- Remittance

- Exchange Rate

- Stock

- Events

- EasyCard

- More

- Download

- Creator

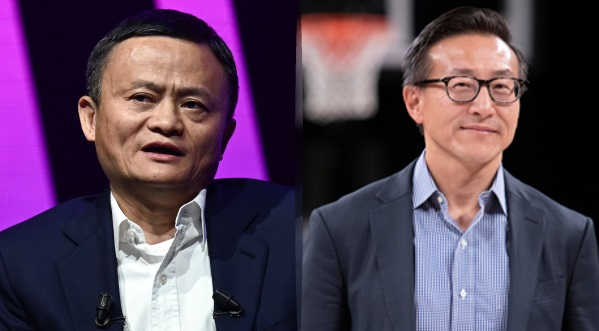

Jack Ma and Joseph Tsai Significantly Increase Holdings in Alibaba, Stock Price Surges 7%! Should We

The usually low-profile Joseph Tsai has made his move.

On January 23rd, it was exclusively learned by reporters that Alibaba Group’s founders, Jack Ma and Joseph Tsai, have significantly increased their holdings in Alibaba shares. The Tsai family fund increased its holdings by $150 million worth of Alibaba shares, and Jack Ma also made a substantial increase in his holdings, although the specific amount was not disclosed. In the same period, Alibaba repurchased a total of 897.9 million ordinary shares (equivalent to 112.2 million American depositary shares) for a total price of $9.5 billion (about 68 billion RMB), making it the Chinese internet company with the strongest repurchase effort.

Affected by this news, Jack Ma has now replaced SoftBank as Alibaba’s largest shareholder, with Alibaba’s US stocks opening high and surging by 7%. At the same time, it has also silenced those who were bearish on Alibaba.

As of the time of dispatch, according to data provided by the multi-asset trading wallet BiyaPay, Alibaba is currently quoted at a stock price of $70.9.

The most recent news was: The Ma family trust plans to reduce its holdings by 10 million Alibaba shares, with a market value exceeding $870 million. This supposed significant increase by Jack Ma, without disclosing the specific amount, is because Jack Ma’s shareholding has decreased from 6.1% in 2019 to about 4.5% now, making him not a significant shareholder with less than 5%, and any share change does not need to be disclosed externally. And Joseph Tsai, holding less than 2%, theoretically does not need to disclose either.

So, how should we view the actions of Jack Ma and Joseph Tsai?

What is their purpose for increasing their holdings?

And should investors also follow suit in bottom fishing?

There’s no era of Jack Ma, only Jack Ma of the era!

The rumors of Jack Ma significantly reducing his Alibaba shares were actually unfounded.

These past few days, Jack Ma and Joseph Tsai increased their holdings in Alibaba shares, whether it’s considered significant is up to interpretation. One thing for sure, Alibaba is no longer the “colossus” Alibaba of the Jack Ma era. There’s no era of Jack Ma, only the Jack Ma of the era! It is always the times that make heroes, and this is fully demonstrated in Alibaba.

It is known that Alibaba has continued its share buyback for five consecutive years. As of December 31, 2023, Alibaba Group still had a buyback quota of $11.7 billion under the share repurchase program authorized by the board of directors, valid until March 2025.

Clearly, the founders’ significant increase in holdings greatly benefits Alibaba. And this has also powerfully refuted the rumors of Jack Ma selling off Alibaba shares two months ago.

However, the presence of the Alibaba ecosystem has indeed diminished a lot in recent years. With the rise of competitors, both directly and indirectly, the Alibaba “colossus” ship is showing signs of fatigue.

Firstly, Tmall has been strongly challenged by JD.com. Although Tmall’s leading position seems still relatively solid, JD.com is no longer the underdog it once was.

Then there’s the rapid rise of Pinduoduo, touted for “social e-commerce.” Even by the end of last year, it had surpassed Alibaba in the US stock market. Although Alibaba has continuously tried to block through Taobao’s special price and other modes, it still couldn’t stop Pinduoduo’s rampant pace.

Following that, in the short video and live broadcast sectors, it was overtaken by new internet giants like Douyin, Kuaishou, and Xiaohongshu.

Lastly, in the local life field, Ele.me has been consistently outperformed by Meituan, to the point where there were rumors of Ele.me possibly being acquired by Douyin.

In short: The rivers and lakes are still the same, but the players have long changed.

What direction will Alibaba head towards Jack Ma and Joseph Tsai’s increase in holdings representing confidence in the company?

