- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

Huang Renxun's "cash-out" is over! Blackwell's release is approaching, and NVIDIA's stock price is r

Nvidia, as a leading global manufacturer of graphics processing units (GPUs), has always maintained a strong market position in the fields of artificial intelligence and high-performance computing. On Tuesday, the company’s stock price rose nearly 4%, attracting widespread attention from investors. The background of this rise is not only related to the company’s continued excellent performance, but also closely related to the market signal conveyed by CEO Huang Renxun’s stock reduction plan temporarily ending. At the same time, the upcoming release of Nvidia’s new product Blackwell has filled the market with expectations and further pushed up the stock price.

Why did the stock price rebound?

Huang Renxun’s reduction plan is a signal to the market

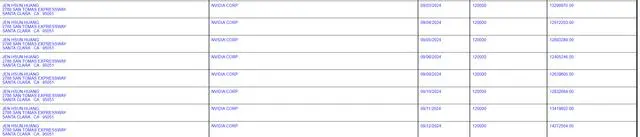

The important factor driving the rise of NVIDIA’s stock price this time is the recent stock reduction action of CEO Huang Renxun. Huang Renxun reduced his holdings of 6 million shares of the company’s stock from June to September 2024 through the 10b5-1 trading plan, cashing out more than $700 million. Although the large-scale sale of stocks by company executives is often seen as a negative signal, which may imply uncertainty about the company’s future or the peak of the stock price, Huang Renxun’s reduction did not cause significant concerns in the market. On the contrary, because this reduction action was carried out under the pre-arranged 10b5-1 plan, the market generally interpreted it as Huang Renxun’s normal financial management strategy rather than questioning the company’s prospects.

Huang Renxun’s stock reduction plan was originally scheduled to last until March 2025. However, he completed the sale of all 6 million shares six months ahead of schedule. Although this action once raised doubts among investors, with the successful completion of his reduction plan, market sentiment gradually stabilized. From the market reaction, Huang Renxun’s early completion of the scheduled sale plan effectively eliminated some investors’ concerns, eased potential selling pressure, restored investors’ confidence in NVIDIA’s stock, and pushed the stock price to rebound.

However, it is worth noting that Huang Renxun’s reduction has not changed his controlling position in the company. As of the latest data, he is still the largest individual shareowner of NVIDIA, holding more than 93 million shares, accounting for about 3.75% of the company’s outstanding shares. This shareholding ratio indicates that Huang Renxun’s confidence in NVIDIA’s future development remains strong, and the market generally believes that his reduction does not mean he is pessimistic about the company’s prospects.

