- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Broadcom's stock price soared by 25%, and its market capitalization exceeded one trillion dollars! T

Broadcom’s (NASDAQ: AVGO) fourth-quarter fiscal year 2024 financial report marked a crucial moment for the company. Thanks to strong revenue growth and surging demand for its custom AI chip technology, its stock price skyrocketed by more than 25%. For the first time, Broadcom’s market capitalization surpassed the one-trillion-dollar mark.

To me, what stands out most is Broadcom’s growing importance as a formidable competitor to Nvidia (NVDA) in the AI chip market.

Hyperscale companies such as Google (GOOG), Amazon (AMZN), Meta (META), and OpenAI are increasingly seeking more efficient custom AI chips to meet their unique needs. Broadcom focuses on providing these specialized solutions, giving it a distinct advantage, especially when it collaborates with OpenAI to develop custom AI chips aimed at driving performance and revenue growth.

While everyone is keeping an eye on Nvidia’s upcoming Blackwell architecture, Broadcom is quietly building what these AI giants need: chips designed from scratch according to their unique requirements.

Broadcom’s strategy is fundamentally different from Nvidia’s approach. Nvidia focuses on general-purpose AI GPUs, while Broadcom has carved out a unique position by developing custom AI accelerators (XPU) tailored specifically for hyperscale customers. This strategy has achieved remarkable results among three major hyperscale customers and two other customers in the advanced development stage.

Why Do Custom AI Chips Pose a Threat to Nvidia’s Dominant Position?

Broadcom’s custom AI accelerator (XPU) plan lies at the core of its strategy. Currently, the company has established solid partnerships with three major hyperscale customers.

The first customer started production in 2024, and the second and third customers are scheduled to commence production in 2025 and 2026 respectively. This phased approach not only enables Broadcom to continuously optimize its technology and manufacturing processes but also gradually builds a stable revenue stream.

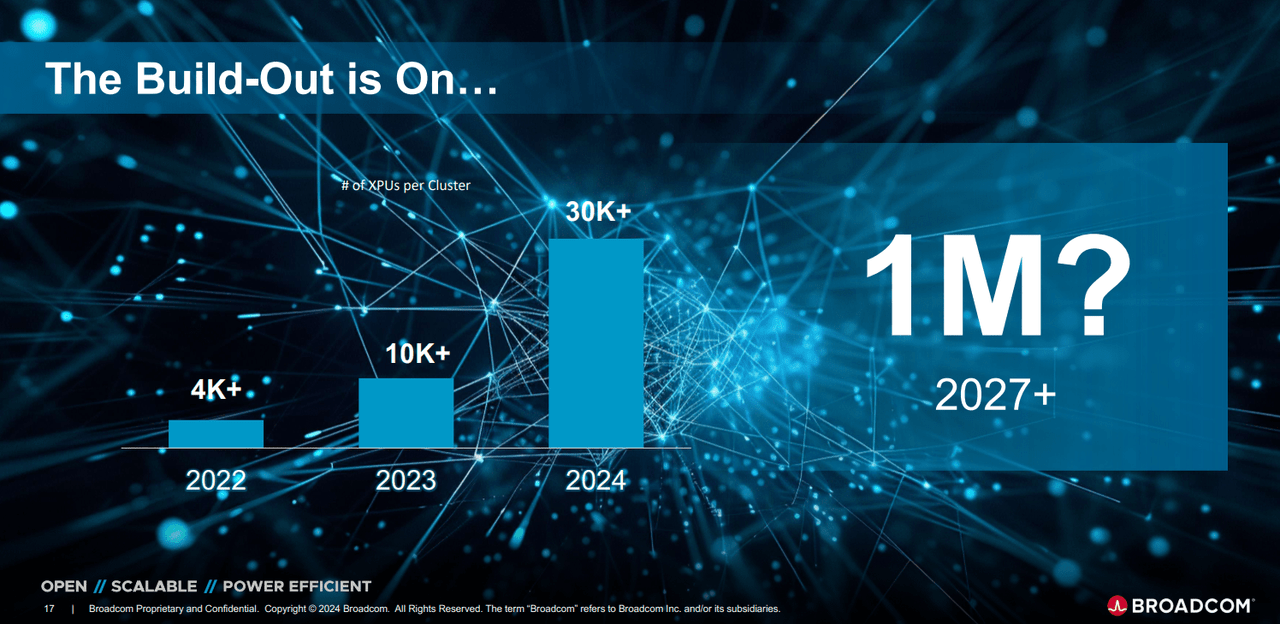

It is worth noting that the deployment scale in these customers’ plans is of crucial significance. According to the company’s management disclosure, the number of XPUs configured in a single cluster has shown a significant upward trend, rising from over 4,000 in 2023 to over 10,000 in 2024. It is estimated that by 2027, the scale of XPUs in a single cluster may reach as high as one million.

