- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

The Rise of Temu, Pinduoduo's Accelerated Expansion in Global E-commerce: The 15% Stock Price Pullba

Pinduoduo’s (PDD) stock price pulled back by approximately 15% after the release of its latest third-quarter earnings report, which is undoubtedly a signal for many investors. Although the company did not provide specific performance expectations, comments from the management indicated that the market competition is becoming increasingly fierce. Increasing investment in retaining merchants and users may lead to a slowdown in future revenue growth and put pressure on profit margins.

However, data from Bloomberg shows that Pinduoduo has received 56 “buy” ratings, 3 “hold” ratings, and 1 “sell” rating. Given its unique position in expanding its share in both the domestic and international e-commerce markets, the stock is unanimously considered a “buy”. Although the overall industry’s revenue growth is restricted in the context of a weak macroeconomy, Pinduoduo still demonstrates a strong growth momentum, especially in the expansion of global e-commerce. Temu, as Pinduoduo’s global e-commerce platform, is becoming the core driving force for its future growth, meeting the growing demand for global discount e-commerce.

Despite the intensified competition and macroeconomic pressure, Pinduoduo still has significant competitive advantages, especially in cost control and pricing power. Compared with its peers, its pricing power and growth potential in the market enable it to maintain and even potentially expand its market share in the future. For growth-oriented investors, this stock price pullback undoubtedly provides a rare opportunity to enter the market.

Stock Price Pullback

Although the short-term decline in the stock price was not entirely unexpected, it was still a “wake-up call” for many people. According to the third-quarter earnings report, although Pinduoduo’s revenue growth remained strong, with a year-on-year increase of 44%, it was slightly lower than market expectations. The gross profit margin slipped from 65.3% in the second quarter to 60%, and earnings before interest and taxes (EBIT) also dropped from 33.6% to 24.5%. This change was mainly due to the increase in advertising costs, and the ratio of selling, general, and administrative expenses (SG&A) rose from 28.7% to 32.5%.

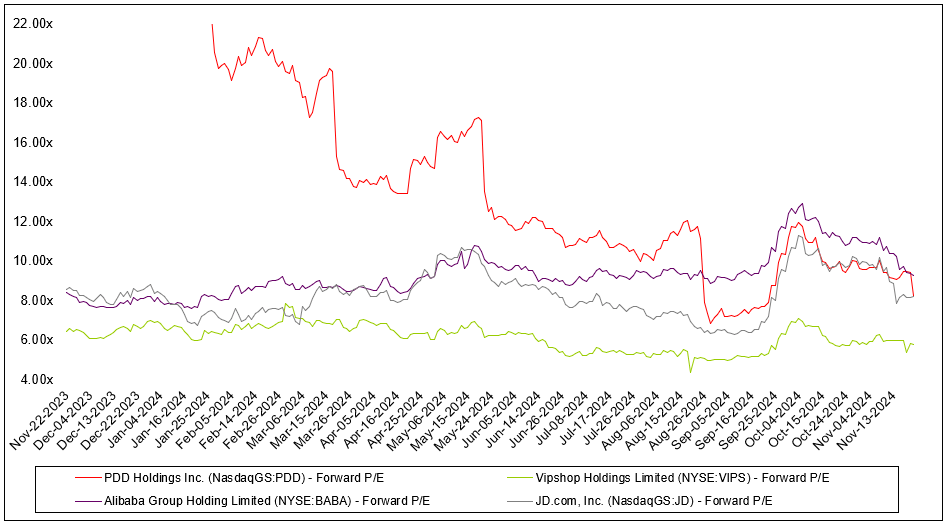

Currently, Pinduoduo is valued at 8.1 times its expected earnings in 2025, a valuation similar to that of JD.com (JD) and lower than that of Alibaba (BABA). This valuation is actually somewhat unfair because Pinduoduo is not only continuously acquiring shares of Alibaba but also has a better position in the global market than JD.com and Alibaba.

