- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

ZEEKR 7X takes the market by storm! Stock Soars 15%, Can It Keep Climbing?

ZEEKR, as an emerging force in the global electric vehicle industry, is rapidly shaping its unique market positioning. It belongs to Geely Group and not only inherits the extensive resources and technological accumulation of its parent company, but also demonstrates its innovative and forward-looking business strategy in the field of electric vehicles. Recently, ZEEKR’s market performance has been particularly noteworthy, especially with the launch of its latest model 7X, which has led to a significant increase in the company’s stock price, which soared by 15% last Friday.

The sharp rise in stock price this time not only recognizes the technological innovation and market strategy of ZEEKR, but also reflects investors’ optimistic expectations for its future growth potential.

Next, let’s explore in detail the reasons behind this and its future investment value.

The reason for the recent surge in stock prices

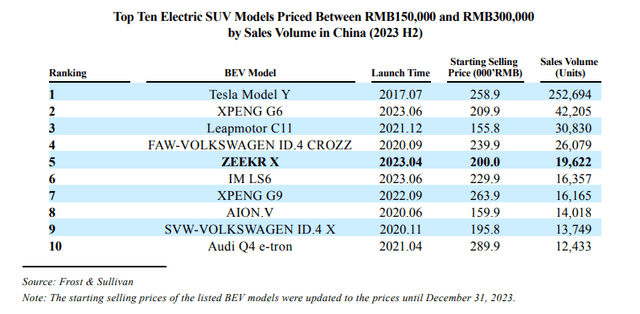

The recently launched 7X model by ZEEKR is positioned as a luxury electric SUV for the high-end market, and has quickly become the focus of the market since its release. The design of ZEEKR 7X adopts futuristic elements and combines multiple breakthrough technologies, including improved endurance and accelerated charging speed, which has attracted widespread attention. According to the official news from ZEEKR, the ZEEKR 7X large five-seater luxury SUV was officially launched recently. The price range is between 229,900 yuan and 269,900 yuan, which is lower than the pre-sale price. Within 20 days since the pre-sale, the order volume has exceeded 58,000, showing the enthusiastic response of the market.

The ZEEKR 7X is equipped with a series of industry-leading technologies, including a new battery technology that significantly improves energy density and increases the driving distance on a single charge while ensuring safety. In addition, the model is also equipped with the latest generation of autonomous driving assistance systems. These high-tech configurations not only enhance the market competitiveness of the vehicle, but also deepen investors’ confidence in ZEEKR’s future technological innovation. This technological advantage is a key factor for ZEEKR to stand out in the fiercely competitive electric vehicle market, and is also one of the reasons for the significant increase in its stock price.

In addition to the hot sales of new models, ZEEKR CEO An Conghui also revealed that although the annual delivery target of 230,000 units set for 2024 is challenging, the company continues to maintain confidence in achieving this goal. The positive market expectations for ZEEKR’s future sales growth and profitability have further pushed up the company’s stock price.

What growth drivers will there be in the future?

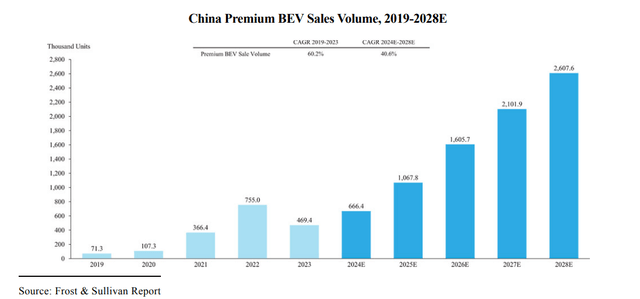

As the demand for electric vehicles in the global market continues to grow, the future growth momentum of ZEEKR mainly comes from its innovative product line, expanding market strategy, and continuous technological progress.

The strategic significance of the launch of new models and their contribution to sales

The launch of the ZEEKR 7X is not only an expansion of the company’s product line, but also an important step in its strategic layout. The success of this model not only demonstrates ZEEKR’s competitiveness in the high-end electric SUV market, but also helps the brand further expand into the international market. The unique design and high-end configuration of the 7X model make it attractive worldwide, providing strong support for ZEEKR to explore new markets and customer groups. Through this strategic product promotion, ZEEKR can accelerate its global market share and enhance brand influence.

ZEEKR’s innovation in electric vehicle technology is one of its core competencies. The company’s continuous research and development of advanced battery technology, electric drive system, and autonomous driving technology have kept its products leading in the market. The innovative technology adopted by ZEEKR 7X not only improves the performance of the vehicle, but also enhances the user’s driving experience, which is the key to its standing out in the fierce market competition. In addition, ZEEKR ensures continuous technological progress and high-quality standards of products through cooperation with global technology suppliers, thereby enhancing consumers’ trust and loyalty to the brand.

