- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Broadcom Surpasses Tesla in Market Cap: Could It Join the Elite Club of Tech Giants? How Long Until

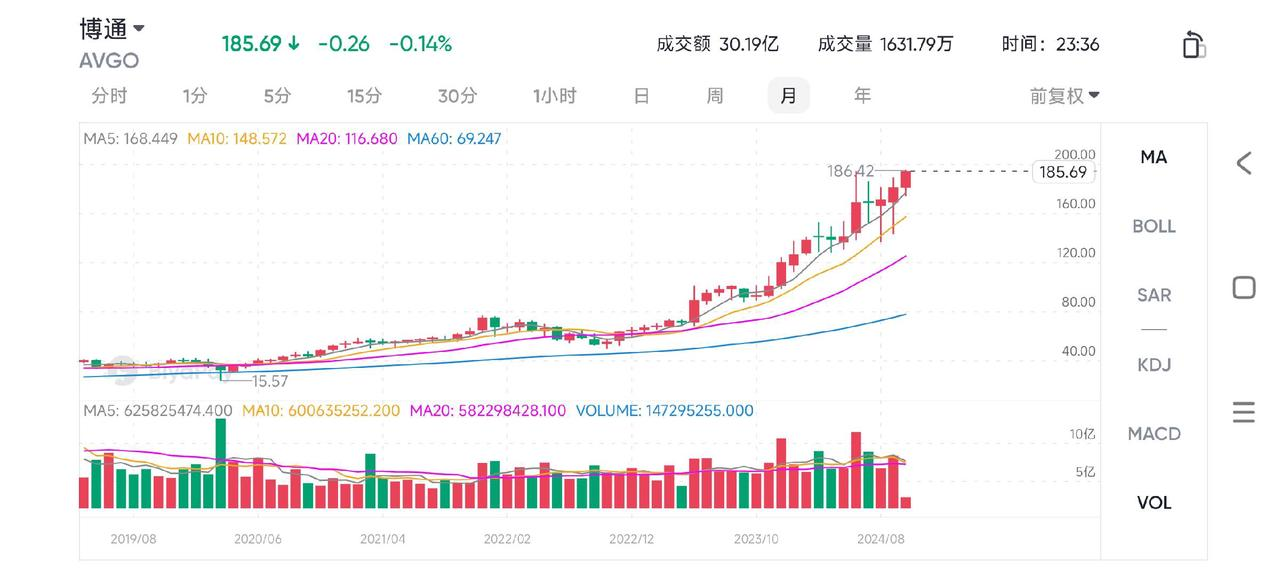

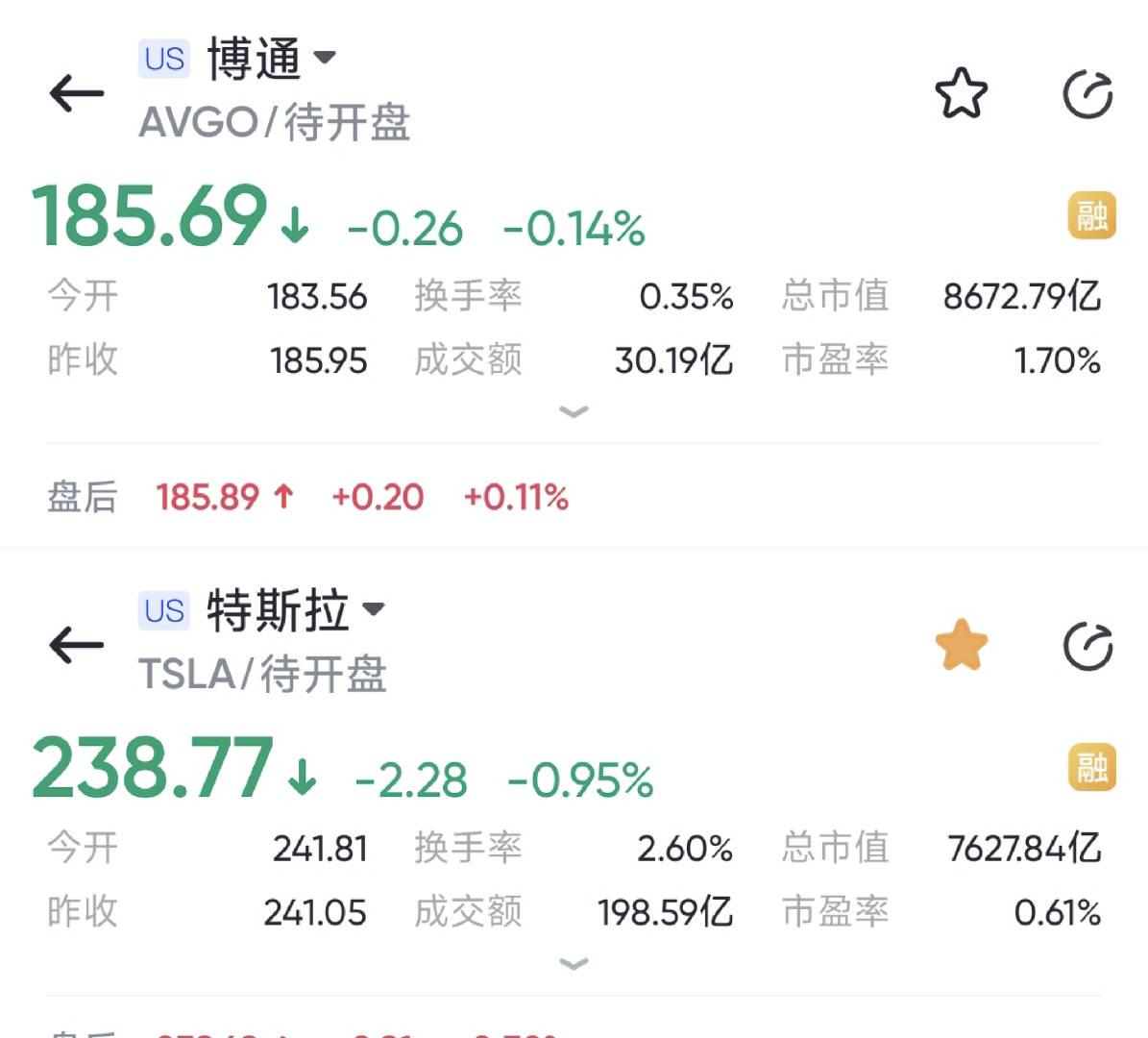

Broadcom is rapidly catching up to the ranks of the top technology companies by market capitalization. Fueled by its expansion in AI infrastructure and successful acquisition of key enterprises like VMware, Broadcom’s market cap has risen over 61% this year, currently standing at around $860 billion—just under 30% away from the $1 trillion mark.

All 27 Wall Street analysts recommend a “buy” rating, projecting the company’s share price will grow by approximately 19% over the next year. While this increase might not be enough to reach the $1 trillion mark immediately, if Broadcom maintains its current growth momentum, it is expected to hit this milestone by 2026. The explosive growth in AI demand, coupled with significant contributions from acquisitions, is swiftly pushing the company towards this historic goal.

Prospects of Reaching $1 Trillion: Driven by AI and Acquisitions

Broadcom is now less than 30% away from a market cap of $1 trillion. Among today’s tech giants, it is becoming an increasingly formidable force, driven by surging demand for AI infrastructure and a well-executed acquisition strategy. The VMware acquisition coincided with the AI boom sweeping the market, making Broadcom one of the key beneficiaries of this trend. Its extensive product line supports AI infrastructure, generating a significant supercycle in operating performance.

The integration of VMware has notably boosted the company’s overall financial results, and growth in AI business has contributed to robust organic growth. If you’re wondering why the share price has surged by over 100% in the past 12 months, these two factors are evidently the key.

