- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

专业券商出入金工具,USDT等值兑换美元,如何使用BiyaPay极速入金嘉信理财?

No need for an overseas bank account, new method for USDT deposit into Charles Schwab! Deposit into Charles Schwab through BiyaPay, where USDT is exchanged for USD at an equivalent value.

BiyaPay Introduction

Founded in 2019, BiyaPay is a multi-asset wallet supporting both fiat and digital currencies.

BiyaPay not only supports the mixed exchange of more than 30 legal currencies and more than 200 digital currencies worldwide, but also is committed to providing users with safer and faster international remittances. It is also a professional tool for depositing and exiting US and Hong Kong stocks, with online (no regional restrictions) account opening and no need for offshore bank accounts. You can exchange USD through USDT, deposit into Jiaxin Wealth Management through ACH, and enjoy the lowest handling fees, with same-day remittance and same-day delivery. You can also exchange USD and Hong Kong dollars through USDT, trade US and Hong Kong stocks in real-time, and deposit and withdraw funds in real-time.

With BiyaPay, users can invest in global markets with just one account and one investment. It’s both a professional broker funding tool and a convenient and fast multi-asset wallet.

Visit BiyaPay’s official website link

BiyaPay Licenses

BiyaPay holds an RIA license registered with the U.S. SEC, under the regulation of the SEC.

BiyaPay holds a financial services license issued by the U.S. MSB, under the regulations of the U.S. MSB.

BiyaPay holds a financial services license issued by the Canadian MSB, under the regulations of the Canadian MSB.

BiyaPay Deposit and Withdrawal Advantages

1. 1:1 USDT to USD Exchange

BiyaPay supports real-time exchanges of digital currencies like BTC, USDT with USD and HKD. USDT can be exchanged 1:1 for USD, allowing users to deposit into major brokers by depositing USDT and exchanging it for USD or HKD, solving the issue of difficult deposits for investors.

2. Unlimited Amount, Freer Asset Allocation

Deposits and withdrawals for U.S. and Hong Kong stocks through BiyaPay have no limit, with fees as low as 0.05%. Users can also withdraw funds for forex, commodities, and more investment methods, truly achieving free asset allocation.

3. Same-Day Transfers, Immediate Arrival

BiyaPay’s online remittance is processed by regular remittance institutions, practically achieving zero bank risk control. It supports local transfers in most countries or regions, with faster arrival speeds, higher efficiency, and generally same-day remittance and arrival!

4. More Convenient Withdrawals

BiyaPay supports the exchange of fiat currencies like USD and HKD into digital currencies, and then online withdrawal to exchanges and sale to local bank accounts, achieving real-time withdrawals and solving the issue of investor funds returning to their country.

Click to enter BiyaPay’s official Telegram community

Two Methods to Deposit into U.S. Stocks Using BiyaPay

One way is through currency exchange with BiyaPay. For Charles Schwab, for example: a single successful deposit of 3 million into Schwab supports both wire transfer and ACH methods, allowing direct ACH deposits without additional bank account opening, with zero bank fees, generally arriving on the same day.

Expansion:

Choosing to deposit into Charles Schwab, as it is currently the largest online broker in the U.S., operating both brokerage and banking businesses. It provides two personal U.S. checking bank accounts, eliminating the need for an additional overseas bank account application, and also offers Chinese services and customer support, which is user-friendly.

Another way is to directly deposit digital currency (USDT) into BiyaPay, exchange it for USD, and trade U.S. stocks without needing an offshore bank account. Simply use an ID card or passport for verification, and trade U.S. and Hong Kong stocks anytime, anywhere. This method saves the cumbersome steps of fiat deposits and withdrawals with traditional brokers, as well as various fees, making it a good choice.

If you already have overseas bank accounts in Hong Kong, the U.S., etc., you can also exchange currency from BiyaPay, withdraw it, and then deposit into brokers like Interactive Brokers, Tiger Brokers, etc. It’s quick and convenient, unlimited, and also arrives on the same day, enjoying the lowest fees.

BiyaPay New Customer Benefits

BiyaPay Registration Link

Download the BiyaPay App

New users get an immediate 16U return on their first trade! 20% cashback on transaction fees!

Guide to Using BiyaPay for Quick Deposits to Charles Schwab (Taking Charles Schwab as an Example)

Click to download the BiyaPay App link, click “Register”, enter the account opening page, fill in personal email information, and complete in just three steps:

Click the top right corner, enter the personal center, and complete identity verification.