Macroeconomics and market strategies

In the US stock market, ZEEKR, as a relatively new participant, has entered a period of adjustment since its stock price peaked at $32.2 in May 2024. This price correction reflects the market’s continued assessment of the long-term value of this emerging enterprise. Historical data shows that the growth of the electric vehicle industry is often affected by macroeconomic factors, especially the economic growth rate decline caused by the tightening of Monetary Policy. Looking ahead, it is expected that these macroeconomic obstacles will ease in the next 12 to 18 months.

Currently, the Federal Reserve has initiated interest rate cuts by 50 basis points, marking the beginning of expansionary Monetary Policy, which is expected to continue until 2025. Such loose Monetary Policy will boost GDP growth and bring positive effects to the electric vehicle industry, especially by suppressing inflationary pressures that may weaken profit margins.

Although these measures may not immediately produce significant economic growth or consumption improvement effects, a cautious optimistic attitude can be maintained towards the economic outlook for the next year. Faced with the two main risks of high interest rates and economic uncertainty, the implementation of these loose policies has created a more stable environment for the development of the electric vehicle industry.

This global economic policy environment has created a favorable background for electric vehicle manufacturers such as ZEEKR, supporting their sustained growth and market expansion, while also helping to alleviate uncertainty caused by macroeconomic fluctuations. ZEEKR has the opportunity to strengthen its market position and brand effect in the global electric vehicle market.

Technological innovation and international expansion

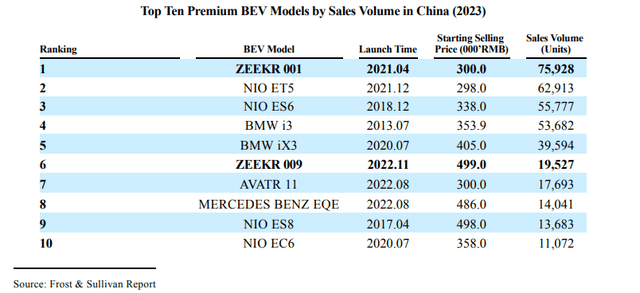

Since the launch of its first model, ZEEKR has rapidly established its market influence through a series of strong product lines and cutting-edge technologies. From the five-seater crossover hatchback ZEEKR 001 launched in April 2021, to the luxury six-seater MPV ZEEKR 009, followed by the compact SUV ZEEKR X, and the high-end sedan launched in early 2024, ZEEKR has continuously expanded its model series to meet the diverse needs of various consumers. This car series not only reflects ZEEKR’s extensive diversity in design and functionality, but also demonstrates its ability to quickly adapt and respond to market dynamics.

Although ZEEKR has only been established for 3.5 years, its market expansion speed and performance growth are extremely significant. ZEEKR has quickly occupied a place in the fierce global electric vehicle market. Since its establishment, ZEEKR’s vehicle delivery volume has repeatedly reached new highs, especially since the launch of ZEEKR 001, which has exceeded 200,000 vehicles. As of August 2024, ZEEKR’s delivery volume for that year has reached 121,540 vehicles, a year-on-year increase of 81%.

The following sales data shows that ZEEKR’s models have performed well in major markets, which also reflects the popularity of the product in the market.

In addition, ZEEKR has also performed well in the high-end pure electric vehicle field in the domestic market. It is expected that the annual compound growth rate of this market will reach 40.6% between 2024 and 2028. The current market policies and economic environment are expected to support ZEEKR’s continued strong growth.

ZEEKR has not only achieved significant success in the domestic market, but also steadily advanced its international market expansion strategy, successfully entering 25 major markets worldwide. The company plans to further expand to 50 international markets, including Europe, Asia, Oceania, and Latin America. In June 2024, ZEEKR signed cooperation agreements with PT Premium Auto Prima from Indonesia and MY’s Sentinel Automotive, marking its strategic deployment in the South East Asia market. This global expansion not only enhances ZEEKR’s market competitiveness, but also lays a solid foundation for the long-term development of the brand.

In terms of technological innovation, ZEEKR continues to break through. Through progress in autonomous driving and battery technology, as well as cooperation with industry leaders such as Mobileye, Waymo, and Onsemi, ZEEKR has ensured the technological leadership of its products. The company also plans to enter the US Robotaxi market, which is expected to achieve a compound annual growth rate of 82.6% between 2024 and 2030, demonstrating ZEEKR’s strategic vision for future high-growth business areas.

ZEEKR has become an important competitor in the electric vehicle industry through its continuous product innovation, international market expansion, and strategic cooperation. Its rapid growth and technological advantages have given ZEEKR a special position in the global electric vehicle market, and it is expected to continue to benefit from future market competition.