According to Broadcom’s third-quarter report for 2024, the company posted revenue of $13.1 billion for the quarter, a year-over-year increase of 47% and a sequential increase of about 5%. The non-GAAP earnings per share (EPS) were $1.24, up 19% year-over-year and 12.7% sequentially, both setting record highs for the company. The gross margin for semiconductor business was 68%, while infrastructure software had a gross margin of 90%, with an overall gross margin of 77.4%.

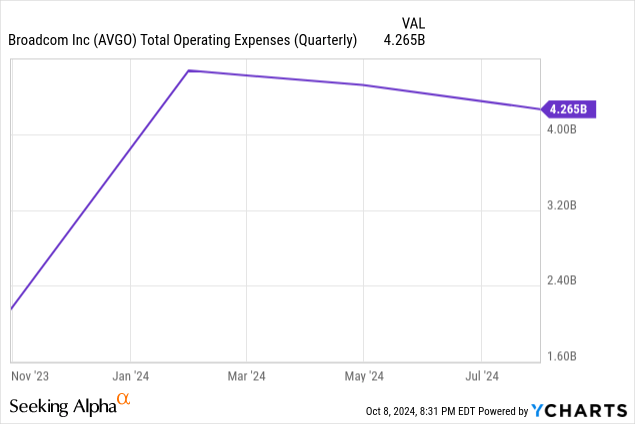

Broadcom’s management attributed these strong results to the growing demand for AI, the VMware integration, and the stabilization of some challenged semiconductor products. Despite the need for increased investment in AI and the costs of integrating VMware, Broadcom maintained high profitability.

In the third quarter of 2023 (before acquiring VMware), the company’s net profit margin was 51.7%, which fell to 46.8% in the third quarter of 2024. Although this seems like a decline, considering the substantial $69 billion merger costs and AI expansion expenses, maintaining this level of profitability reflects Broadcom’s operational excellence.

In a third-quarter earnings call, Broadcom CEO Hock Tan stated:

“When we acquired VMware, our goal was to achieve an adjusted EBITDA of $8.5 billion within three years post-acquisition. We are on track to meet or exceed that EBITDA target in the upcoming fiscal year 2025.”

In this regard, the integration of VMware has driven software infrastructure revenue from $2 billion to $5.8 billion, with the segment’s gross margin at 90%, clearly enhancing profitability. Broadcom swiftly launched and internally integrated this acquisition, generating considerable profits and cash flow, which will instill greater confidence for future acquisition targets.

The growth in AI business has also been remarkable. In the third quarter, revenue from the networking segment reached $4 billion, up 43% year-over-year, accounting for 55% of total semiconductor revenue. Specifically, revenue from custom AI accelerators grew 350% year-over-year, while Tomahawk 5 and Jericho3-AI Ethernet switches grew 400% year-over-year, and optical communication components grew 300%.

Based on these strong performances, Broadcom raised its fiscal 2024 AI revenue forecast by $1 billion to $12 billion, which would account for approximately 24% of total expected revenue for the year. Behind these numbers, Broadcom’s stock price has benefited from numerous favorable factors, including sales and profit growth from VMware, efficient acquisition integration by management, and increasing AI spending. The AI business and acquisitions serve as dual drivers pushing the company towards the $1 trillion market cap goal.

Analysts predict that if Broadcom maintains its current growth trend, it could very likely achieve a market cap of $1 trillion by 2026, joining the ranks of true tech giants.

From VMware to Symantec: Steady Growth through Acquisitions

Broadcom’s rise to prominence relies not only on the growth of its AI business but also on its successful acquisition strategy, which has played a vital role in boosting the company to tech giant status. Through multiple successful acquisitions, including Symantec, CA Technologies, and VMware, Broadcom has gradually built a moat that spans both the semiconductor and software sectors, steadily expanding its business domain.

Compared to other companies, Broadcom’s approach to acquisitions resembles that of a private equity firm. Its goal is not merely to expand its business scope but to achieve both “revenue growth and high profit margins” through acquisitions. Acquired companies quickly transform into high-margin business modules for Broadcom, owing to its exceptional integration capability.