Deposit USDT equivalent to USD with no fees. On the App homepage, click “Transfer In”, select “Chain Deposit”, deposit USDT:

Click the “Flash Exchange” page. After the USDT deposit arrives, you need to first exchange USDT for USD:

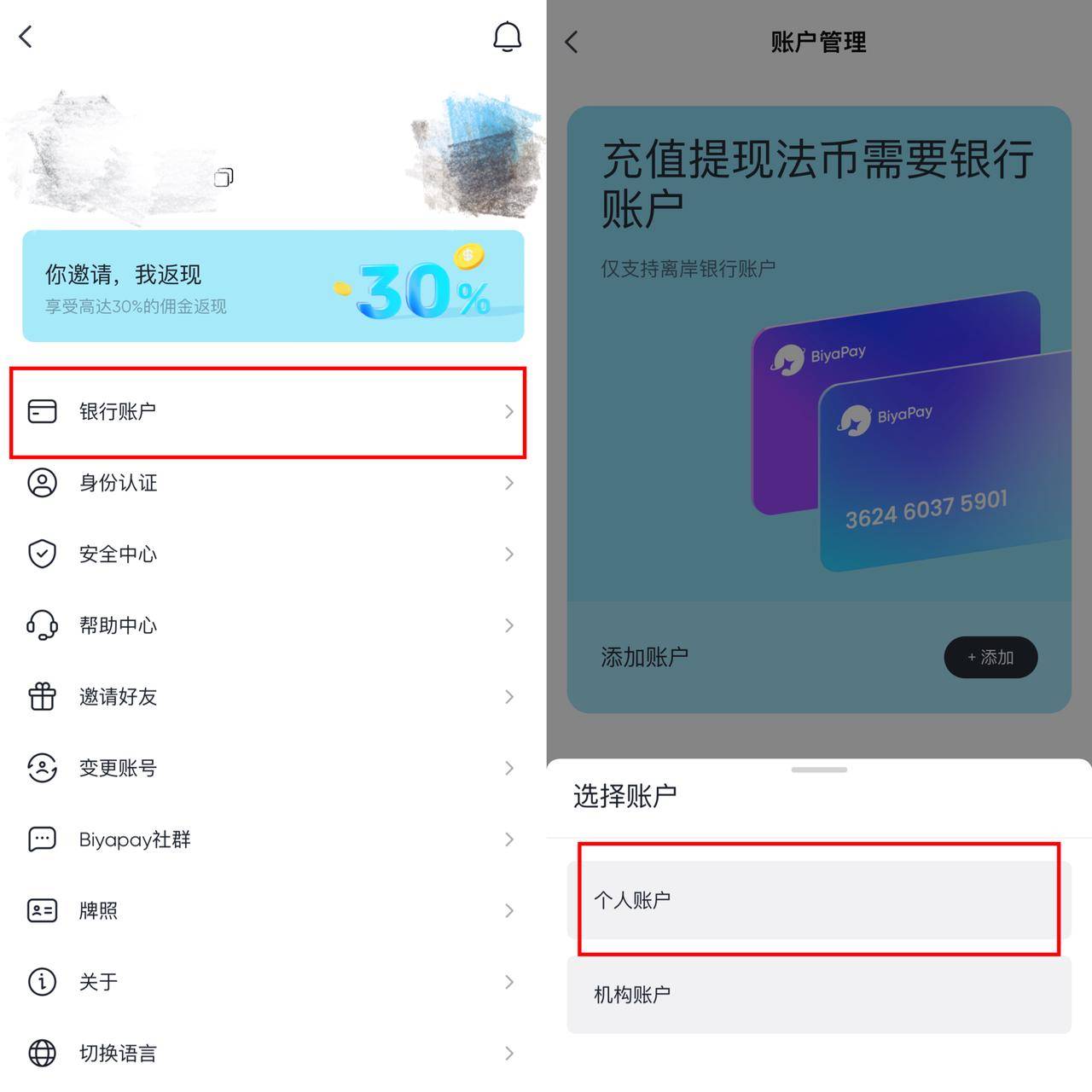

Next, click the top right corner to enter the personal center, click “Bank Account”, then click “Add Account”.

Choose the type of account you need, usually select a personal account, then click next, fill in personal information:

After filling out, submit the account and wait for approval, generally approved on the same day.

Click ‘Transfer Out’ on the homepage, click “Bank Account Withdrawal”, select the currency, fill in the withdrawal amount, and click next to withdraw to the bound bank account.

Then wait for the funds to arrive at Charles Schwab. If withdrawn on the same day, it will be credited during U.S. business hours.

Notes

After opening an account with Charles Schwab, they will provide you with two receiving accounts, one bank name: JP Morgan Chase for domestic U.S. receipts, and another bank name: Charles Schwab Co. Inc for international receipts.

The Charles Schwab U.S. domestic receipt account is suitable for small amounts, not exceeding 40,000 USD per transaction. BiyaPay will use ACH for remittance.

The Charles Schwab international receipt account can exceed 40,000 USD per transaction. BiyaPay will use wire transfer for remittance.

In summary, USDT deposit into Charles Schwab through BiyaPay has the following features:

- Fast arrival time (credited on the same day during U.S. business hours)

- Single ACH transaction limit of 40,000 USD, unlimited for wire transfers

- No need for additional overseas bank accounts

- No risk control

- Low loss (USDT to USD exchange, withdrawal fee 0.5%~1%, minimum 20 USD)

For users who have questions about registering and opening an account with BiyaPay, you can contact BiyaPay customer service for one-on-one guidance:

Customer Service Email: service@biyapay.com

Customer Service Telegram: @biyapay001

Customer Service SkypeLive: Live.cid.d53ae2872b464237

Click to enter the official Telegram community