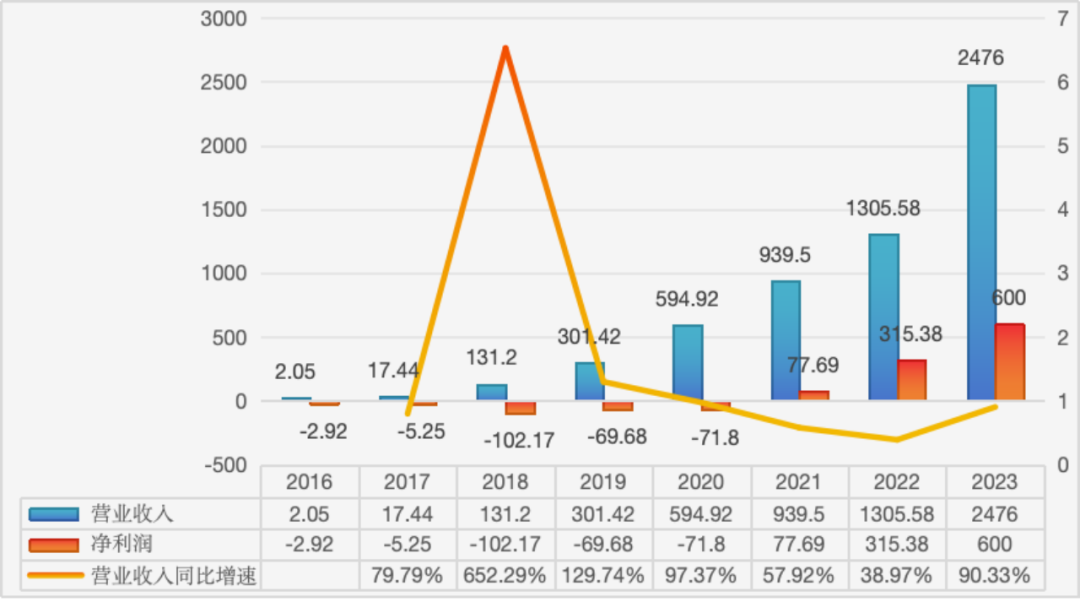

For the full year of 2023, Pinduoduo’s total revenue reached 2476.39 billion yuan, an increase of 90% compared to the same period in 2022, mainly due to increases in online marketing services (advertising) and transaction service income (commissions); net profit was 600.27 billion yuan, up 90% year-on-year; earnings per share were 46.51 yuan, compared to 27.45 yuan in the same period last year.

Performance of Pinduoduo since its establishment

Alongside its earnings, Pinduoduo’s stock price has also sprinted.

In 2023, it saw an increase of 79.41%, far surpassing competitors like Alibaba and JD.com. After last year’s third-quarter report, Pinduoduo’s market value even surpassed Alibaba, becoming the highest-valued Chinese concept stock in the U.S. market.

