- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Over $5 Trillion in Contracts Expire on the First 'Quadruple Witching Day' of the Year

This week’s hot inflation data has continued to fuel Wall Street’s concerns about a possible delay in the Federal Reserve’s rate cuts. The performance of U.S. stocks in the past two trading days has also become quite erratic. Tonight, U.S. stock investors will undoubtedly face another critical test—the first “Quadruple Witching Day” of 2024!

What is Quadruple Witching Day?

Investors in the U.S. stock market pay attention to this very special day, known as “Quadruple Witching Day,” which might sound related to witchcraft. But what exactly is “Quadruple Witching Day,” and how does it affect the U.S. stock market?

Quadruple Witching Day refers to the third Friday of March, June, September, and December in the U.S. market. On this day, derivative financial instruments in the U.S. market expire and settle. These derivatives include stock index futures, stock index options, individual stock futures, and individual stock options.

Due to the expiration of these financial derivatives, market fund managers and investors need to close their positions or roll them over to contracts with later expiration dates. Therefore, Quadruple Witching Day usually brings significant trading volume and drastic price fluctuations to the market.

2024 Quadruple Witching Dates in the U.S. Market:

- First Quarter: March 15

- Second Quarter: June 14

- Third Quarter: September 13

- Fourth Quarter: December 13

Impact of Quadruple Witching Day on the Market

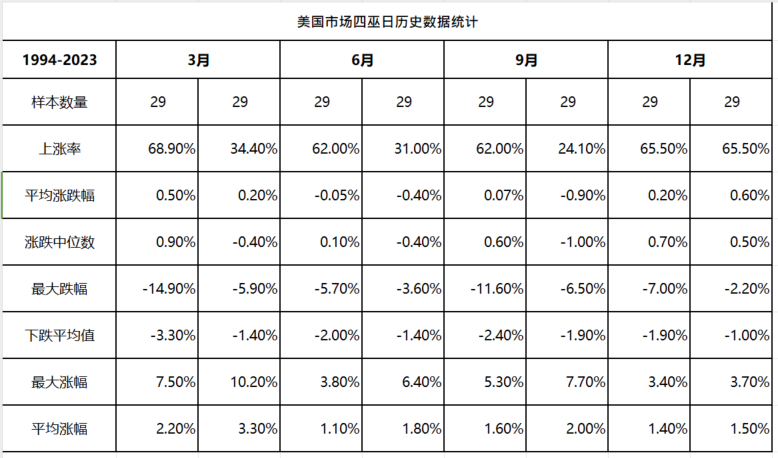

According to Bloomberg data from 1994 to 2023, the week of Quadruple Witching Day and the following week typically show a negative impact on the market in March, June, and September, with a 60-70% chance of a market decline, averaging a drop of 1.4-1.9%. In contrast, the stock market usually performs better in the week following December’s Quadruple Witching Day.

Overall, while Quadruple Witching Day is not particularly ominous, short-term traders should be extra cautious in the week following Quadruple Witching Day due to the higher volatility in the U.S. stock market. However, long-term investors with well-diversified portfolios need not be overly concerned about the impact of this event.

Risks of the First Quadruple Witching Day of 2024

The upcoming Quadruple Witching Day on March 15 (Friday) is set to have a significant impact, with over $5 trillion in financial derivatives expiring.

Of this, $3.2 trillion in index options, mostly tied to the S&P 500 index, will expire at the opening of the U.S. stock market on Friday. Additionally, according to data from Asym 500, another $1.9 trillion in options linked to individual stocks and index-tracking ETFs will expire at market close.

Although the total amount of options expiring is slightly less than the previous Quadruple Witching Day in December, it is still considered substantial compared to recent history.

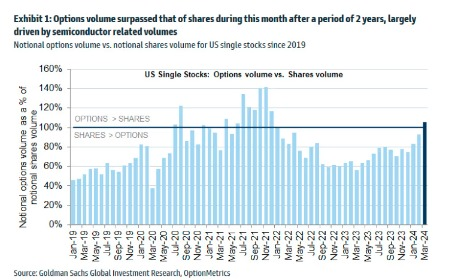

In fact, according to Goldman Sachs, the trading volume of single-stock options in March is expected to exceed that of spot stocks for the first time since the end of 2021, increasing the likelihood of significant market volatility. Remember, the last time this happened, the U.S. stock market entered a bear market in 2022.