Nevertheless, Pinduoduo still has strong cash flow. The cash on its balance sheet is currently close to $44 billion, and it earned $772 million in interest income in the third quarter. Calculated on an annualized basis, this means that Pinduoduo can earn approximately $3.1 billion in interest income just from its cash reserves, with a yield of 2.1%. From this perspective, Pinduoduo’s financial situation is undoubtedly very healthy, providing a powerful backing for its future expansion.

Many investors may question how Pinduoduo can maintain such a healthy financial situation when its gross profit margin and profit margin have declined. In fact, Pinduoduo’s strategic focus is on long-term growth, especially increasing investment in manufacturers and the platform ecosystem. The management understands that although there is significant profit pressure at present, this will lay the foundation for its future market expansion and sustainable growth. It is worth mentioning that the shareholding ratio of Pinduoduo’s senior management is as high as 32%. They, like retail shareholders, jointly bear the risks brought by market fluctuations, which also reflects the management’s firm confidence in the company’s long-term development.

This approach is similar to Amazon’s strategy: although Amazon’s gross profit margin is much lower than that of Pinduoduo, through heavy investment in its high-profit AWS business, Amazon has reaped huge returns in the long run. Although Pinduoduo has endured some compression in profit margins in the short term, this “long-term” investment strategy will undoubtedly have a profound impact on the company’s future competitiveness and market share.

Judging from these data and background, Pinduoduo’s short-term pullback may just be a temporary fluctuation, and instead, it provides a more attractive entry point for investors who are optimistic about the company’s long-term development. For those who want to enter the market early, it is recommended to use the multi-asset wallet BiyaPay to buy this stock as soon as possible. There is still an opportunity to enter at a low price at present. BiyaPay also supports trading in US and Hong Kong stocks as well as digital currencies, facilitating users to regularly check price trends and quickly complete deposit and withdrawal operations at critical moments.

If you encounter problems with fund deposits and withdrawals, BiyaPay provides efficient, safe, and card-freezing solutions. Whether it is recharging digital currencies and converting them into US dollars or Hong Kong dollars, or withdrawing funds to a bank account, it can quickly and flexibly meet the fund needs and ensure that investors do not miss any market opportunities.

Analyzing PDD Through the SA Analyst’s Five-Factor Model

When we use the SA analyst’s five-factor model to examine Pinduoduo (PDD), we are actually looking for potential stocks that can not only stand out in the market but are also undervalued in terms of valuation. For Pinduoduo, several key points make it a company that cannot be ignored.

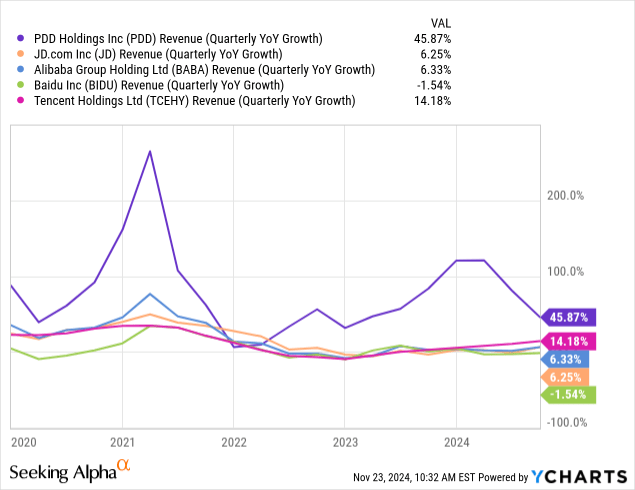

Revenue Growth and Market Share Pinduoduo’s revenue growth in recent years has been remarkable. It has not only caught up in the domestic market but, more importantly, has also grabbed a share from giants like Amazon, with an annual revenue growth of over 20%. This is no small feat in the e-commerce industry.

Moreover, Pinduoduo’s success is not accidental. Through its innovative social e-commerce model, it has successfully attracted a large number of price-sensitive consumers, especially among young people and users in small towns, greatly expanding its market share.

Founder Management and Leadership Pinduoduo’s success is inseparable from its founding team. Huang Zheng, a former Google engineer, founded Pinduoduo in 2015 and has been at the helm ever since. He not only holds a large number of shares himself but also enables core team members to be deeply involved. The collective shareholding of the management is 32%, which undoubtedly ensures the consistency of interests and also ensures that they have a long-term perspective and a sense of responsibility for the company’s development.

