- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

AI, Cloud Services, and Quantum Computing are the three driving forces. Google's 15% growth potentia

Google’s parent company is considered one of the undervalued giants in current technology stocks. Despite its dominant position in search engines and advertising, its rapid growth in emerging fields such as Cloud Services, AI, and Quantum Computing has not been fully reflected in its stock price. As the market’s recognition of these technologies increases, its investment value is gradually emerging.

Although some investors are concerned that AI tools may replace Google search or have concerns about the Anti-Trust pressure it faces, we believe that these concerns have been overpriced and have limited actual impact. Next, we will analyze Google’s growth potential, explore the reasons for its undervaluation, and provide investment advice based on the current market environment.

Core business analysis: Continued leadership in search engines and advertising

1. Search engine business: Solid market dominance

Google, as the world’s largest search engine, still holds an unshakable position in its core business - search and advertising. According to the latest data from Statista, Google’s market share in search exceeds 90%, far ahead of its competitors. Although the rise of AI technology in recent years has sparked speculation about the future of search engines, current market data and trends indicate that Google is still an irreplaceable leader in this field.

The reason why Google’s search engine has been able to dominate for a long time is due to multiple factors. Firstly, Google’s continuous innovation in search technology and the provision of personalized search results through powerful Data Analysis capabilities have kept users highly dependent. Secondly, Google continuously optimizes its ad platform to help companies accurately place ads, which is also its main source of revenue. In 2024, Google’s advertising business still accounts for more than 57% of Alphabet’s total revenue, demonstrating its overwhelming position in the global advertising market.

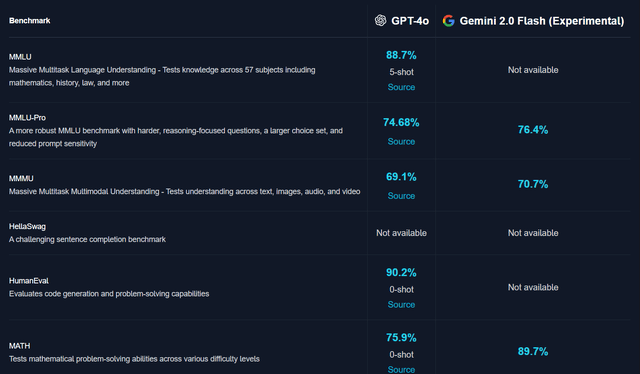

2. The merger of artificial intelligence and search engines: the rise of Gemini AI

With the development of AI technology, especially generative AI, many people are beginning to worry that this type of technology will weaken the market share of traditional search engines. However, Google’s response strategy has not been underestimated by the market. Instead, its continued investment in AI is becoming an important driving force for its future growth.

Google’s Gemini AI is an important weapon against generative AI challenges. The launch of Gemini 2.0 indicates that Google is actively integrating its AI technology into search engines to further enhance User Experience. Compared with OpenAI’s GPT-4o, Gemini 2.0 performs well in multiple key performance indicators, especially in speed and accuracy. CEO Sundar Pichai mentioned in a public speech that Gemini 2.0 can not only significantly improve the efficiency of search engines, but also provide advertisers with more accurate user data, thereby enhancing their advertising revenue.

The combination of AI and search engines undoubtedly opens up new growth space for Google. With Gemini AI continuously improving and deeply integrating with Google search, we can foresee that Google will be able to maintain its leading position in the competition between generative AI and search engines in the future.

3. Strong support for advertising business: the synergy effect of YouTube and Google Ads

Google’s advertising business is not limited to the search engine itself. YouTube and Google Ads also provide strong support for it. As the world’s largest online video platform, YouTube attracts billions of users every month, providing advertisers with rich marketing resources. At the same time, Google Ads helps various enterprises improve marketing effectiveness through precise advertising delivery technology, further consolidating Google’s dominant position in the digital advertising field.

In the Q3 2024 financial report, Google’s advertising revenue once again showed strong growth momentum. Despite the overall slowdown in market growth, Google’s ad platform still performed well. This trend indicates that despite the increasingly fierce external competition, Google can still maintain the growth of its advertising business by relying on its huge user base and strong technical capabilities.

Quantum Computing: Beyond the Potential of Traditional Computing

Google has continuously made breakthroughs in the field of Quantum Computing. In December 2024, Google launched its latest Quantum Computing chip, Willow, which can use quantum bits for data storage and calculation, and handle complex tasks that traditional computers cannot complete. Google stated that the Willow chip can complete tasks that supercomputers cannot complete in 5 minutes, marking a major breakthrough in Quantum Computing technology.

Although Quantum Computing is still in the experimental stage, its potential to improve computing efficiency, promote new drug development, materials science, and AI innovation is enormous. Google’s progress in Quantum Computing has laid the foundation for future technological innovation and may become an important competitive advantage in the next few decades.

According to predictions, the Quantum Computing market is expected to experience explosive growth, with a global market size expected to reach $131 billion to $170 billion by 2035. Google, with its technological accumulation in the field of Quantum Computing, is expected to occupy a leading position in this market. If Google can establish advantages like in the AI chip market, its Quantum Computing business will become an important engine for the company’s future growth.

Quantum Computing is not only a technological breakthrough, but also has huge monetization potential. Google’s continuous investment and research and development will give it a unique competitive advantage in the field of Quantum Computing, bringing considerable profit opportunities.

