- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Sixth

Adobe's financial report plummeted nearly 9%, weak profit forecasts have raised concerns about AI, b

Adobe (Nasdaq: ADBE), the parent company of Photoshop and the manufacturer of photo processing software, released its new quarterly financial report on Thursday. The company is known for its creative program suite. The third-quarter earnings exceed expectations. But Adobe’s stock price plummeted nearly 9% in after-hours trading. This decline has sparked widespread market attention and raised doubts among investors about Adobe’s future development. Although the company’s profits and revenue exceeded expectations, the disappointing fourth-quarter earnings guidance has raised concerns among investors about whether Adobe can continue to maintain its leading position in the AI field.

With the rapid development of AI technology, Adobe is actively integrating generative artificial intelligence into its products, especially its Firefly project, which provides creators with AI-based image and video generation tools. However, fierce market competition, especially pressure from tech giants such as Microsoft and Google, has brought considerable challenges to Adobe. Many investors are beginning to consider whether Adobe’s current stock price crash is a bottom fishing opportunity or whether there is a greater market risk.

Adobe’s recent financial report review

Overview of the third quarter financial report

In the third quarter of 2024, Adobe announced solid financial data. The revenue for the quarter reached $5.41 billion, a year-on-year increase of 11%, exceeding analysts’ expectations of $5.37 billion. The earnings per share also performed well, reaching $4.65, higher than the market’s expected $4.54. Adobe’s continued growth in digital media and digital experience platforms is undoubtedly a key driver of its strong performance.

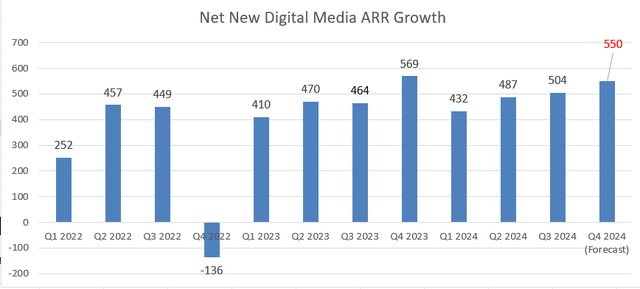

In addition, Adobe’s annual recurring revenue (ARR) net growth in the digital media field reached $504 million, a key indicator that exceeded analysts’ expectations and highlighted the company’s strong appeal in the subscription service field. Adobe’s core products, such as Creative Cloud, Document Cloud, and Experience Cloud, still maintain high levels of user stickiness and innovation.

Overall, Adobe’s third-quarter performance exceeded market expectations, demonstrating its strong strength in the digital media field. However, despite the impressive third-quarter results, the market’s focus quickly shifted to fourth-quarter profit guidance.

Profit guidance for the fourth quarter

Adobe’s fourth-quarter earnings guidance was slightly weaker than market expectations. The company expects fourth-quarter revenue to be between $5.50 billion and $5.55 billion, while analysts generally expect $5.61 billion. Adjusted earnings per share are expected to be between $4.63 and $4.68, also lower than the market average.

Although this profit guidance appears conservative compared to previous quarters, Adobe management explained that some factors were due to the early completion of some transactions in the third quarter, which lowered the growth expectations for the fourth quarter. It is worth noting that this short-term fluctuation did not affect the company’s overall growth expectations for the second half of the year. However, the market has reacted strongly to this, and investors are concerned about whether Adobe can maintain its long-term growth momentum in the face of fierce competition in the artificial intelligence field.

ARR growth in digital media business

Adobe’s digital media business has been the core engine of the company’s growth. In the third quarter, the digital media ARR increased by $504 million, exceeding market expectations. This indicates that despite facing competitive pressure, Adobe’s subscription services still have stable user growth and strong market demand.

However, the fourth quarter ARR guidance is slightly weak, expected to be $550 million, a decrease of 3.3% year-on-year. This decline in growth rate has raised concerns about Adobe’s long-term digital media growth, especially as the application of AI technology in the future may lead to changes in market dynamics.

Although these data may cause market concerns in the short term, it should be noted that the continued growth of ARR indicates that Adobe still has great potential in its digital media products. With the continuous enhancement of AI capabilities in tools such as Adobe Firefly, future ARR growth is expected to be strongly driven.

The core reason for the stock price crash

Despite Adobe’s strong performance in the third quarter, the market is full of doubts about its future growth, especially after the profit guidance for the fourth quarter was lower than analysts’ expectations, which further amplified these concerns. The core reason for Adobe’s stock price plunge of 9% is the uncertainty of investors about its short-term prospects, especially whether Adobe’s performance in the AI field can meet expectations.