Gross Profit Margin Exceeding 60% Pinduoduo’s gross profit margin has always remained above 60%, which is strong evidence of its profitability. In the past 12 months, Pinduoduo’s gross profit margin has reached 62%. Although investors predict that there may be a slight decline in profit margins in the future due to the need to increase payments to manufacturers, it is worth noting that Pinduoduo’s revenue growth rate is much faster than the decline in profit margins, and the company’s overall gross profit is still growing steadily. This means that despite facing certain cost pressures, Pinduoduo can still maintain healthy profitability, and the gross profit margin still has great potential for improvement in the next few years.

Reasonable Expectation of 15% Revenue Growth in the Next Three Years Judging from historical performance, Pinduoduo’s average annual revenue growth rate has always remained at a relatively high level. Pinduoduo’s revenue growth rate in the past three years was 58% per year, and its expected future growth rate is 28%. Considering Pinduoduo’s market penetration depth and the progress of its internationalization process, it is entirely reasonable to maintain the expectation of stable growth. Obviously, Pinduoduo’s growth story remains intact and is far above the 15% threshold, so it deserves a passing grade.

Valuation - 4% Owner Yield: (Expected R&D + EBIT) / EV Pinduoduo’s owner yield is currently 19.5%. The owner yield means that if Pinduoduo cuts all its R&D expenditures and pays out its R&D budget and EBIT as huge dividends at a 100% payout ratio, the expected yield before tax and before one-time adjustments will be close to 20%.

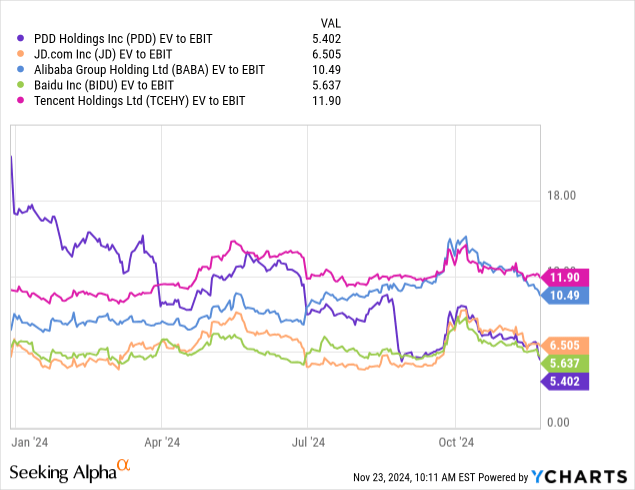

From the perspective of the EV/EBITDA level, Pinduoduo is also disconnected from other large domestic peers. Pinduoduo’s EV/EBIT ratio has fallen from the more appropriate 12 - 18 times TTM. Regardless of growth, in absolute terms, Pinduoduo has become the cheapest in terms of stock price among similar companies.

At the same time, its revenue growth still maintains a leading position.

Pinduoduo may be the only company in the large e-commerce field that has basically maintained stable revenue growth in the past three years when the economy has slowed down significantly. This reflects the strength of its shared discount business model and also reflects users’ desire to seek discounts when the transportation time is slow.

These indicators suggest that Pinduoduo’s pricing is much lower than the domestic discount prices, and a crisis must occur in Pinduoduo to justify this valuation.

Risk Factors

I will focus on introducing some key risk points that investors should keep in mind:

Firstly, some institutional investors have detected a crisis that has not yet become news. Although there is currently no direct evidence that this risk exists universally in any company, it may help explain Pinduoduo’s current valuation.

In the e-commerce industry, the competitive pressure faced by Pinduoduo cannot be ignored. Both JD.com and Alibaba have abundant cash reserves, similar to Pinduoduo, which means that there may be a long-term price war in the future. Although Pinduoduo attracts a large number of users through low prices, this competitive situation may last for several years and put great pressure on its profits.