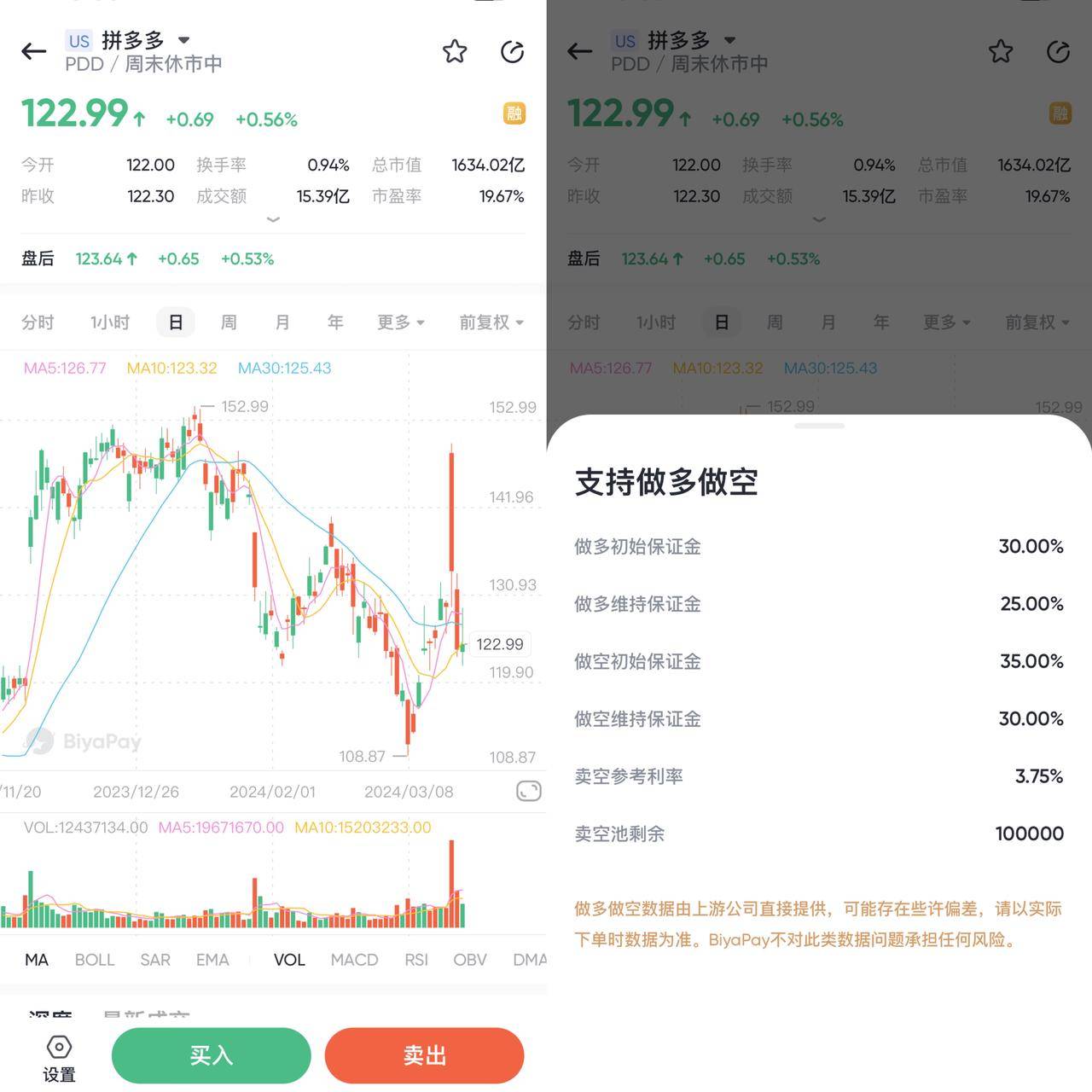

However, in the two trading days following this financial report, the stock price behaved quite oddly. According to the BiyaPay App, Pinduoduo’s market trend (as shown below) indicates that the stock closed at 127.68 USD the day before, opened 16% higher at 148.3 USD the day after the financial report, then fell continuously, closing at 132.17 USD. The next day, it plummeted by 7.47% to 122.3 USD, even lower than the price before the financial report by 5 USD.

In the face of Pinduoduo’s explosive performance, the stock price was “cut down,” obviously. Besides the short-term speculation’s uncertainty, there are areas where investors are still not confident in Pinduoduo. So, what exactly is going on with Pinduoduo?

PDD market trend, chart source BiyaPay App

Temu has become the new engine

The core of Pinduoduo’s significant revenue and profit increase stems from its cross-border platform Temu, which has been online for less than two years.

In September 2022, Pinduoduo launched Temu, a new cross-border platform model of “full management”—meaning merchants only need to take care of production, while the platform manages the entire process of placement, operation, and logistics. It integrates these key steps originally managed by merchants, thus forming a scale effect to reduce costs and increase efficiency, making the entire system operate more efficiently than other e-commerce platforms.

In just over a year, Temu’s business scope has expanded to more than 50 countries and regions worldwide, especially in North America, where it has gradually opened up the market through continuous advertising and expanding influence. This move not only helps Pinduoduo expand its overseas market but also brings more growth opportunities and development space.

This earnings report also proves that Temu, less than two years online, has become the second growth curve for the Pinduoduo group, and Pinduoduo’s growth is far from reaching its peak.

Regarding the growth in performance that far exceeded expectations, Pinduoduo’s executive director and co-CEO said in the earnings call, “The revenue growth of the platform is due to the overall consumer recovery and our direct and effective consumer promotion measures, which are also the natural result of our continuous efforts to create more value for consumers and merchants.”