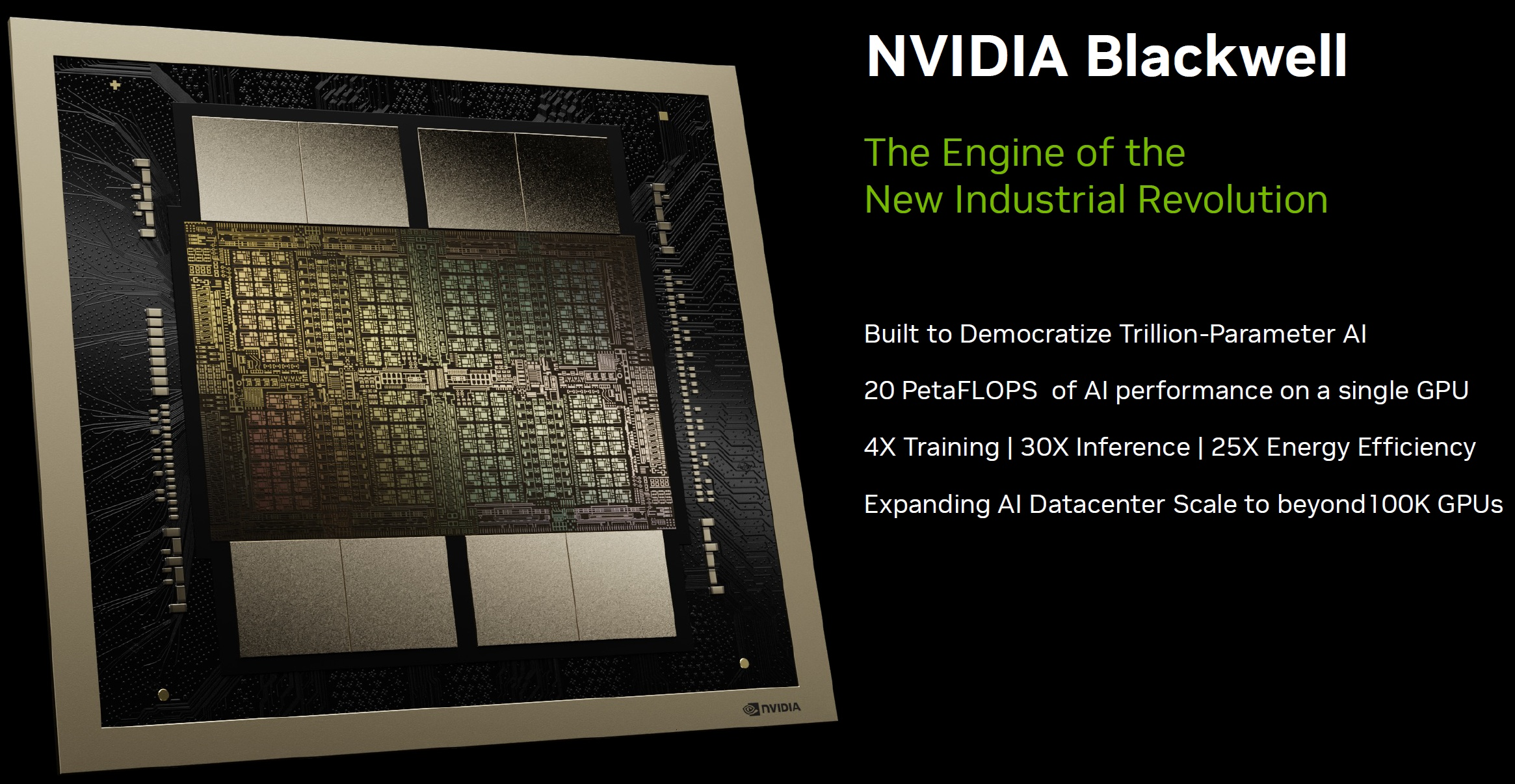

Blackwell’s release is approaching, and the market is looking forward to new products

Meanwhile, the market is eagerly anticipating NVIDIA’s upcoming next-generation GPU product, Blackwell. Blackwell represents NVIDIA’s latest technological breakthrough and is expected to be widely used in high-performance computing, artificial intelligence, and Machine Learning fields. Management expects Blackwell to bring billions of dollars in revenue in the 2025 fiscal year, which further enhances investor confidence and drives up the stock price. The release of Blackwell not only means further breakthroughs in technology for NVIDIA, but also indicates that the company’s leadership position in AI and Cloud Services will be further consolidated.

What growth potential does it have?

NVIDIA’s financial performance in recent years has been remarkable, especially in the past year, where the company has shown growth rates far exceeding market expectations. Whether it is revenue or profit, NVIDIA’s growth demonstrates its strong market competitiveness and continuous innovation ability. Through the expansion of the Data Center business, the Competitive Edge advantage of technology leadership, and opportunities in emerging fields such as enterprise-level AI and autonomous driving, NVIDIA’s growth potential is undoubtedly worth paying attention to.

Financial report performance exceeded expectations

The numbers announced by NVIDIA in its latest financial report are encouraging. The company’s revenue increased by 122% compared to the previous year, reaching $30 billion, with a gross profit margin of 75.7%, indicating significant results in cost management and efficiency improvement. Earnings per share increased by 153% year-on-year, reaching $0.68, which not only reflects the company’s improved profitability but also the huge demand for NVIDIA in the global market.

NVIDIA’s core business, especially the data center field, contributed most of the revenue growth. With the surge in demand for Cloud Services, artificial intelligence, and high-performance computing, NVIDIA’s data center business revenue increased by 154% year-on-year, reaching $26 billion. This growth trend indicates the increasing demand for AI computing capabilities worldwide, and NVIDIA’s leading technology in this field puts it at the forefront of the industry.

Data center business grows strongly

NVIDIA’s Data Center business is an important driving force for the company’s revenue growth. The Hopper series GPU performs well in computing power and efficiency, attracting top global enterprises and technology companies. With its powerful parallel computing capabilities, this GPU meets the needs of AI training, inference, and high-performance computing, becoming one of the preferred products in the market.