The $69 billion acquisition of VMware is particularly notable as one of Broadcom’s most important recent mergers. Post-acquisition, the profitability of VMware improved significantly, with an adjusted EBITDA target of $8.5 billion within three years. CEO Hock Tan has said the company is on track to meet or even exceed this EBITDA target by the fiscal year 2025, showcasing Broadcom’s extraordinary post-acquisition execution ability.

Wall Street analysts are generally optimistic about Broadcom’s acquisition strategy and stock price growth. J.P. Morgan analyst Harlan Sur believes that Broadcom, leveraging the synergy from integrating VMware, is poised to reach the $1 trillion market cap milestone in the coming years, maintaining an “overweight” rating.

Broadcom’s diversified acquisition strategy has helped the company expand from semiconductors to network security, cloud computing, and enterprise software, forming a complete “hardware + software” ecosystem. This structure not only drives high growth but also enhances its resilience, laying a solid foundation for the company’s march towards a $1 trillion valuation.

AI and Financial Performance: Drivers of Steady Growth

Broadcom’s AI business and its solid financial performance are key drivers of its rapid market cap growth, complementing each other to provide a strong foundation for the company’s development.

In the third quarter of fiscal 2024 (ended August 4), Broadcom’s revenue reached $13 billion, representing a 47% year-over-year increase. Although organic growth after accounting for the VMware acquisition was only 4%, this doesn’t imply that AI has had no impact on Broadcom.

“As you know, our hyperscale customers continue to expand and scale their AI clusters. Customized AI accelerators grew 3.5 times year-over-year. Structurally, Ethernet switching driven by Tomahawk 5 and Jericho3-AI grew more than 4 times year-over-year, while optical lasers and thin chips used for optical interconnects grew 3 times.”

If you closely analyze these data, it represents incredible growth. Ethernet switch growth was 400%, and custom AI accelerators (e.g., Alphabet’s Tensor Processing Unit (TPU), which surpasses NVIDIA’s GPU in AI performance) grew 350%, exceeding market expectations.

The rise in AI demand also contributed to Broadcom’s gross margin improvement. In the third quarter, Broadcom achieved a gross margin of 77.4%, with infrastructure software boasting a 90% gross margin.

Despite significant investments in AI expansion and integration costs for VMware, Broadcom has maintained healthy profitability and net profit margins. Although net profit margin in the third quarter of 2024 dropped to 46.8% from 51.7% a year earlier, considering the merger costs and AI-related expenditures, maintaining this level of profitability highlights Broadcom’s operational excellence.

Broadcom’s free cash flow has also been robust, generating $4.79 billion this quarter, accounting for 37% of total revenue. This healthy cash flow supports the company’s large-scale acquisitions and effectively helps manage debt.

Overall, the rapid growth of the AI business and strong financial performance go hand in hand, driving Broadcom towards its $1 trillion market cap target.

The Symbolic Victory of Surpassing Tesla: A Challenger Becomes a Leader

Broadcom has surpassed Tesla in market capitalization, securing its place among the “Big Seven” in technology, representing not only a symbolic victory but also a fundamental enhancement in its standing within the tech world.

Over the past year, Broadcom’s stock price has risen by over 100%, surpassing other well-known tech companies, including Tesla. This growth is no coincidence; it is a result of the AI business boom, successful acquisition integration, and financial stability.

Interactive Brokers Chief Strategist Steve Sosnick believes that Broadcom’s rise in 2024 should see it replace Tesla among the “Big Seven.” He argues that Broadcom captures the current market focus on AI stocks, whereas Tesla may become an AI stock in the future, but Broadcom already is.

Broadcom may not guarantee a lead over Tesla in the short term, as Tesla’s stock is known for its volatility, potentially surpassing Broadcom’s market cap for a time. However, Broadcom’s long-term outlook is more optimistic, with Wall Street analysts generally expecting further price growth for Broadcom while projecting declines for Tesla.