He mentioned that Temu is still in the early stages and may face many changes and challenges in the future. However, no matter how the market environment changes, consumers’ demand for “more benefits, good service” from e-commerce platforms remains unchanged, and Pinduoduo is prepared for long-term investment.

According to HSBC’s estimates, Temu contributed 23% to Pinduoduo’s total revenue in 2023, and this figure is expected to rise to 43% in 2024 and exceed 50% by 2025. HSBC also stated that it expects Temu’s total merchandise value (GMV) to double in 2024, reaching about 48 billion USD, and to reach 140 billion USD by 2027.

Therefore, it is not hard to see that Pinduoduo can be regarded as a money-making machine.

So, back to Pinduoduo itself, why has its stock performance been below expectations?

When it comes to Pinduoduo’s stock price, it really follows a “junk stock” trend, with a high opening and low close, and a long negative volume…

This has also come as a surprise to the market. Since the beginning of the year, Pinduoduo’s stock price has fallen by 16.41%, while the S&P 500 index and the Nasdaq index have risen by 9.89% and 9.26%, respectively.

Relatively speaking, the transparency of the U.S. stock market is higher. Good corporate performance is recognized by the market, leading to a rise in stock prices. It is very rare to see a situation like Pinduoduo’s, where earnings soar but the stock price plummets. The only plausible explanation is that Temu is likely to be sanctioned by the United States.

Data shows that in 2023, the U.S. market accounted for 60% of Temu’s total merchandise sales volume. However, the platform plans to reduce this ratio to 30% by 2025.

Some analysts believe that Pinduoduo’s stock price drop is mainly due to geopolitical conflicts, thus causing market concerns about whether Temu will face risks in the complex overseas environment.

On March 12, Goldman Sachs downgraded Pinduoduo’s stock rating from “buy” to “neutral,” lowering the target price from 196 USD to 136 USD. Goldman Sachs believes that the policy landscape for cross-border business is rapidly changing, including a bill recently passed by the U.S. House Energy and Commerce Committee focusing on foreign applications. Before the policy is further clarified in major countries, it may suppress investor interest in Pinduoduo in the short to medium term. Moreover, it is expected that Pinduoduo’s business expansion in China will slow down due to the gradually escalating competitive landscape, as competitors refocus on growth this year.

Although Goldman Sachs’ downgrade occurred before the publication of Pinduoduo’s fourth-quarter report, it still reflects investor concerns. However, most analysts remain bullish on Pinduoduo, with HSBC, J.P. Morgan, and others giving the stock a “buy,” “hold,” or “outperform” rating.

As an investor, do you think now is the time to get on board?

In terms of stock performance, although Pinduoduo’s stock once rose more than 18% before the U.S. stock market opened after the earnings announcement and fell back during the session, it still ended up 3% higher, fully demonstrating the market’s recognition of Pinduoduo’s performance and its expectations for future development.

As an investor, the editor suggests that you should monitor the market trend regularly on the BiyaPay App according to your own investment strategy and get on board at the right time. If you want to buy at a low price, you only need to search for its code on BiyaPay to trade online in real-time. You can also deposit digital currency (USDT) into BiyaPay and then withdraw fiat money to invest in U.S. stocks.

In summary, Pinduoduo’s latest earnings report undoubtedly provided a strong boost to investors and the market.

I remember a long time ago, the Pinduoduo magnate shared his dream on his personal account. Although PDD’s team may lag behind Alibaba’s team by 20 years, PDD might have the opportunity to create a different Alibaba under the new distribution of traffic, new forms of user interaction, and new international circumstances.

Now, in the era of AI e-commerce, this seemingly inconspicuous “cut” has become one of the three giants of e-commerce. It is rare for a company to be successful once, but it is almost unheard of for a company like Pinduoduo to break through the cracks of e-commerce giants domestically and then quickly succeed in the overseas e-commerce market.

Despite the current stock price not soaring as high as its booming earnings, Pinduoduo’s achievements are still enough to shock the e-commerce world. I am ready to be long-term bullish on Pinduoduo, believing it will achieve better performance and bring returns to investors.