In addition, JD.com’s delivery infrastructure far surpasses that of Pinduoduo. Dada’s (DADA) 30-minute express delivery service is ahead of Pinduoduo’s delivery standards. This gap is not limited to the domestic market. International platforms such as Amazon, Temu, and eBay also continuously challenge Pinduoduo’s market share through price and speed. Although Pinduoduo is famous for its low prices, the gap in delivery and service may affect its expansion in more mature markets.

Finally, the recent fluctuations in Pinduoduo’s profit margin may continue to decline and may even happen earlier than many investors expect. This means that although revenue growth is strong, the pressure on the gross profit margin and selling, general, and administrative expenses may erode part of the growth, resulting in earnings before interest and taxes being lower than investors’ expectations. A similar situation has occurred in DLocal (DLO), so special attention is needed.

Current Valuation

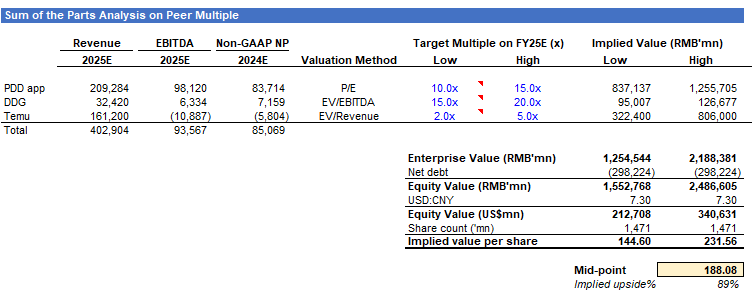

Based on the current valuation, Pinduoduo’s investors are actually getting the potentially huge asset of Temu for free at the existing price.

Firstly, the price-to-earnings ratio of Pinduoduo’s domestic e-commerce business ranges from a minimum of 10 times to a maximum of 15 times. Assuming that the revenue of this business will continue to maintain double-digit growth, this prediction is expected to be slightly conservative. If the net profit margin is 40%, based on these assumptions, the per-share value of Pinduoduo’s domestic business is between $78 and $117, with a median value of $97, while the current stock price is approximately $99, which means that the value of Pinduoduo’s domestic e-commerce business is almost in line with the existing stock price.

Next, Pinduoduo’s DDG grocery delivery business is valued using the EV/EBITDA method. Considering the peer multiples in the global food delivery and grocery delivery industries, the implied value is approximately $10 per share.

Finally, regarding Temu, we assume that its revenue growth rate in 2025 will be 60%. To value Temu, a platform with huge global expansion potential, we refer to the EV/Revenue multiples of similar businesses. Domestic peers have an EV/Revenue of 1 time, while international platforms such as Amazon and eBay have an EV/Revenue of 2 to 3 times. Given that Temu’s revenue growth rate is significantly faster than these companies, we believe its revenue multiple should be higher. Therefore, Temu’s valuation is 2 to 5 times EV/Revenue.

Based on these assumptions, we derive that Pinduoduo’s overall valuation range is from $144 to $231 per share, with a median value of $188, which means that from the current stock price perspective, Pinduoduo’s stock price has approximately 89% room for growth.

In conclusion, Pinduoduo demonstrates strong competitive advantages and huge growth potential, especially in terms of globalization layout and innovative business models. Although it currently faces certain market competition pressure and short-term profit margin fluctuations, the company still has considerable long-term development prospects by virtue of its undervalued market valuation, steadily growing revenue, and a powerful management team.

From a valuation perspective, Pinduoduo’s current stock price is undoubtedly undervalued by the market. Through a reasonable valuation of its core businesses, we believe that the value of Pinduoduo’s stock is expected to rise significantly, especially in the context of the continuous expansion of the global e-commerce market. Even in the short term, facing risks such as price wars and macroeconomic fluctuations, Pinduoduo’s position in the global market and its continuous innovation ability provide strong support for its long-term growth.

For long-term investors, Pinduoduo’s stock price pullback provides an ideal buying opportunity, especially considering its expansion potential in the international market, the decision-making ability of the management, and the uniqueness of its business model. If you focus on the long-term value in the next few years rather than short-term fluctuations, then Pinduoduo is undoubtedly an investment target worthy of attention.