AI is one of the key drivers of Adobe’s future growth. Investors originally hoped that Adobe could occupy a more dominant position in the AI field and drive the company’s continued growth. However, the guidance for the fourth quarter was not as expected, causing some investors to question whether Adobe can maintain its innovation ability and market share in fierce competition.

In addition, the slowdown in ARR growth in the digital media field has further exacerbated market concerns. ARR is a key indicator for measuring Adobe’s subscription business growth and a core pillar of its future revenue growth. Although the third quarter’s ARR performance was strong, the decline in the fourth quarter guidance raises doubts about whether Adobe’s user growth has reached a bottleneck, especially as competitors increase their efforts to develop AI tools.

Adobe’s future prospects are still good

Strong financial performance supports

Despite market concerns about future growth, it is undeniable that Adobe’s financial performance remains strong. In the third quarter, the company not only exceeded market expectations for revenue and earnings per share, but also demonstrated a solid performance in its operating activities. In the quarter, Adobe generated $2.02 billion in cash flow, significantly higher than the $1.87 billion in the same period last year. At the same time, the company also repurchased 5.20 million shares of stock, further demonstrating its financial health and ability to give back to shareholders.

Adobe has always maintained good financial management and profitability, especially in the fields of digital media and digital experiences. With the continuous increase in market demand for creative software and digital marketing solutions, Adobe has the ability to continue creating long-term value for shareowners. Although the market has been disappointed with profit guidance in the short term, Adobe still has strong growth potential in the long run, especially in the continuous expansion of its core business.

Growth potential driven by artificial intelligence

Adobe’s future development largely depends on its layout in the field of artificial intelligence, especially through the Firefly project and other generative AI tools. Adobe is rapidly improving its product innovation capabilities. The Firefly platform has become the core of the company’s AI strategy. Users can generate text-based images, videos and other content through this platform, greatly improving the efficiency of creative workflows.

This year, Adobe plans to release Firefly’s video model, which will enable users to generate videos automatically through AI and seamlessly integrate with existing video editing tools such as Adobe Premiere Pro. The launch of this feature is likely to attract more video creators and advertising and marketing companies, thereby enhancing Adobe’s competitiveness in the digital media market.

In addition, the comprehensive application of AI in Adobe products, especially the generative AI function in core tools such as Photoshop and Illustrator, has enabled users to complete more complex and repetitive tasks through AI. This not only improves user work efficiency, but also further enhances the attractiveness of Adobe subscription services. In the long run, with the intelligent upgrade of more creative tools, Adobe’s AI function will continue to drive its ARR and overall revenue growth.

Adobe’s expansion potential in the global market

In addition to its continued strong performance in the North American market, Adobe is actively expanding its business globally, especially in the European and Asia-Pacific markets. With the acceleration of global digitization, the demand for Adobe solutions from enterprises and creators is gradually increasing. This provides Adobe with new sources of revenue and growth space.

Adobe’s expansion in these international markets not only enhances its global business layout, but also enables the company to generate revenue from more diverse markets, reducing its dependence on a single market. In the future, with the continuous growth of the digital economy, Adobe is expected to continue to benefit from the global wave of digital transformation.

Adobe’s challenges and risks

The impact of weak profit guidance

Adobe’s earnings guidance for the fourth quarter appears slightly conservative, especially its revenue and earnings per share forecasts are lower than analysts’ expectations. Although Adobe explained that some transactions completed ahead of schedule in the third quarter affected its performance growth expectations for the fourth quarter, the market is still uneasy about this. This conservative earnings forecast has raised doubts among investors about Adobe’s short-term growth ability and triggered a sharp drop in its stock price.

From historical data, Adobe has been relying on its stable subscription revenue and ARR growth to drive overall performance. However, the conservative guidance for the fourth quarter may indicate that Adobe faces certain challenges in responding to market demand and slowing growth, especially in the context of uncertain global economic environment and rapidly increasing investment in AI Technology by competitors.

This weak guidance may continue to affect market confidence in Adobe in the short term, but in the long run, Adobe still has a strong business foundation and revenue sources, especially in maintaining a leading position in the digital media and digital experience market. Therefore, investors need to evaluate whether this short-term volatility represents systemic risk or a market opportunity for investors to overreact.

Regulatory risks and data privacy issues

As a global leading software company, Adobe also faces regulatory challenges from different markets. Especially in the field of data privacy and security, Adobe needs to deal with complex laws and regulations to ensure the data security and privacy protection of its global customers.

