- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Market Pullback and Federal Reserve Policy: A Brief Respite in the Bull Market or a Warning Bell?

The recent release of the Federal Reserve’s Summary of Economic Projections (SEP) suggested a reduction in the frequency of rate cuts next year. However, history has shown that the Fed’s forecasts are often inaccurate. As a result, investors who make decisions solely based on these projections may be exposed to risk. In particular, the Fed’s forecasting errors over the past few years suggest that relying exclusively on these predictions to guide market operations is unwise.

This week, the Federal Reserve cut interest rates by 25 basis points, but the stock market plummeted by 3% on the same day. After the Fed released its economic projections, the market saw significant sell-offs, accelerating the decline. In reality, yesterday’s market didn’t differ much from earlier trends—the stock market’s valuations remained close to the heights seen during the dot-com bubble. The 3% drop only brought the market back to levels seen a few weeks ago, and many popular stocks had diverged far from their fundamentals. The decline was merely a small fluctuation.

Nevertheless, the recent pullback in the market has led to oversold conditions, and the underlying economic fundamentals remain strong. The bull market is expected to persist until 2025. A pullback is a normal phenomenon in market cycles and presents a good entry opportunity for investors.

The Federal Reserve’s Forecasts Are Unreliable

Looking back at the Federal Reserve’s quarterly economic projections over the past few years, their accuracy has been questionable. For example, last year’s economic forecast projected a growth rate of only 1.4% for this year, yet the actual growth rate has already exceeded 2.5%. In the March forecast, the Fed predicted six rate cuts of 0.25% each, but it only lowered rates three times, totaling 100 basis points.

Do you think this time’s economic forecast will be more accurate? I remain skeptical. Therefore, relying solely on these predictions for the next one, two, or even three years to make investment decisions is clearly irrational.

It’s worth noting that in less than three weeks, the stock market has rapidly fallen from an overbought condition to an oversold area, which is actually a buying opportunity in a bull market. The bull market is expected to continue until 2025.

No matter how these forecasts evolve, the key point is that the Fed’s next move will likely be a further rate cut, rather than an increase, as inflation is more likely to continue falling than rising. These two factors are positive for the market.

Will the Fed Act Proactively?

In September, the Fed unexpectedly cut rates by 50 basis points before the election. Compared to the standard 25-basis-point cut, this substantial reduction lacked sufficient economic support. The federal government’s growing deficit suggests that, according to basic economic theory, the Fed should maintain relatively high rates to control this, or else risk triggering a second round of severe inflation.

The current economic forecast summaries indicate that the Fed has recognized this, meaning the market’s previous expectation of a substantial rate cut without a recession is clearly unrealistic.