Such a rapid exponential expansion of the cluster scale will directly translate into considerable revenue potential, strongly supporting the company’s estimate that the serviceable available market (SAM) will reach between $60 billion and $90 billion in 2027.

Broadcom’s leading position in the network infrastructure field endows it with a vital competitive advantage. The company’s Tomahawk and Jericho product lines dominate the Ethernet network domain, and their performance is even more outstanding compared to InfiniBand solutions.

Specific performance data shows that the Ethernet-based solution can shorten the job completion time by 10% and increase the failover recovery rate by as much as 30 times (taking 53 microseconds compared to 1,600 microseconds for InfiniBand). As AI clusters expand to hundreds of thousands of nodes, the importance of such performance advantages becomes increasingly prominent.

Compared to traditional solutions, customers adopting Broadcom’s solutions can reduce their operating costs by 30% and accelerate the deployment speed of new storage by 77%. Moreover, Broadcom’s copper cable extension capability exceeds 4 meters, far surpassing the industry standard of 2 meters. Coupled with its linear pluggable optical fiber technology, it can reduce power consumption by 33%. This series of achievements fully demonstrates Broadcom’s significant technological leadership in the connection solution aspect.

In addition to the existing three hyperscale customers, Broadcom is also in an advanced development stage for two other customer projects. These two customers are expected to significantly expand their SAM scale in the future, potentially even exceeding the current estimate range of $60 billion to $90 billion.

Considering Broadcom’s current market position and growth prospects, it is painting an extremely attractive expansion blueprint. It is not difficult to speculate that in the next three years, it is highly likely to fundamentally reshape the landscape of the artificial intelligence chip industry.

Broadcom and OpenAI Join Hands

The news that Broadcom and OpenAI have formed a partnership has attracted widespread attention. This cooperation particularly highlights Broadcom’s differentiated competitive strategy in the AI chip track.

Currently, Nvidia dominates the AI training chip field with an unshakable position. However, Broadcom has taken a different path. Instead of rashly engaging in head-on competition in the training chip area, it has keenly captured a new strategic high ground in the AI computing field—AI inference.

AI model training is a phased task. Once the model is established, in various practical application scenarios, the inference process (that is, the process in which the model makes predictions and decisions based on what it has learned) will be executed repeatedly and at a much higher frequency than the training stage. Broadcom has precisely positioned itself according to this market characteristic, targeted the opportunities in the AI inference field, and is fully committed to developing customized inference chips to meet the specific business needs of different hyperscale computing enterprises and tap the commercial potential of the inference process.

At present, most hyperscale enterprises rely on the same type of GPU for both training and inference tasks. This “one-size-fits-all” model ignores the unique computing requirements of different businesses in the inference stage. The launch of Broadcom’s customized inference chips directly addresses the performance bottlenecks of general-purpose GPUs and is expected to significantly improve computing speed and energy efficiency, helping enterprises reduce operating costs and providing hyperscale enterprises with a more suitable and high-quality option for optimizing inference workloads.

To implement this strategy, Broadcom has assembled a professional chip team consisting of about 20 elites. The core team members, Thomas Norrie and Richard Ho, are both industry veterans. Their previous experience in leading the development of tensor processing units at Google has injected a powerful technological gene into the team.

Under the cooperation framework, Broadcom, together with OpenAI, has reached a manufacturing cooperation agreement with TSMC. The first customized chip is expected to make its debut in 2026.