Compared to Tesla, Broadcom’s growth appears more stable. Tesla’s stock price has exhibited high volatility, while Broadcom, driven by steady business expansion and cash flow, demonstrates a more sustainable growth path. Over the past four years, Broadcom’s share price has grown by 290%, whereas Tesla’s stock has experienced multiple sharp swings and returned to near its level four years ago.

Piper Sandler analyst Harsh Kumar echoes similar views: they continue to see Broadcom as the best AI play besides NVIDIA, given its strong position in the ASIC chip space and a robust software portfolio.

Broadcom’s success is not only reflected in its stock price but also in its emerging leadership—by adopting a “hardware + software” dual-driver strategy, Broadcom has established a significant presence in the AI and infrastructure space. This strategy sets Broadcom apart in tech competition, transforming it from a behind-the-scenes player to a true industry leader. The victory in market capitalization over Tesla symbolizes Broadcom’s strength in the tech industry and its potential future leadership.

Investment Opportunity: Is the Window Closing?

Broadcom’s stock has risen over 100% in the past year, showing strong momentum. This rally is attributed to the company’s strategic positioning in AI, successful acquisition integration, and sound financial management. With its market cap approaching $1 trillion, investors are left wondering: is the window of opportunity for investing in Broadcom closing?

Despite the current high price, analysts remain optimistic about Broadcom. J.P. Morgan analyst Harlan Sur has an “overweight” rating for Broadcom, expecting its market cap to surpass $1 trillion in the coming years. Moreover, Bernstein’s Stacy Rasgon noted that Broadcom could continue to lead in the semiconductor sector due to its strong profitability and efficient integration strategy, projecting further price appreciation. These perspectives suggest that Broadcom still holds significant investment value, even at current levels.

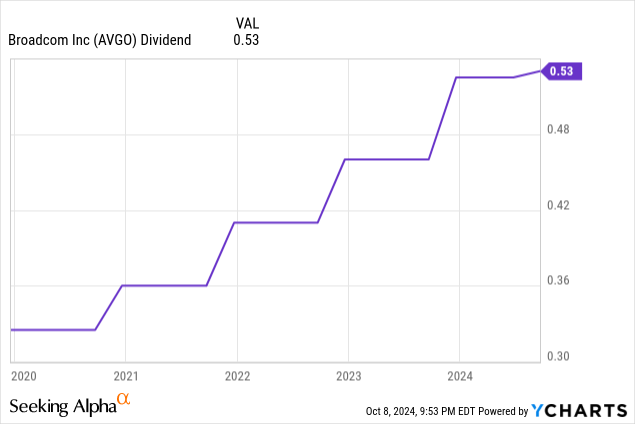

Broadcom’s consistently increasing dividend is also a key factor attracting investors.

On a per-share basis, the company paid out a total of $2.5 billion in cash to shareholders during the third quarter, with a payout ratio of about 0.52 for the quarter, which is in the “green zone,” suggesting the company will continue to raise dividends in the foreseeable future.

Driven by the AI business and infrastructure software, Broadcom’s free cash flow has remained strong, supporting dividend growth. This quarter, free cash flow reached $4.79 billion, accounting for 37% of revenue. This healthy cash flow supports Broadcom’s shareholder return strategy, making Broadcom one of the few AI giants that balance growth and return.

Nonetheless, Broadcom’s high P/E ratio reflects high market expectations for its future growth, and its current valuation is not considered cheap. Compared to the industry median, Broadcom’s P/E is significantly above its historical average, indicating investors’ confidence in the company’s revenue and profit growth in the coming years. Thus, for investors, Broadcom remains a viable long-term investment, though its valuation and market volatility should be taken into account.

When considering the investment opportunity with Broadcom, it is crucial to assess the current growth prospects. The continued increase in AI demand, coupled with the company’s broad footprint across semiconductor and software, could continue to drive share prices higher. However, as Broadcom gets closer to the $1 trillion market cap target, investors should balance the relationship between short-term volatility and long-term returns to identify suitable entry points. Against this backdrop, the window of opportunity may be slowly closing, but for investors focused on long-term growth, Broadcom remains a tech giant worth keeping an eye on.