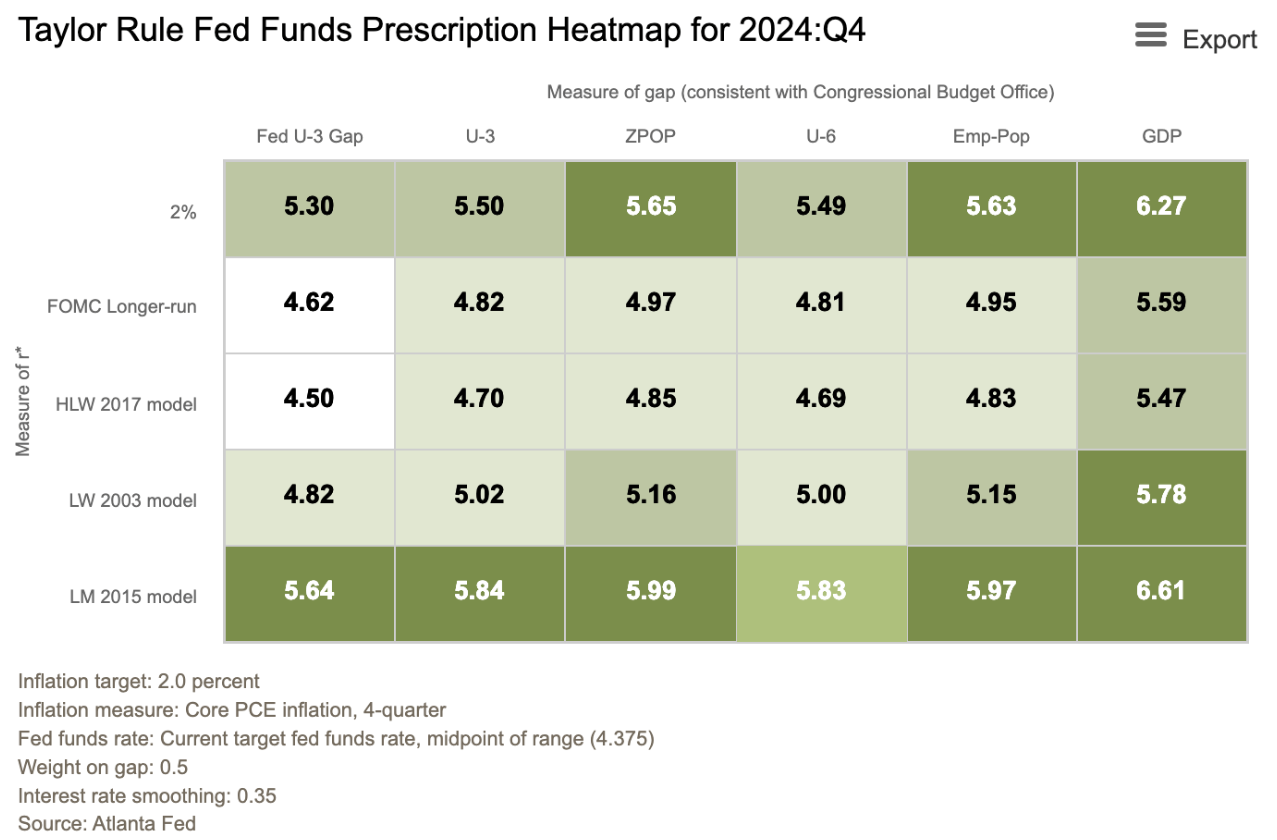

In the study process, the author used 30 Taylor Rule-based interest rate models for analysis. The Taylor Rule is a famous macroeconomic model designed to show the ideal interest rate level. Historically, when the Fed has deviated from the Taylor Rule, it has often lagged behind economic conditions.

The results showed that 28 out of 30 models suggested that the Fed should raise rates. Most of the models believe the federal funds rate should be around 5%, which is 50 basis points higher than its current level.

However, the Fed has been slow to act and has not yet achieved its 2% inflation target. Due to this, long-term debt rates are gradually bridging the gap caused by low short-term rates. As of this writing, the 10-year Treasury yield has risen to 4.56%, while the 30-year fixed mortgage rate is nearing 7.125%.

The massive fiscal deficit is not hard to explain. If the government continues its heavy spending without raising taxes to cover these costs, this could lead to a major surprise in 2025. Although it may seem unlikely that rates will rise by another 150 basis points, this would bring rates back to levels seen in the 1990s. The low interest rates of the 2010s do not necessarily indicate that this will continue in the future. If most Fed members belong to one political party while the president belongs to another, the Fed has no political motivation to support converting debt into monetization.

Thus, the current market pullback may be just a common occurrence in a bull market. In a strong bull market, pullbacks are inevitable and actually present more buying opportunities, rather than signals of a market downturn. Regardless of the Fed’s rhetoric or actions, the fundamentals remain strong, and this hasn’t changed.