OpenAI’s current financial situation shows a situation where costs exceed revenues. It is estimated that this year’s computing costs may reach as high as $50 billion, while its revenue is only $37 billion. Broadcom’s custom chip development plan is like a “timely rain”. It aims to address the pain points of key players in the AI field like OpenAI by customizing chip solutions that can reduce costs and increase efficiency, with the hope of reversing its high-cost situation and releasing greater profit-making potential.

Although Nvidia still firmly holds the throne in the training chip market for now, with the exponential expansion of AI application scenarios and the surging demand for inference chips, Broadcom, relying on its forward-looking strategic layout, professional technical team, and customized product line, has already gained an edge at the starting line of the inference chip market. It is expected to take the lead in this potentially huge emerging track and reshape the competitive landscape of the AI chip industry.

Broadcom’s Acquisition of VMware to Strengthen AI Business Layout

When Broadcom announced its $69 billion acquisition of VMware, many Wall Street analysts had doubts about this hefty price. However, just one year later, Broadcom has achieved significant improvements in both growth and profitability with the help of VMware, achieving remarkable results.

Now, VMware has become an integral part of Broadcom’s infrastructure software division and delivered an outstanding performance in the fourth quarter of fiscal year 2024—generating revenue of $58 billion.

What is worth noting is that the highlight lies not only in its high growth rate of 196% year-on-year but also in the outstanding operational efficiency demonstrated in achieving this growth—all within just one year.

Before the acquisition, VMware’s operating condition was not ideal. At that time, its quarterly expenditure was approximately $24 billion, and its operating profit margin was less than 30%. But after being incorporated into Broadcom’s management system, the situation has undergone a fundamental change. Now, VMware’s quarterly expenditure has been slashed by half to $12 billion, while its operating profit margin has more than doubled, rising to 70%, achieving a qualitative improvement in operational efficiency.

A deeper analysis reveals that the key to Broadcom’s success lies in its focused operation on VMware Cloud Foundation (VCF). Instead of trying to meet all market needs in every aspect, Broadcom has precisely focused on the most critical core business—virtualizing the entire software stack of the data center. It is precisely this highly focused strategy that has brought it astonishing returns.

Looking ahead, given that the current trend of artificial intelligence-optimized cloud infrastructure is giving rise to a new demand cycle, I firmly believe that VMware under Broadcom will continue to maintain its current growth momentum and may even achieve a faster growth rate, further helping Broadcom expand its territory in the AI business and consolidate its market position.

Broadcom’s Valuation Analysis: Still Possessing Huge Upside Potential

The fact that Broadcom’s market capitalization recently exceeded one trillion dollars might seem a bit excessive to many people. However, after careful consideration, it can be found that its current valuation is not only reasonable but may even not fully reflect its true potential in the long journey of the artificial intelligence market.

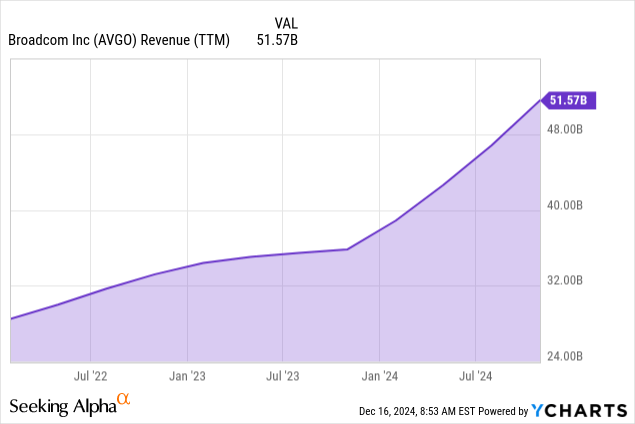

Looking back at fiscal year 2024, Broadcom’s overall revenue performance was quite impressive. Its revenue surged by 44% compared to the previous year, soaring to a high of $516 billion.

Among them, the most important artificial intelligence business has become the core growth engine, with an astonishing year-on-year increase of 220%, achieving excellent results of $122 billion and firmly occupying 41% of the semiconductor business revenue segment. Such a rapid expansion trend has undoubtedly laid a solid foundation for the company’s overall value and demonstrated its strong pioneering strength in the AI track.