It’s undeniable that the effect of Jack Ma and Joseph Tsai announcing their increased holdings is evident, with Alibaba’s stocks, both in Hong Kong and the US, seeing a surge of over 5%. However, looking at the whole year, Alibaba’s downtrend is obvious, from a high of $89 to now $74, with a market value of $188.5 billion, only $1.3 billion more than Pinduoduo’s $187.2 billion.

Of course, from the hot searches this year, we indeed roughly know that Alibaba is rapidly adjusting:

In the first half of last year, 24-year-old Alibaba Group, from an Alibaba business group, moved towards a new governance structure of “1+6+N” multiple business groups and business companies operating independently.

In the second half of the year, Alibaba singled out 1688, Idle Fish, DingTalk, Quark, and other first batch of strategic innovative businesses, adopting more independent strategies to face the broadest market.

Moreover, Alibaba will increase strategic investments in global business networks, expanding business opportunities worldwide. Although going global will face many challenges, faced with the increasingly pressing Pinduoduo, Alibaba had no choice but to resort to “returning” to the past, picking up the original intention of “making it easy to do business anywhere.”

Whether it’s the volatile market environment or the competitive pressure from many platforms, Alibaba urgently needs a breakthrough. As Alibaba’s sole permanent partner, Joseph Tsai has witnessed Alibaba’s past. Perhaps Tsai is just the kind of global-experienced and diversified background breaker needed at this time. Facing internal and external troubles, Tsai steps up from behind the scenes to the forefront, once again taking on a key role in Alibaba.

I hope Tsai can be like “an old general commanded to guard the land,” with “the bow drawn like a full moon, the arrow shot like a shooting star.”

The tycoons are bottom fishing; should we follow suit?

I always believe that the major Chinese concept stocks are currently undervalued. After all, the past over three months of decline has been too obviously dominated by sentiment. Alibaba’s PE ratio is less than 10, and its PB ratio is 1.27, which doesn’t seem like a valuation for a tech company.

Of course, we can find reasons, such as being targeted by Pinduoduo, or not growing as before. But this problem also exists for big American companies. Generally, significant shareholders’ increase in holdings is definitely good news, but retail investors need to understand one thing.

The funds in the hands of major shareholders are much “thicker” than those of ordinary people. They don’t need every transaction to make money; they just need to identify the bottom area. $150 million, for them, does not affect daily life or other investment decisions.

I would generally advise retail investors to dollar-cost average at the bottom, and that too in a reverse pyramid fashion. Even this advice might lead to using up the ammunition too early. Not to mention, many people simply cannot hold back and often go all-in. Another strategy worth considering is to think about bottom fishing after the tycoons have bottom fished 2~3 times. This can give some margin for error.

Some might ask, what if some tycoons only bottom fish once and it bounces back significantly?

Then just consider that opportunity as non-existent. A trading strategy that demands multiple conditions will inevitably filter out some opportunities but can also avoid losses.

What I want to say is, sometimes many people regret why they didn’t seize such obvious opportunities at the time. In fact, those opportunities were never meant for you in the first place.

To sum up, Alibaba’s stock is indeed undervalued and does have investment value, but no one can say for sure when it will rise. However, here I recommend BiyaPay as a professional investment tool, which I have been using. It supports real-time online trading of US and Hong Kong stocks without the need for an overseas bank account. If you have a brokerage account and an overseas bank account, BiyaPay can be used as a tool for depositing and withdrawing funds for US and Hong Kong stocks. By depositing cryptocurrencies (such as USDT) to exchange for USD or HKD, then withdrawing funds to a personal bank account, and finally transferring funds into a brokerage account. This method is fast, without limits on the amount, and without any deposit or withdrawal troubles, while also allowing you to keep an eye on the market dynamics of Alibaba stocks.

Final Words: The wild era has ended, and we must welcome a new era!

Thus, it’s not hard to understand why Jack Ma and Joseph Tsai significantly increased their holdings in Alibaba shares. Alibaba is not like what the internet rumors suggested, stuck in a slow turnaround, but rather, it signifies that Alibaba’s business foundation and the group’s future development will welcome a wave of positive news.

At the same time, a seasoned e-commerce industry investor told Barron’s Chinese edition, “The actions of the two founders are sufficient to show the market that Alibaba is currently undervalued by the market.” He added, although Alibaba “is still a company with long-term value,” investors still need to pay attention to the risks of the company’s strategy not landing as expected, the slowing momentum of consumer recovery, and the lack of market investment confidence affecting Alibaba’s stock price in the short term.

As of the latest closing day, Alibaba’s US stock market value was $188.5 billion, and its Hong Kong stock market value was HK$1.49 trillion.