- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Meta has ushered in a strong rebound. How can investors control this dark horse and seize short-term

Meta Platforms has always been a leader in the global social media industry. With its extensive user base, it has become an important source of advertising revenue. With the continuous development of the digital advertising market, Meta not only firmly holds the throne of social media, but also constantly expands its business boundaries, explores cutting-edge technologies such as generative AI and virtual reality, and strives to maintain a leading position in technological innovation.

Despite a sharp drop in stock price between 2022 and 2023, Meta has risen in recent days as the company continues to adjust its business and innovate, once again attracting investors’ attention.

Nowadays, with the market’s attention to the performance of the “tech giant” stock price heating up again, whether Meta can continue to lead in this stock market “bull market” has become a hot topic among investors.

Meta’s market dominance and innovation drive

As the world’s largest social media company, Meta has successfully occupied an important share of the digital advertising market by relying on platforms such as Facebook, Instagram, WhatsApp, and Messenger. According to the latest data, the total monthly active users of these platforms under Meta are close to 4 billion, accounting for nearly half of the global internet users. This huge user base provides Meta with an unparalleled source of advertising revenue, making it one of the preferred platforms for global advertisers to place ads.

However, Meta is not limited to its existing achievements. In order to maintain its leading position in the fierce market competition, Meta continues to increase its innovation efforts. For example, the launch of features such as Instagram Reels, Facebook Stories, and WhatsApp Status not only improves user interaction and stickiness, but also successfully attracts the favor of a large number of advertisers. Especially the short video and instant sharing functions have successfully met the needs of current users and become new growth points for advertising revenue.

In addition, Meta’s exploration in the fields of virtual reality and augmented reality, especially its investment in the Metaverse project, has brought new development potential to the company. Although the project is still in its early stages and the results have not yet been demonstrated, its long-term strategic significance should not be underestimated. Meta’s founder Mark Zuckerberg has clearly stated that the Metaverse will become the foundation of the next generation of the Internet, and Meta will also strive to become a leader in this field.

These innovations not only enhance Meta’s market position, but also provide a guarantee for its future profit growth. However, it is worth noting that although innovation drives the company’s revenue growth, these new businesses still face considerable uncertainty, especially the high-risk long-term investment of the Metaverse. Investors need to balance between high growth potential and uncertainty.

For potential investors, they can go to the multi-asset wallet BiyaPay to monitor the trend of Meta market and make a threat and risk assessment. BiyaPay provides efficient and secure deposit and withdrawal services, supports US and Hong Kong stocks and digital currency transactions. Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to their personal bank accounts for convenient investment. With the advantages of fast arrival speed and unlimited transfer amount, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Technical Fundamental Analysis: Stock Price Volatility and Market Sentiment

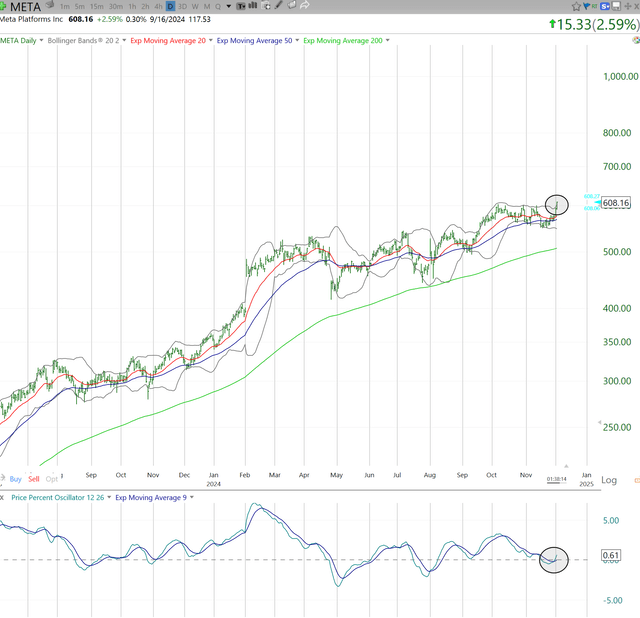

Meta’s stock price has shown significant volatility in recent years, especially the sharp decline from 2022 to 2023. It fell from a high of $400 to around $100, reflecting the market’s uncertain expectations for its future. However, with the advancement of the company’s innovative business and the recovery of market sentiment, Meta’s stock price gradually recovered and rebounded in 2024.

From a technical analysis perspective, Meta is currently at an important technical breakthrough point. If the stock price breaks through the existing resistance level, it may enter a new upward phase, and may even impact the price of $1000. However, this potential also comes with overall market risks, especially the uncertainty of the global economy and the hidden concerns of the technology stock bubble. If there is any major fluctuation in the market, Meta’s stock price may once again face significant Downside Risk.

Therefore, when investing in Meta, investors must be cautious about the risks of Technical Fundamentals, especially the impact of changes in the macroeconomic environment on its stock price.