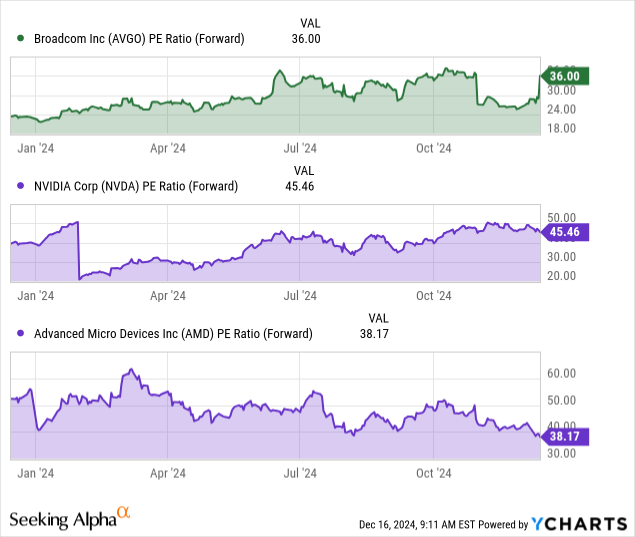

When looking at the expected price-earnings ratio alone, 36 times might give people an initial impression of being on the high side at first glance. However, when compared in the context of the industry as a whole, it can be seen that the situation is reasonable.

Nvidia’s contemporaneous expected price-earnings ratio is as high as 45.4 times, and AMD’s is 38.1 times. In comparison, Broadcom’s price-earnings ratio multiple is clearly more advantageous, highlighting its characteristic of not being fully priced in the capital market. This means that compared to its peers, its valuation does not show signs of being overheated. On the contrary, there is a potential for it to be undervalued, and the market has not yet fully grasped the depth of its value.

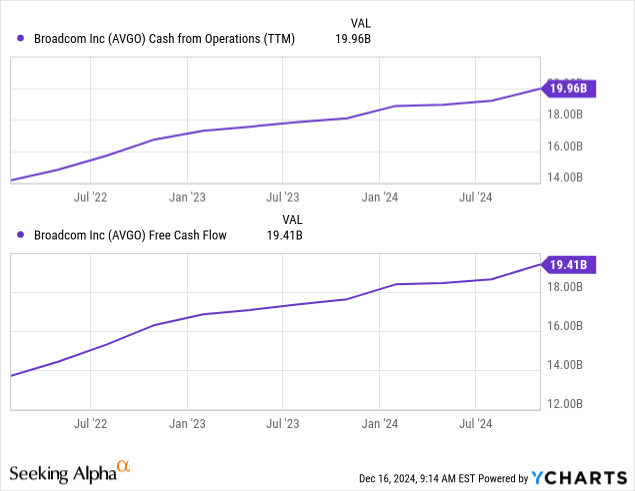

In terms of operational efficiency, Broadcom stands out with an operating profit margin of 63% and an adjusted EBITDA margin of 65%. These two sets of data are among the best in the industry, functioning like a precise profit-making machine that efficiently converts business into substantial profits.

It is worth mentioning that the free cash flow margin of 39% fully demonstrates Broadcom’s extraordinary ability to allocate funds. Even when making large-scale investments in resources for future growth, it can still ensure a steady inflow of abundant cash, highlighting the robustness and resilience of its financial condition.

The solidity of its financial condition should not be underestimated either. In fiscal year 2024, Broadcom generated operating cash flow of $199.6 billion and free cash flow of $194.1 billion. This excellent combination of robust growth, considerable profits, and strong cash generation ability is undoubtedly a “hot cake” in the eyes of the capital market. According to conventional logic, it fully deserves a higher premium multiple, further strengthening the rationality of its current valuation.

Therefore, it can be said that the current market may still be struggling to keep up with the pace of Broadcom’s transformation into a leader in the AI infrastructure field.

Although the one-trillion-dollar market capitalization seems to have reached a high point, given Broadcom’s mature and proficient execution ability, outstanding profitability, and vast growth opportunities in the AI landscape, it undoubtedly still holds huge upward potential. Its current valuation is actually within a reasonable range and may even be just the tip of the iceberg, not yet fully reflecting its entire value potential.

Risks Still Exist

Although I am full of optimistic expectations for Broadcom’s future development in the AI chip market, it cannot be ignored that the road ahead is by no means smooth, and numerous obstacles lie ahead, waiting to be overcome.