In recent years, with the increasing attention to data privacy protection worldwide, Adobe needs to constantly adjust its data management policies to comply with legal requirements in various countries. The General Data Protection Regulation (GDPR) in Europe and privacy laws in various US states, such as California’s Consumer Privacy Act (CCPA), have put forward higher compliance requirements for enterprises in data collection, storage, and use.

The existence of Adobe’s early termination clause also exposes it to potential legal risks. If customers find it difficult to stop using Adobe products midway, it may trigger litigation and regulatory investigations. If Adobe is found to have engaged in improper behavior in such issues, it will not only face high fines, but also have a negative impact on its brand reputation. In addition, as data privacy laws continue to change, Adobe needs to continue to invest in data security and privacy protection to meet the challenges of new regulations.

Although Adobe’s data privacy management measures are relatively sound at present, with the increasingly complex data compliance environment, the company still needs to maintain a high degree of flexibility and responsiveness. The uncertainty of this regulatory environment, especially in the context of increasingly strict data privacy protection requirements worldwide, may have a short-term impact on Adobe’s operations.

Competitive pressure in the AI field

With the rapid development of AI technology, Adobe is facing competition from various parties, especially from technology companies such as OpenAI. OpenAI’s Sora model is an AI model that can generate realistic videos based on text instructions. As one of the most innovative generative AI tools on the market, this product poses a direct threat to Adobe’s Firefly video generation tool.

Adobe’s challenge lies in how to successfully integrate these AI features into its own product system and continue to maintain a differentiated advantage over competitors. Although Adobe is currently collaborating with companies such as OpenAI to integrate third-party AI models into its platform, the market’s expectations for these technologies are very high. Adobe must maintain the technological leadership of its products to ensure continued customer attraction and retention.

Despite Adobe’s Firefly platform and related AI tools having significant innovative advantages, the AI market competition is fierce. Tech giants such as Microsoft and Google are rapidly expanding their market share through Cloud Services and generative AI models, and Adobe’s pressure cannot be underestimated. Adobe needs to continuously improve the breadth and depth of AI technology applications, as well as continuously enhance the User Experience in its ecosystem, to cope with the competition in this field.

In addition, the rapid development of AI has also provided Adobe with a double-edged sword effect. On the one hand, AI technology is expected to greatly enhance the functionality and user appeal of Adobe products; on the other hand, rapid technological updates may shorten product lifecycle and continuously increase customer expectations. This brings continuous innovation pressure to Adobe, but also means that it needs to increase research and development investment to ensure that its AI tools continue to remain competitive in the market.

Overall, competition in the AI field is a huge challenge for Adobe, but it also provides great opportunities for the company. If Adobe can maintain its technological leadership in this field and effectively integrate AI features into its products, it is expected to gain more market share in the coming years.

Is the stock price decline a bottom fishing opportunity?