Profitability and financial soundness

Meta’s profitability is one of the important factors that attract investors. As a company that relies on advertising revenue, Meta’s business model is undoubtedly efficient. Its strong user base provides the company with stable cash flow and high profit margins. In the past few quarters, Meta’s advertising revenue has continued to grow, especially in short video advertising businesses on Instagram and WhatsApp, further consolidating its leading position in the global advertising market.

According to the latest financial report, Meta’s gross profit margin and net profit margin remain at industry-leading levels. Its cash reserves are also very sufficient to support the company’s strategic investments and business expansion in the coming years. Meta’s total cash and cash equivalents exceed $40 billion, which gives the company strong financial resilience to respond to market fluctuations, increase research and development investment, and respond to potential acquisition opportunities.

In addition, Meta has further enhanced investor confidence through its shareowner return plan. The company not only repurchases stocks to support the stock price, but also maintains high capital expenditures to some extent, especially in the fields of metaverse and virtual reality. These measures indicate that although the current shareowner return has not been fully realized, the company is laying the foundation for future growth.

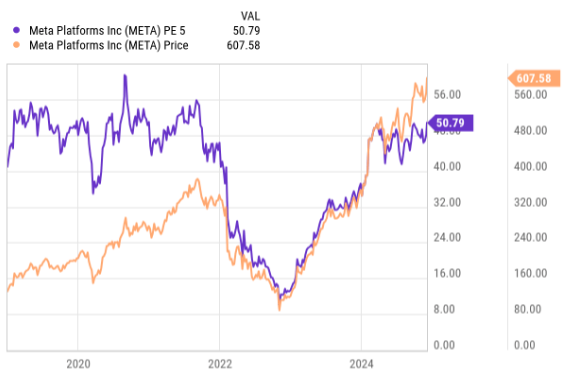

However, it is worth noting that despite Meta’s strong profitability, its valuation level is still high, with a Price-To-Earnings Ratio of up to 50 times, far exceeding the valuation level of traditional value stocks.

This means that when investors buy Meta stocks, they are actually paying for future growth. Therefore, investors need to closely monitor whether Meta’s future profit growth can support the current high valuation level. If the company’s innovative projects fail to bring expected returns or the global economic environment undergoes drastic changes, Meta’s valuation may face adjustment pressure.

How to grasp the potential increase of Meta?

For investors who are willing to take certain risks, Meta’s stock still has huge potential for growth. Its huge user base, stable profit model, and constantly advancing innovative strategies may lead to a new wave of growth for Meta in the next few years.

With its breakthroughs in multiple business areas, especially the continuous growth of advertising revenue on social platforms and investments in virtual reality and generative AI, Meta undoubtedly has huge growth potential. If Meta can maintain this trend, it may usher in a new wave of growth in the next few years.

Currently, from a Technical Fundamental perspective, Meta’s stock price is in a strong upward phase. Of course, changes in the stock market are extremely complex, and any changes in macroeconomic factors or market sentiment can lead to drastic fluctuations in stock prices. Therefore, investors must maintain a clear understanding of market risks and do sufficient risk management when deciding whether to intervene.

Meta provides certain short-term trading opportunities for investors who prefer short-term operations. Through technical analysis, investors can capture the opportunity for stock prices to rise after breaking through key technical levels. When the market sentiment is good and technical indicators show positive signals, investors can choose to buy at the right time, and sell when the stock price reaches the expected increase to obtain short-term profits. However, the risk of short-term operations is that stock price fluctuations are often greatly affected by external factors, and short-term fluctuations are difficult to predict. Therefore, investors need to have strong market sensitivity and operational skills.

For investors who prefer long-term investment, Meta is still a choice worth paying attention to. Despite its current high valuation, Meta’s strong market position and continuous innovation ability make it have strong long-term investment value in the long run. Especially after breakthroughs in emerging fields such as virtual reality, metaverse, and generative AI, Meta’s growth potential will be further released. Long-term investors can consider holding Meta stocks and wait for them to gradually show more growth momentum in the next few years. However, it should be noted that although the long-term prospects are bright, investors still need to bear greater market volatility risks. Therefore, rational positioning control and periodic examination of market changes are crucial when making long-term investments.

Risk management is always key in all investment strategies. Whether it is short-term trading or long-term holding, a reasonable risk management strategy can help investors cope with potential market fluctuations. Investors should allocate funds reasonably according to their risk tolerance and avoid concentrating too much funds on a single high-risk stock. In addition, using derivative instruments such as options for hedging can effectively reduce latent risks caused by market fluctuations. By diversifying investments and adopting flexible trading strategies, investors can maximize the potential for capital appreciation under controllable risks.

Overall, Meta is still an investment target full of opportunities. Its strong user base, leading technological innovation, and stable profit model have laid a solid foundation for future growth. Despite facing the challenge of high valuation, as long as risk management is proper, there is still huge potential for investment in Meta.