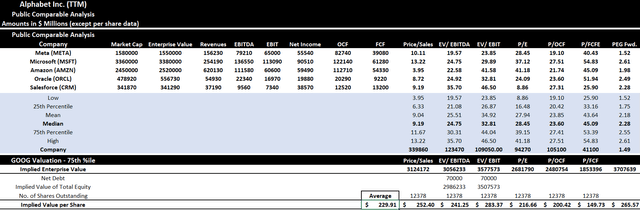

Investment advice and valuation

Based on a comprehensive analysis of the fundamentals and Technical Fundamentals of Google’s parent company, we believe that Google’s current stock price still has significant upward potential. By using the median Price-To-Earnings Ratio method for valuation and comparing it with comparable companies in the same industry such as Meta, Microsoft, Amazon, Oracle, and Salesforce, we can conclude that Google’s stock price target is $230, which indicates that Google’s stock price may have about 15% upward potential. Based on this, we maintain our buy rating on Google’s stock.

For investors who want to seize this long-term growth potential, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limits, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

The reasonableness of this valuation stems from Google’s continued performance and innovation in multiple business areas. Firstly, Google Cloud continues to grow, driving it to occupy an increasingly important position in the Cloud Service market. Secondly, the release of Quantum Computing technology, such as the Willow quantum chip, further enhances Google’s competitiveness in cutting-edge technology fields. In addition, Google’s innovative progress in AI and Data Analysis, especially the Gemini model that competes with GPT-4, also brings huge growth potential for the company in the future. Although there is still some pessimism about whether artificial intelligence will replace traditional search engines, we believe that these concerns are unfounded.

Through the median Price-To-Earnings Ratio method and comparative analysis with peers, Google shows underestimation relative to peers in multiple indicators such as Price-To-Earnings Ratio, enterprise value, and EBITDA multiples. The only exception is free cash flow, which is mainly due to Google’s heavy investment in infrastructure such as artificial intelligence chips and data centers, resulting in relatively large capital expenditures. However, in the long run, these investments will bring sustained returns to the company.

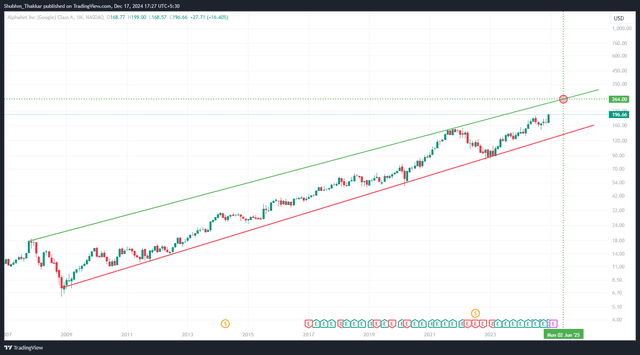

Technical Fundamental analysis also supports this view. From the monthly trend chart, the stock price is currently in an important upward trend (green trend line), and compared with the historical low point (red trend line), there is still a lot of room for the current stock price to rise. Driven by the current strong bull market, combined with solid fundamentals and the company’s continuous innovation, it is expected that by June 2025, Google’s stock price is expected to reach $264, which is a further increase of about 15% from the current price.

Investment strategy

For investors, holding Google stock for the long term is a stable choice. As a global leading technology company, Google has a strong market position and forward-looking technology layout, especially its leadership position in Cloud Services and Quantum Computing, providing it with sustainable growth momentum. With further development in these strategic areas, it is expected that Google will continue to maintain profitable growth in the coming years. Therefore, for long-term investors seeking stable growth, Google stock will be an ideal investment target.

In addition, it is recommended that investors adopt a strategy of buying on dips. Even though Google has broad prospects, its stock price may still be affected by market fluctuations in the short term, leading to a price correction. Therefore, when the stock price fluctuates or the market falls, investors should seize the buying opportunity to lower investment costs and lay a foundation for future gains.

Investors should also be flexible in responding to market changes and adjust investment strategies in a timely manner. For example, if the performance of a certain business sector of Google, such as Cloud Service or Quantum Computing, falls short of expectations, or if there are significant negative changes in the global economy, investors should adjust their holdings in a timely manner based on market signals to reduce risk exposure. When the market’s risk perception of technology stocks changes, especially when Google’s stock price is too high, investors can consider partial profit-taking.

What risks should investors pay attention to?

Despite Google’s strong growth potential in multiple fields, it also faces some significant risks. Firstly, market competition risks cannot be ignored. Although Google Cloud has made significant progress in the Cloud Service market, fierce competition with giants such as Amazon AWS and Microsoft Azure still exists. If competitors launch more innovative or attractive products, Google’s market share may be challenged, thereby affecting its revenue and profitability.

Secondly, policy and regulatory risks are also important factors that investors need to pay attention to. The regulation of technology companies in various countries around the world is becoming increasingly strict, especially in terms of data privacy and Anti-Trust. If Google cannot successfully respond to these policy challenges, it may face high compliance costs, and may even be restricted from business development in certain markets, which will affect its overall operations.

Furthermore, the risk of technological progress not meeting expectations is also worth noting. Although Google has made significant progress in the fields of artificial intelligence and Quantum Computing, these technologies are still in their early stages of development. If Google fails to promote the monetization application of these technologies as expected, it may affect the company’s future growth potential and lead to market doubts about its innovation ability.

Finally, macroeconomic risks are also a challenge that Google must face. Against the backdrop of slowing global economic growth and high inflation, advertising spending and corporate investment may decline, which will directly affect Google’s core source of revenue. Economic uncertainty may lead companies to cut advertising budgets, thereby affecting Google’s profitability and growth expectations.

Overall, as a global leading technology company, Google not only has strong growth potential but also constantly expands new business boundaries with its innovation in fields such as Cloud Service, artificial intelligence, and Quantum Computing. However, risk factors such as fierce market competition, policy regulatory pressure, technological uncertainty, and macroeconomic fluctuations may still affect its future performance. Nevertheless, with its stable market position and innovation-driven advantages, Google is still a worthy investment target, especially in the context of Cloud Service and AI technology becoming the core competitiveness of enterprises.