The most pressing issue is the execution risk, especially when it comes to aligning with the aggressive development schedule of custom AI accelerators. The challenges are numerous.

Broadcom’s current strategic blueprint involves simultaneously advancing the project plans of multiple hyperscale customers, with production schedules stretching from 2024 to 2026. Such a compact layout undoubtedly poses a severe test for the company’s project management and resource allocation capabilities. It is necessary to ensure that all links are closely connected while also taking into account the differentiated needs of different customers. The slightest mistake could trigger a chain reaction and disrupt the overall rhythm.

Even though an agreement has been reached with TSMC for custom chip production, the problem of capacity expansion remains thorny.

Currently, Broadcom needs to achieve a huge leap in production capacity within just a few years. It has to increase from supporting over 30,000 XPU clusters in 2024 to potentially meeting the demand of one million XPUs per customer in 2027, with the capacity requirement nearly increasing by 33 times. Such an exponential growth scale not only tests the bearing capacity and resilience of production facilities and the supply chain but also brings a series of derivative problems such as technology and process upgrades and yield control. The slightest negligence could cause capacity bottlenecks to become a constraint on business expansion, resulting in delayed deliveries and damage to customer trust.

In terms of the market landscape, Nvidia remains an insurmountable peak. It firmly occupies the leading position in the AI chip market, holding more than 80% of the market share, and its brand is renowned and deeply rooted in people’s hearts. The upcoming Blackwell architecture is expected to further raise the industry performance benchmark and reshape the competitive barriers. More importantly, Nvidia has painstakingly built a vast software ecosystem over the years, which is like a tightly intertwined web that firmly locks in a large number of customers.

For potential customers, switching from Nvidia to Broadcom means having to face high conversion costs, including software adaptation, rebuilding the development toolchain, and retraining the technical team. All of these are formidable challenges. Although Broadcom has taken a differentiated approach through its customization strategy in an attempt to break through, only when its performance and efficiency advantages are significant enough to form an overwhelming attraction can it persuade customers to take risks and invest in its customized solutions.

As of the fourth quarter, our cash was $93 billion, and the total principal debt was $698 billion.

In this quarter, we replaced $50 billion of floating-rate debt with new senior notes. We used the cash on hand to pay off the senior notes due in the fourth quarter and additional floating-rate debt, thereby reducing the debt by $25 billion. —— Excerpt from AVGO’s fourth-quarter fiscal year 2024 earnings conference call record

Although the company’s strong cash flow generation ability (with operating cash flow of $199.62 billion in fiscal year 2024) brings some comfort, a decline in artificial intelligence expenditures may put pressure on the company’s financial flexibility.

To sum up, it is still recommended to “strongly buy” Broadcom here. This confidence mainly stems from the following aspects:

Firstly, Broadcom has a clear and definite goal, which is to occupy a considerable share in the AI chip market worth between $60 billion and $90 billion by 2027. This goal has pointed the way for its subsequent development, enabling it to strategically layout various businesses and actively expand the market around it.

Secondly, Broadcom has demonstrated strong execution capabilities in custom AI solutions and network infrastructure. It can leverage its professional expertise to customize AI solutions that fit the different needs of customers. Meanwhile, in the network infrastructure field, it relies on its excellent technology and efficient operations to occupy an advantageous position. These two aspects together have built its solid competitiveness.

Moreover, it has established strategic partnerships with important players such as OpenAI. Through such cooperation, it can integrate multiple resources, complement each other’s advantages, and further expand its influence and business coverage within the industry.

Finally, Broadcom has strong financial performance and can generate abundant cash flow, which provides sufficient financial support for its continuous investment in research and development, market expansion, etc., making it more confident in market competition.

I think for those investors who want to enter the artificial intelligence chip market, Broadcom undoubtedly offers an extremely attractive opportunity. It focuses on customized solutions and building strategic partnerships. This unique development model enables it to show distinctive value in both the consumer artificial intelligence market and the enterprise artificial intelligence market, better meeting the needs of different market entities.

Furthermore, as the artificial intelligence infrastructure market continues to move forward, Broadcom, relying on its precise strategic positioning and excellent execution ability, is expected to significantly boost shareholder value and bring substantial returns to investors within the next 3 to 5 years.