Continuous revenue growth and profit enhancement potential

In the past few years, ZEEKR’s revenue performance has been exceptionally strong, thanks to its stable and healthy product delivery volume and expanding market share. As of the second quarter of 2024, the company’s revenue has reached $2.80 billion, a year-on-year increase of 58.4%. In particular, automobile sales account for 67% of the company’s total revenue, and the profit margin of automobiles has remained stable at 14.2%. Sales of batteries and other key automotive components also performed well, contributing 26.4% of total revenue, totaling $729.20 million.

Behind this revenue growth, ZEEKR’s investment in product refresh and technological upgrades cannot be ignored. The recently launched high-end sedan is equipped with updated ADAS systems and AI operating systems, as well as efficient batteries that can be charged quickly in a very short time. These technological innovations not only strengthen ZEEKR’s market competitiveness, but also are expected to further improve its profit margin.

Although the company recorded an operating loss of $1.20 billion in 2023, by the first half of 2024, this figure had significantly decreased to a non-GAAP operating loss of $394 million, indicating substantial progress in improving operational efficiency and reducing costs. As the company continues to optimize its product portfolio and market strategy, operating losses are expected to continue to decrease.

In terms of financial structure, as of the second quarter of 2024, ZEEKR’s cash reserves reached as high as $1.10 billion, providing strong financial support for the company’s operating activities and future expansion plans. Although there may be a risk of equity stake dilution in the short term, if product delivery continues to grow and operating losses can be further controlled, this risk will be greatly alleviated. In addition, with ZEEKR’s active expansion in multiple new markets around the world and the continuous increase in research and development investment, the company’s financial situation is expected to further strengthen.

What are the risk factors?

In the globalized business environment, macroeconomic uncertainty has always been a major challenge that enterprises need to face. For electric vehicle manufacturers such as ZEEKR that rely on global markets and supply chains, this uncertainty is particularly influential. In addition, geopolitical risks, trade policy changes, and Market Access barriers also bring considerable challenges to ZEEKR. At the same time, fierce competition in the industry and the gradual saturation of the market are also risk points that cannot be ignored.

Macroeconomic uncertainty and its possible impact on ZEEKR

Macroeconomic uncertainty is a reality that every global enterprise must face. For electric vehicle manufacturer ZEEKR, this uncertainty is particularly critical. Economic fluctuations affect consumer spending habits, investment decisions, and long-term strategic planning of enterprises. In the context of an uncertain economic outlook, ZEEKR may face a series of challenges, including reduced demand, rising capital costs, and strategic adjustments for global expansion.

Specifically, the global economic slowdown may cause consumers to postpone or cancel the purchase of high-value goods in their plans, such as electric vehicles. In addition, credit tightening will increase the capital cost of ZEEKR, making it more difficult to expand capacity or carry out technological innovation. At the same time, currency fluctuations may cause instability in import and export costs for companies operating in multiple countries, affecting ZEEKR’s pricing strategy and profit margins in different markets.

In addition, the instability of Global Financial Marekt may also weaken investors’ confidence in ZEEKR and the entire electric vehicle industry, leading to stock price fluctuations and increasing the difficulty of raising funds for the company. In extreme cases, these economic factors may force the company to adjust its business strategy, including postponing or reducing certain planned expansion projects.

Geopolitical Risks, Trade Policy and Market Access Barriers

Against the backdrop of geopolitical tensions and uncertain trade policies, ZEEKR, like other global companies, faces certain risks. Trade restrictions, tariff increases, and other forms of economic protectionism may lead to an increase in ZEEKR’s manufacturing costs, which may seriously affect ZEEKR’s supply chain and global distribution network. For example, tariffs on electric vehicle components such as batteries may directly affect the cost structure, thereby affecting the pricing and market competitiveness of the final product.

Market Access barriers are another major challenge, especially in countries with strict standards and high tariffs on imported cars. Regulations and environmental standards in each market may affect the product configuration of ZEEKR, and even require expensive localization design changes to comply with local regulations, which undoubtedly increases the cost and complexity of entering new markets.

Challenges of competition and market saturation within the industry

The electric vehicle industry is undergoing unprecedented changes. The acceleration of technological innovation and the influx of new entrants have made competition increasingly fierce. As a member of the industry, ZEEKR is not only facing electric vehicle models from traditional car manufacturers, but also innovative products from many start-up companies. These competitors continue to launch new models with advanced technology and attractive prices, constantly reshaping the market landscape.

With the maturity of electric vehicle technology and the reduction of costs, there are more and more types of products on the market, and consumers’ choices are also increasing. This situation prompts ZEEKR to continuously innovate and improve product performance, efficiency, and User Experience.