In addition, the upcoming release of the Blackwell series GPU has brought more expectations to the market. As NVIDIA’s next-generation GPU product, Blackwell’s technological innovation and extensive Application Area have become potential pillars for the company’s future revenue growth. Blackwell can not only meet the complex computing needs of Cloud Services and Machine Learning, but also play an important role in the fields of generative AI and Deep learning. The market demand for Blackwell has exceeded the company’s existing capacity, and the supply shortage will further drive NVIDIA’s revenue growth.

This strong demand for data center and GPU technology not only demonstrates NVIDIA’s competitiveness in this field, but also demonstrates its future revenue growth Sustainability.

Competitive Edge Advantage

NVIDIA’s Competitive Edge advantage in the industry is particularly significant, mainly reflected in its leading position in technology, customer loyalty, and the strong ecosystem it has built. Firstly, NVIDIA has always maintained its technological leadership in the GPU and accelerated computing fields through continuous research and development investment and innovation. Whether it is parallel processing, deep learning models, or optimization of GPU architecture, NVIDIA’s technology far exceeds that of its competitors.

Secondly, NVIDIA has further consolidated its Competitive Edge by building a powerful software and hardware ecosystem. NVIDIA’s CUDA platform is one of the core tools for Deep Learning development, widely used in the fields of AI and data science, helping developers use NVIDIA hardware for efficient computing. In addition, NVIDIA’s Omniverse platform provides enterprises with virtual collaboration and simulation capabilities, further enhancing customers’ dependence on NVIDIA’s platform. This ecosystem has created extremely high customer loyalty for NVIDIA. Once customers enter NVIDIA’s platform, the cost of switching to other suppliers is extremely high, further strengthening the company’s leadership position in the market.

Diversification of market opportunities

In addition to data centers, NVIDIA also has broad market opportunities in the fields of enterprise AI and autonomous cars. As the demand for enterprise-level AI continues to grow, more and more companies are turning to AI-driven solutions to improve productivity and develop new business applications. NVIDIA has partnered with most Fortune 100 companies to provide various technology solutions from generative AI to intelligent driving. In the automotive industry, NVIDIA’s autonomous driving platform has attracted the attention of global automakers, and its autonomous driving chips and AI cockpit solutions have laid a solid foundation for future autonomous driving technology.

What risks do you face?

Despite NVIDIA’s strong growth potential and market leadership, it still faces some potential risks that could affect its future development trajectory. Investors need to have a comprehensive understanding of these risks when analyzing NVIDIA and be prepared for possible challenges.

Risk of economic recession

The uncertainty of the global economy is a key external risk faced by NVIDIA. With the slowdown of global economic growth, especially the signs of economic recession in major markets, the capital expenditure of enterprises may be affected. This is particularly important for large technology companies that rely on high-end hardware and computing equipment, as they may reduce Technology Investment to maintain profit margins. If the global economy enters a comprehensive recession, NVIDIA’s customers may reduce their procurement plans for high-performance computing products such as Hopper and Blackwell, which may have an adverse impact on NVIDIA’s revenue growth.

Although the demand for AI and high-performance computing remains strong, companies often postpone investments in non-critical technologies during economic downturns, especially in the expansion of Cloud Services and Data centers, which may put pressure on NVIDIA’s short-term performance. Therefore, NVIDIA may face the risk of slowing growth during economic downturns, especially if the global economic recovery is slower than expected.

Competitive threats from AMD, Intel, and startups

Although NVIDIA maintains a leading position in GPU and accelerated computing technology, the threat from competitors cannot be ignored. Established semiconductor companies such as AMD and Intel have increased their investment in high-performance computing and AI in recent years, trying to narrow the gap with NVIDIA. AMD has gained customers’ favor in some specific markets with its Radeon series products and continuously improving computing architecture. Intel, on the other hand, is trying to occupy a larger market share in enterprise-level computing and Cloud as a Service through its Xe GPU and Deep Learning acceleration technology.

In addition to these traditional competitors, a group of startups have emerged in the market, focusing on developing new computing architectures and AI acceleration chips. Companies such as Grog and Etched are challenging NVIDIA’s dominant position in AI training and inference through innovative computing methods. By simplifying the design of computing cores and improving the scalability and efficiency of chips, these companies may pose a substantial competitive threat to NVIDIA in the future high-performance computing market.