Attention, Nvidia Investors!

Goldman Sachs analysts have noted a significant increase in options market activity this month, driven by bets on semiconductor stocks, particularly Nvidia, which has become one of the most sought-after contracts again.

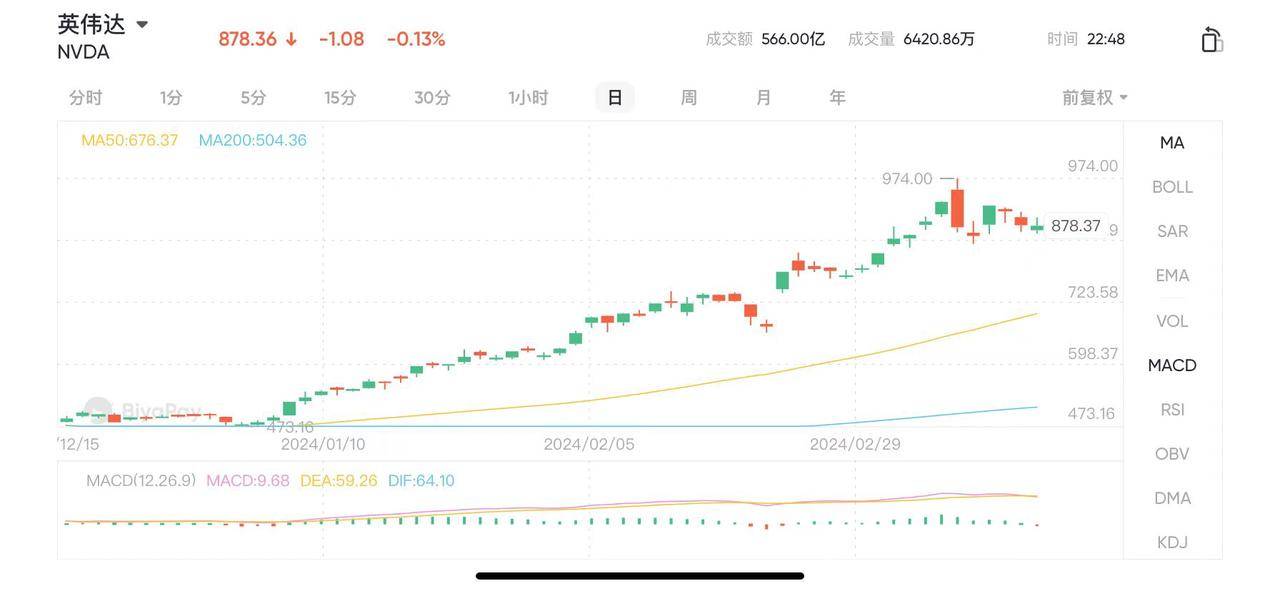

In the past month, Nvidia options accounted for a quarter of the single-stock options market, including bearish options betting on Nvidia dropping to $350 in March, and bullish options predicting a rise to over $900 in the coming months.

Data shows that traders continue to favor bullish options for semiconductor stocks and other popular options over bearish ones. Analyst Brent Kochuba stated in a report to clients on Thursday, “Friday represents a very large quarterly options expiration, dominated entirely by bullish positions.”

Such large Quadruple Witching Days often stimulate volatility in related stocks and indices before expiration. Kochuba suggests that the strong bullish sentiment leading up to Quadruple Witching Day likely puts pressure on the stock market, a notion that seems to be substantiated by recent market trends, where the upward momentum of U.S. stocks has faced obstacles.

The market validated these expectations with the Nasdaq dropping 155.36 points.

However, influenced by the Nvidia AI Developer Conference GTC2024 on March 19th, Nvidia’s stock went against the trend and rose by 1.04% on Friday. To keep a close eye on Nvidia’s stock performance and trade Nvidia shares, one can use the BiyaPay platform. BiyaPay not only allows trading in U.S. stocks but also offers trading in Hong Kong stocks and cryptocurrencies.