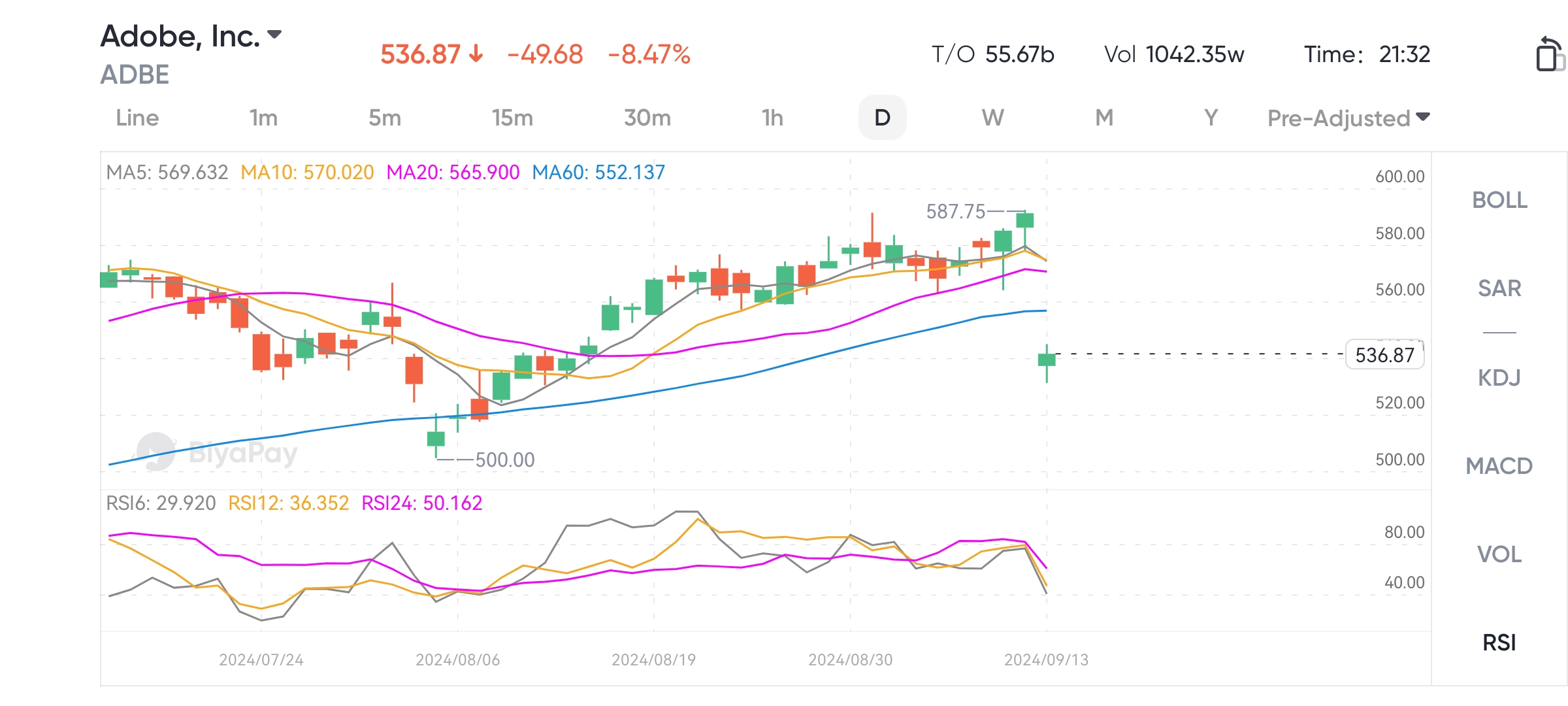

After Adobe’s stock price plummeted by 9%, the market began to re-examine the company’s valuation level. According to the reverse DCF (discounted cash flow) model, Adobe’s current stock price already has a relatively reasonable valuation when reflecting the market’s expectations for its future cash flow growth.

Currently, Adobe’s free cash flow per share is $14.62, while the stock price has fallen back to around $536 after a sharp drop. By analyzing the growth rate of free cash flow, the market expects Adobe’s free cash flow per share to grow at an annual rate of 12.8% over the next decade, followed by a long-term growth rate of 3%.

This valuation expectation indicates that the market holds a relatively optimistic attitude towards Adobe’s future growth. Although the profit guidance for the fourth quarter is slightly lower than expected, Adobe’s growth potential is still huge in the long run. The rationality of this valuation indicates that the current stock price crash may be a short-term market reaction, providing a relatively ideal bottom fishing opportunity for long-term investors.

Interested investors can go to BiyaPay to buy Adobe, and of course, they can also monitor the trend of the stock to find a more suitable buying opportunity. If you have difficulties with deposits and withdrawals, you can also use it as a professional tool for deposits and withdrawals of US and Hong Kong stocks. Recharge digital currency to exchange for US dollars or Hong Kong dollars, withdraw to your bank account, and then deposit to other securities firms to buy stocks. The deposit speed is fast, and there is no limit, so you will not miss investment opportunities.

However, investors need to be cautious when considering bottom fishing, especially during periods of significant market mood swings. Adobe’s stock price may still be further affected by external factors, such as changes in the global economic environment or strategic adjustments by other tech giants in the AI field. Therefore, investors should consider market trends and Adobe’s long-term fundamentals comprehensively when choosing bottom fishing to avoid short-term losses caused by premature entry.

Overall, after Adobe released its financial report, the stock price plummeted mainly due to investors’ disappointment with its Q4 earnings guidance being lower than expected. Although the market has concerns about the company’s future growth ability in the short term, Adobe’s fundamentals remain strong in the long term, especially in the layout of digital media and AI.

Despite facing fierce competition in the AI market, Adobe continues to drive innovation through its Firefly platform and other generative AI tools, and the ARR growth of its subscription business provides a strong revenue base for the company. With Adobe’s continued expansion in the global market, especially in strengthening the application of AI technology in products, Adobe still has huge growth potential in the long run.

The current stock price decline may be more of an overreaction of market sentiment. Through valuation analysis, it can be seen that Adobe still has a reasonable market pricing. For investors willing to bear short-term fluctuations, this decline may be a rare opportunity for bottom fishing.