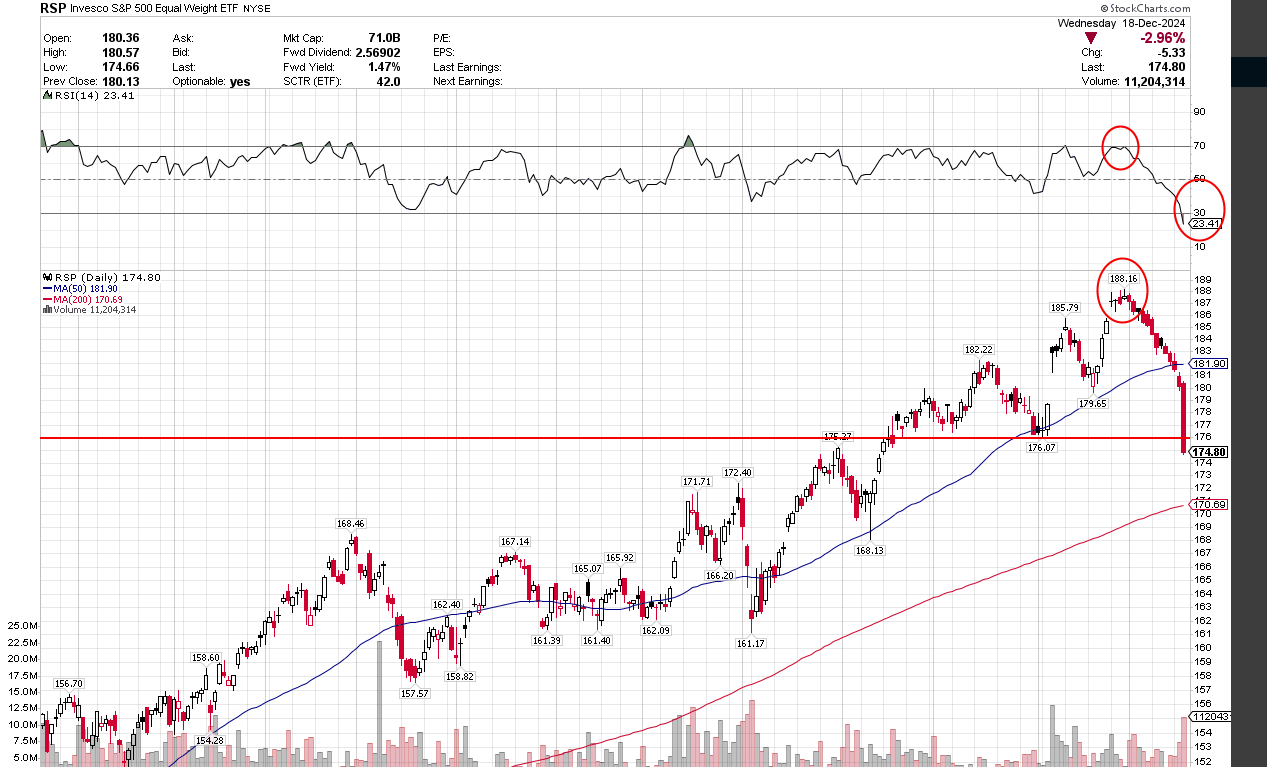

In fact, the Fed recently cut rates by a full percentage point, signaling that the easing cycle is far from over. Looking at the latest charts of the S&P 500 Equal Weight Index (RSP), the market is now in a deeply oversold state after pulling back by 7% from its historical highs. I believe that if the market experiences a slight downturn, we may see the formation of a long-term support zone.

Large-Cap Valuations Remain Elevated, and Tech Stocks Show Growing Dependence

Currently, large-cap valuations remain at historically high levels, approaching the extremes seen during the dot-com bubble, and even surpassing the valuations from the pandemic period of 2021. The forward P/E ratio of the S&P 500 has reached 23 times, which is 30% higher than its long-term average.

Yesterday’s market pullback only erased the gains made since October of last year, but what is most surprising is the severity of the sell-off. Assets considered “cheap” suffered even greater impacts. The euro/dollar exchange rate briefly dropped to 1.03, nearing parity with the dollar, and the Japanese yen depreciated once again. Meanwhile, small-cap stocks (like IJR) saw about a 10% decline, completely erasing the post-election gains.

Today, the market generally believes that investor confidence in large-cap tech stocks is almost blind, with investors willing to pay any premium, as these tech companies seem immune to economic cycles, only rising and rendering profit and cash flow concerns less important. At the same time, there’s a widespread belief that even if the stock market falls, the Fed will continue to ease monetary policy, printing more money to “rescue” the market, thus preventing investors from facing losses.

Now, some argue that companies like Apple (AAPL) are no longer viewed purely as profit- and cash flow-based investments but rather as “collectibles.” Are you really considering buying stocks as collectibles?

In contrast, many high-quality preferred stocks and international markets offer considerable dividend yields, and small-cap stocks are now trading at near their lowest valuations in 25 years, remaining highly attractive. Real Estate Investment Trusts (REITs) and some small-cap stocks also present good investment opportunities.

The Overhyped Tech Stock Trend May Be Facing a Turning Point

In the first quarter of 2024, many large tech companies will carry out significant layoffs in response to the over-expansion of their workforce in recent years. After two years of AI (Artificial Intelligence) fever, the massive investments these companies made in AI have yet to translate into substantial profits. If consumers fail to pay higher prices for AI technology, this investment frenzy may quickly reverse.

According to Generally Accepted Accounting Principles (GAAP), some companies can record profits through equipment sales, while buyers of equipment can defer cost recognition by capitalizing the purchase. This accounting treatment hides the years of unprofitable investments, which is a core characteristic of modern stock market bubbles.

Current Issues in the Market

Although the market has experienced some volatility, it has not strayed from its fundamentals:

- Large-Cap Stock Valuation Bubble: Even after recent sell-offs, large-cap stock valuations in the U.S. remain near historical highs, similar to levels seen during the dot-com bubble.

- Real Estate Bubble: Despite a decline in rents, mortgage rates have surpassed 7% and are continuing to rise, yet U.S. home prices remain resilient. Meanwhile, with construction growing and market supply increasing, buyers are finding it hard to afford current home prices due to high rates, and many are not fully capitalizing on this advantage.

- USD Strength: Despite the strength of the U.S. dollar against other currencies, this has not brought the expected benefits to U.S. households. In fact, few investors are truly taking advantage of the currently low-priced overseas assets, possibly due to lingering uncertainties about the economic outlook.

- Small-Cap Stocks Are Relatively Cheap: Compared to large-cap stocks, small-cap stocks in the U.S. are remarkably cheap. These small companies face some challenges, but their valuations are more attractive relative to the big players, potentially offering opportunities for investors willing to take on higher risks.

- Political Shifts Not Yet Materialized: Despite significant political changes in the U.S. on the horizon, President Biden will remain in office for another month, and Trump will officially take office on January 20. Political instability may not immediately affect the market, but it is still something investors should monitor, as its potential economic impact cannot be ignored.

The market has seemingly experienced a dramatic turn, with speculators rapidly selling off stocks. However, from a broader perspective, the underlying issues remain largely unchanged—the challenges the market faces are almost identical to those it faced six months ago. The sharp volatility seen yesterday may simply be a temporary reaction, and the market is likely to return to the sluggish state it has been in over the past few months.

At the same time, the connection between current stock prices and the underlying economic fundamentals has become increasingly unclear. As a result, if the market continues to decline, the losses could deepen quickly. Over the past 25 years, the S&P 500 has dropped more than 50% twice—will we see a third such decline this time? Only time will tell.