Customer concentration risk

NVIDIA’s revenue relies heavily on a few large-scale enterprise customers, especially major global Cloud as a Service providers. According to data disclosed by the company, about 45% of NVIDIA’s data center revenue comes from these large customers. This highly concentrated customer base makes NVIDIA vulnerable to changes in a single customer’s business. If these large customers switch to other competitors’ products due to economic pressure or changes in technology choices, NVIDIA’s revenue will face a significant risk of decline.

How is the return on investment?

NVIDIA’s stock price has experienced a significant increase in the past few years, especially benefiting from the high global attention to artificial intelligence technology. Market sentiment has played a crucial role in driving up NVIDIA’s stock price. With the rapid expansion of generative AI applications, NVIDIA’s GPU demand continues to rise, and investors have extremely high expectations for the company’s growth. However, as the stock price soars, there are also concerns that the stock price may be overvalued, especially in the short term due to market mood swings.

Technical analysis shows that there may be a short-term risk of a pullback in NVIDIA’s stock price near the high point. Since the company announced the plan to release its new product Blackwell, the market’s optimism about NVIDIA’s future performance has continuously pushed up the stock price, forming an overbought technical signal. However, investors should be cautious about short-term fluctuations because NVIDIA’s technical foundation and market demand remain stable. With the official launch of Blackwell and subsequent market reactions, the stock price is expected to continue to rise after short-term fluctuations.

In the future, NVIDIA’s revenue and profit are expected to continue to maintain strong growth, especially in the Data center and AI technology Application Area. The company’s management expects that with the release of Blackwell GPU, the company will usher in a new round of revenue growth cycle. It is expected that by the fiscal year 2025, Blackwell’s sales will reach billions of dollars, which will bring stable revenue sources to NVIDIA. In addition, NVIDIA’s Hopper GPU still maintains strong market demand, especially in Cloud Services and large enterprise AI projects. Hopper’s performance is excellent, and its demand is expected to continue until 2026.

From a profit perspective, NVIDIA is expected to maintain a high profit level with its high gross profit margin product portfolio and strong market demand. NVIDIA’s current gross profit margin is 75.7%, which is at a very high level in the technology industry. As the company further optimizes production and R & D costs, the profit margin is expected to remain above 75%, which will provide stable returns for investors.

How do investors layout?

For investors, NVIDIA has both short-term opportunities and long-term potential. In the short term, investors can seize trading opportunities in stock price fluctuations based on market sentiment and the timing of new product releases. Blackwell’s release may bring further stock price increases in the short term, but investors also need to pay attention to rapid changes in market sentiment, especially during periods of high volatility.

Considering the potential volatility, investors need to pay attention to the market in a timely manner in order to find the right time to buy. Specifically, you can go to BiyaPay to monitor the market trend of NVIDIA and choose the appropriate time to buy.

In addition, if you encounter difficulties in depositing and withdrawing funds, BiyaPay can also serve as a professional tool for depositing and withdrawing funds from US and Hong Kong stocks. You can recharge digital currency to exchange for US dollars or Hong Kong dollars, quickly withdraw to your bank account, and then transfer the funds to other brokerage accounts to buy stocks. The platform has a fast and unlimited transfer speed, so you won’t miss investment opportunities.

Especially for long-term investors, NVIDIA’s leading position in technology and extensive market demand provide a solid investment foundation for investors. Investors can consider increasing their holdings of NVIDIA stocks through BiyaPay, especially before the market potential of emerging fields such as data centers, enterprise AI, and autonomous driving is fully unleashed. Investors should maintain continuous attention to NVIDIA’s new product releases and market dynamics to ensure that their investment decisions are consistent with the company’s future development direction.

In addition, investment risk diversification can be considered. Although NVIDIA has significant growth potential, investors still need to diversify their investment portfolios to cover different industries and asset classes to cope with potential market fluctuations and various risks faced by the company.

Overall, NVIDIA has demonstrated strong market prospects and growth potential with its technological advantages in the fields of artificial intelligence and high-performance computing. Despite facing some risks, especially challenges from competitors and macroeconomic uncertainties, its extensive market opportunities and continuous technological innovation provide investors with long-term investment value. Investors should maintain continuous attention to market changes, make reasonable arrangements, seize investment opportunities in NVIDIA’s new product releases and business expansion, and reduce risks by diversifying investments. In the coming years, with the launch of Blackwell and further development of the company’s business, NVIDIA is expected to continue to lead the innovation wave in the technology industry.