In addition, the intensification of market competition often accompanies price wars and compression of profit margins, which puts pressure on the financial situation of ZEEKR. In order to maintain profitability and market share, ZEEKR must optimize its cost structure, improve operational efficiency, and also need to innovate marketing strategies to enhance brand appeal and customer loyalty.

The rapid changes in consumer demand are also issues that ZEEKR needs to respond flexibly to. With the improvement of environmental awareness and the development of technology, today’s consumers not only pay attention to the performance and price of cars, but also pay more attention to the environmental protection characteristics, intelligent functions, and interconnection with daily life of cars. ZEEKR needs to keep up with market trends, adjust product development strategies, ensure that it can quickly respond to market changes, and meet consumers’ new expectations.

What is the investment outlook?

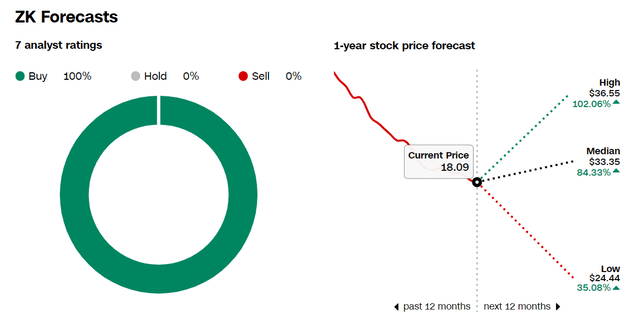

The stock price performance of ZEEKR is influenced by various factors, including macroeconomic conditions, industry dynamics, company performance, and global market volatility. When the company announces major technological breakthroughs or new market expansion plans, positive investor sentiment can drive up the stock price. Conversely, if the global market is unstable or Company Finance’s performance does not meet expectations, it may cause the stock price to fall.

Market expectations also have a decisive impact on the stock price of ZEEKR. Analysts’ predictions on the company’s future revenue growth, profitability, and market expansion capabilities will directly affect investors’ views. Good market expectations can enhance investor confidence and promote stable or rising stock prices. ZEEKR’s continuous investment in research and development and market expansion strategies is key to maintaining positive market expectations.

ZEEKR’s financial health and investment return potential

The financial health and investment return potential of ZEEKR continue to receive high attention from the market. Although ZEEKR has not yet achieved profitability at the EBITDA level, other financial indicators show its growth potential. In particular, its forward enterprise value-to-sales ratio (EV/Sales) is only 0.38, which shows a significant valuation discount compared to the industry median of 1.29. In addition, the company’s Price-To-Sales Ratio (P/S) is 0.42, far below the industry median of 0.93, indicating that the market’s current valuation of ZEEKR may be too conservative.

Investors and analysts have a positive assessment of ZEEKR, and they are optimistic about its future performance. The most pessimistic 12-month forward target price is $24.44, which means there is a 35% upside potential compared to current levels. Considering the median target price of analysts is $33.35, the potential upside potential could reach 84.33%.

This valuation potential, coupled with ZEEKR’s continuous technological innovation and market expansion in the electric vehicle field, provides appeal for its stock. Although the market is cautious about emerging electric vehicle manufacturers, ZEEKR’s steady growth and technological progress indicate that its stock may be undervalued by the market.

If you are also optimistic, you can go to BiyaPay to seize the opportunity and buy ZEEKR. Of course, if you think the current stock price is high, you can also monitor the trend of the stock on the platform to find a more suitable time. In addition, BiyaPay can also be used as a professional tool for depositing and depositing US and Hong Kong stocks. You can exchange digital currency for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited arrival speed, which will not let you miss investment opportunities.

Long-term investment value

The long-term investment value of ZEEKR lies in its innovation ability and market expansion strategy, which enables the company to maintain competitiveness in the fiercely competitive electric vehicle market. However, investing in ZEEKR also inevitably faces many risks, including intensified market competition, rising raw material costs, and changes in the global economic and policy environment. These factors may all have an impact on the company’s long-term performance.

ZEEKR stocks have shown good investment value in the current market environment. The company’s strong technical foundation, healthy financial situation, and active market expansion strategy are expected to achieve significant growth in the next few years.

Taking into account ZEEKR’s Market Positioning, financial health, and future growth potential, ZEEKR has demonstrated the possibility of becoming a leader in the electric vehicle industry. The company’s continuous innovation and market expansion strategy have laid a solid foundation for its long-term growth. Despite facing multiple market and macroeconomic challenges, ZEEKR still maintains a stable competitive situation. When considering long-term investment in ZEEKR, investors should comprehensively evaluate its technological advantages, market expansion capabilities, and potential risk factors to make wise investment decisions.